Ponzi schemes have captivated public attention for over a century, not because they offer legitimate financial opportunities, but because they represent one of the most deceptive forms of fraud in modern economic history. At their core, these schemes promise high returns with little or no risk—yet deliver nothing but loss to the majority of participants. Understanding why Ponzi schemes are illegal requires more than just knowing the law; it demands insight into how they operate, who they harm, and what safeguards exist to prevent them.

How Ponzi Schemes Work: The Illusion of Profit

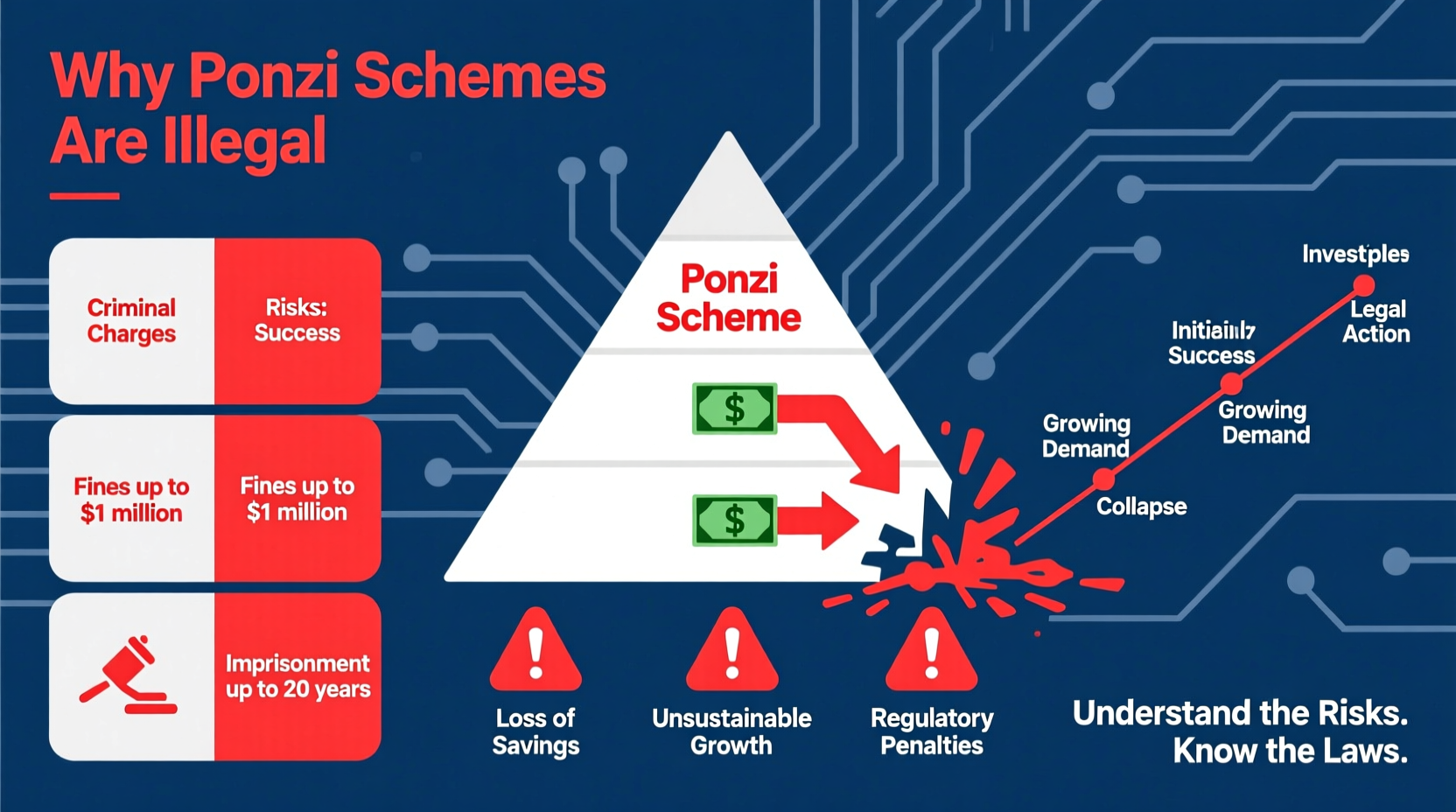

The mechanism behind a Ponzi scheme is deceptively simple. Instead of generating actual returns through investment or business activity, the operator pays earlier investors using funds contributed by newer investors. This creates the illusion of profitability, encouraging more people to join and existing participants to reinvest. As long as new money flows in, the scheme appears successful.

The critical flaw lies in sustainability. Without real earnings, the system collapses when incoming funds slow down or when too many investors attempt to withdraw their money. The first few participants may receive payouts, reinforcing the belief in legitimacy, while the vast majority—especially those who joined later—lose everything.

Legal Frameworks That Make Ponzi Schemes Illegal

Ponzi schemes violate multiple layers of financial regulation and criminal law. In the United States, they are primarily prosecuted under federal securities laws enforced by the Securities and Exchange Commission (SEC). Key statutes include:

- Securities Act of 1933: Requires full disclosure of material information about investments offered to the public.

- Securities Exchange Act of 1934: Prohibits fraud and deceit in connection with the purchase or sale of securities.

- Investment Advisers Act of 1940: Regulates professionals who give advice for compensation.

Beyond civil enforcement, perpetrators can face criminal charges under Title 18 of the U.S. Code, including wire fraud, mail fraud, and money laundering—all carrying severe penalties such as fines and decades-long prison sentences.

“Ponzi schemes don’t just break the law—they betray trust on a massive scale.” — Mary Jo White, Former Chair of the SEC

Risks and Consequences for Victims and Society

The damage caused by Ponzi schemes extends far beyond individual financial losses. Entire communities can be devastated when retirees lose life savings, small businesses collapse due to lost capital, or family trusts are wiped out. Psychological impacts include stress, depression, and broken relationships among victims who often feel shame or guilt for falling prey.

On a broader level, widespread fraud undermines confidence in legitimate financial markets. When people equate investing with deception, participation declines, slowing economic growth and innovation.

Notably, even indirect exposure poses risks. Financial institutions that fail to detect suspicious transactions may face regulatory scrutiny or reputational harm. Auditors, accountants, or lawyers who ignore warning signs could also be held liable if found complicit through negligence.

Mini Case Study: The Collapse of Bernard Madoff’s Empire

No discussion of Ponzi schemes would be complete without mentioning Bernard Madoff. For nearly two decades, Madoff ran what became the largest known Ponzi scheme in history, defrauding investors of approximately $65 billion. He claimed to use a split-strike conversion strategy, but in reality, no trades were executed.

Victims included charities, pension funds, celebrities, and ordinary individuals who trusted his reputation and steady returns. When the 2008 financial crisis triggered a wave of redemption requests, Madoff could not meet them. His confession in December 2008 revealed the entire operation was a façade.

Madoff was sentenced to 150 years in prison. While some funds have been recovered through asset seizures and clawbacks, many victims never regained their original investments. The case exposed systemic failures in oversight and highlighted how credibility and social networks can be exploited to perpetrate fraud.

Spotting a Ponzi Scheme: A Practical Checklist

Early detection can prevent significant losses. Use this checklist to evaluate any investment opportunity:

- Are returns unusually high compared to market averages?

- Is there a lack of clear documentation or audited financial statements?

- Do you receive payments from unknown third parties instead of the company itself?

- Are withdrawals delayed or discouraged?

- Does the promoter emphasize recruiting others over product performance?

- Is the investment strategy overly complex or vaguely explained?

- Have independent sources verified the firm’s registration and licensing?

Global Legal Responses and Prevention Measures

While U.S. regulators have robust tools to combat fraud, Ponzi schemes remain a global issue. Countries vary in their enforcement capacity, allowing operators to exploit weak jurisdictions. International cooperation through bodies like the International Organization of Securities Commissions (IOSCO) helps harmonize standards and share intelligence.

Preventive measures now include:

- Enhanced due diligence requirements for financial advisors.

- Mandatory reporting of suspicious transactions by banks.

- Public education campaigns by regulatory agencies.

- Whistleblower programs offering rewards for credible tips.

In recent years, digital assets have introduced new vectors for old scams. Cryptocurrency-based Ponzi schemes, often disguised as “decentralized finance” platforms, have surged. Regulators are adapting, but investor vigilance remains essential.

Comparison Table: Ponzi Scheme vs. Legitimate Investment

| Feature | Ponzi Scheme | Legitimate Investment |

|---|---|---|

| Source of Returns | New investor funds | Actual profits, interest, dividends |

| Transparency | Low or nonexistent | Regular reports, audits, disclosures |

| Regulatory Oversight | Absent or falsified | Registered with authorities (e.g., SEC) |

| Withdrawal Process | Delayed, restricted, or denied | Clear terms, timely processing |

| Growth Model | Dependent on constant recruitment | Based on performance and market conditions |

Frequently Asked Questions

Can a Ponzi scheme ever be legal?

No. By definition, a Ponzi scheme relies on deception and misappropriation of funds, violating securities and criminal laws regardless of jurisdiction. Even if initially well-intentioned, any structure that pays old investors with new investors’ money without genuine profit generation becomes illegal once the pattern is established.

What should I do if I suspect a Ponzi scheme?

Immediately stop investing and gather all relevant documents, communications, and transaction records. Report your concerns to the appropriate authority—such as the SEC, FBI, or local financial regulator—and consult a legal professional specializing in securities fraud. Avoid confronting the operator directly, as this may trigger evidence destruction.

Are multi-level marketing (MLM) companies the same as Ponzi schemes?

Not necessarily. While both rely on recruitment, legitimate MLMs generate revenue from actual products or services. If compensation depends primarily on enrolling others rather than selling goods, however, the model may cross into illegal territory. Regulatory agencies assess each case based on substance, not structure alone.

Conclusion: Protect Yourself and Promote Financial Integrity

Ponzi schemes persist because they exploit human psychology—our desire for quick wealth and our tendency to trust familiar faces. Their illegality stems from fundamental principles of fairness, transparency, and economic stability. Recognizing the warning signs, verifying claims independently, and supporting strong regulatory frameworks are crucial steps toward protection.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?