In a typical interest rate environment, longer-term investments like certificates of deposit (CDs) offer higher yields than shorter-term ones. Investors expect to be compensated more for locking up their money over extended periods. But occasionally, the market behaves differently—short-term CD rates rise above long-term rates, creating what’s known as an inverted yield curve. This phenomenon can seem counterintuitive, especially to savers focused on maximizing returns. Understanding why this happens—and what it means for your financial decisions—is essential for navigating today’s complex banking landscape.

What Is a CD Rate Inversion?

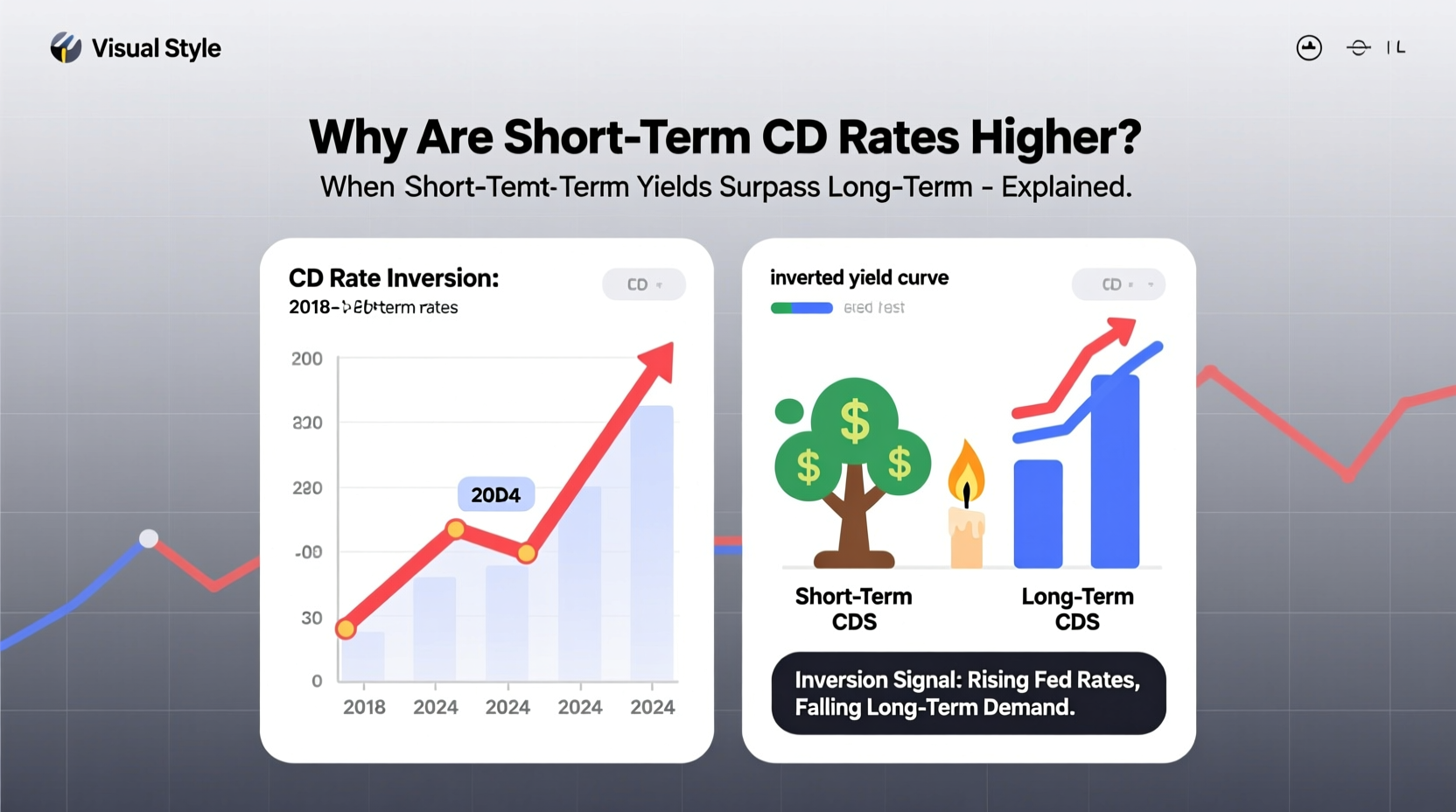

A CD rate inversion occurs when shorter-term CDs offer higher interest rates than longer-term CDs. For example, a 6-month CD might yield 5.2%, while a 5-year CD from the same bank offers only 4.0%. This flips the traditional expectation on its head and often reflects broader economic signals rather than isolated bank policy.

This inversion typically stems from shifts in monetary policy, inflation expectations, and investor sentiment. When banks anticipate that interest rates may fall in the future—due to slowing economic growth or central bank intervention—they may offer higher rates on short-term deposits to attract immediate funding, while keeping long-term rates lower to avoid long-term liability at high payouts.

“An inverted CD yield curve is not just a curiosity—it’s a signal. It often reflects cautious optimism about near-term returns and concern about long-term economic stability.” — Dr. Linda Chen, Senior Economist at Capital Markets Insight Group

Why Are Short-Term CD Rates Higher? Key Drivers

Several interrelated factors contribute to short-term CD rates surpassing long-term ones:

- Federal Reserve Policy: When the Fed raises interest rates to combat inflation, banks quickly pass those increases to short-term products. Long-term CDs, however, are priced with future rate cuts in mind, especially if a recession is expected.

- Market Expectations: If investors believe rates will decline in 12–18 months, banks have less incentive to lock in high rates for five years. Instead, they compete aggressively for short-term deposits now.

- Liquidity Needs: Banks facing temporary cash shortages may boost short-term CD rates to draw in quick capital without committing to long-term cost increases.

- Competition Among Online Banks: Digital banks often lead rate hikes on short-term CDs to attract new customers, using aggressive pricing as a marketing tool.

Real-World Example: The 2023 Rate Surge

In mid-2023, many online banks offered 12-month CDs yielding over 5.0%, while 5-year CDs averaged around 4.3%. Customers who assumed longer terms meant better returns missed out on higher short-term yields. Sarah Mitchell, a freelance graphic designer from Austin, capitalized on this trend by laddering her savings into six consecutive 6-month high-yield CDs. By reinvesting each maturing CD at prevailing rates, she earned an average return of 5.1% annually—higher than any available 5-year option at the time.

When rates began to stabilize in late 2024, she shifted part of her portfolio into longer-term CDs, locking in favorable rates before projections suggested a potential drop. Her strategy illustrates how understanding rate inversions can lead to smarter, more flexible saving decisions.

Strategies to Maximize Returns During Inversion

Rate inversions don’t last forever, but they create opportunities for strategic savers. Consider these approaches:

- CD Laddering: Spread your investment across multiple maturities (e.g., 6-month, 1-year, 18-month). This allows you to capture high short-term rates while maintaining access to funds and flexibility to reinvest as conditions change.

- Stay Liquid Initially: Avoid locking large sums into long-term CDs during inversion. Keep capital in shorter instruments to benefit from compounding at elevated rates.

- Monitor Economic Indicators: Pay attention to CPI data, Fed meetings, and unemployment trends. These influence future rate paths and help determine when to extend or shorten your CD duration.

- Compare Institutions Regularly: Online banks frequently update their CD rates. Use comparison tools monthly to ensure you're not missing better deals elsewhere.

- Consider Bump-Up CDs: Some banks offer CDs that allow one rate increase during the term. While initial rates may be slightly lower, they provide upside potential if rates continue rising.

CD Investment Checklist

- ✅ Assess current yield curve shape (normal, flat, or inverted)

- ✅ Compare short-term vs. long-term CD rates across 3+ institutions

- ✅ Evaluate your liquidity needs over the next 1–3 years

- ✅ Decide whether to ladder, lock in, or stay flexible

- ✅ Set calendar reminders for maturity dates

- ✅ Review options 30 days before each CD matures

Comparing CD Options During Inversion

| CD Term | Average Rate (Q2 2024) | Pros | Cons |

|---|---|---|---|

| 6-Month | 5.10% | High rate, quick access to funds | Must reinvest soon; rate risk |

| 1-Year | 5.25% | Peak short-term yield, balance of return and timing | Limited flexibility compared to 6-month |

| 2-Year | 4.70% | Moderate commitment, decent return | Lower than shorter terms; less responsive to rate hikes |

| 5-Year | 4.00% | Stable income, protection if rates fall | Potential opportunity cost if rates remain high |

Note: Rates based on national averages from FDIC-insured online banks in April 2024.

Common Misconceptions About CD Inversions

Many savers assume that longer commitments always yield better returns. However, this isn't universally true—especially in volatile rate environments. Another myth is that CD inversions signal imminent economic collapse. While an inverted yield curve has historically preceded recessions, it's not a guaranteed predictor. The lag between inversion and downturn can range from 6 to 24 months, offering time to adjust strategies proactively.

Additionally, some believe that all banks follow the same rate patterns. In reality, regional banks, credit unions, and digital-only institutions set rates independently based on customer acquisition goals and funding needs. Shopping around can reveal significant differences even within the same maturity.

FAQ: Your Questions Answered

Does CD rate inversion mean a recession is coming?

Not necessarily. While an inverted Treasury yield curve has preceded past recessions, CD inversions reflect both macroeconomic trends and bank-specific strategies. They suggest caution but aren’t definitive recession signals. Other indicators—like employment data and consumer spending—should also be considered.

Should I move all my money into short-term CDs now?

It depends on your financial goals. If you prioritize maximum yield and can manage reinvestment timing, favoring short-term CDs makes sense during inversion. However, if you value predictability and fear rate drops, allocating part of your portfolio to mid-term CDs (1–2 years) balances risk and reward.

Can CD rates change after I open an account?

No—once you open a standard CD, the interest rate is fixed for the term. Only bump-up or variable-rate CDs allow changes, and those come with specific conditions. Always confirm the rate type before investing.

Final Thoughts: Turning Market Anomalies Into Advantage

CD rate inversions challenge conventional wisdom, but they also present strategic openings for informed savers. Rather than defaulting to “longer equals better,” take a dynamic approach. Analyze the yield curve, understand the forces behind rate movements, and align your choices with personal liquidity needs and risk tolerance.

The goal isn’t to time the market perfectly—but to make deliberate, educated decisions that compound over time. Whether you choose to ladder, lock in, or wait, staying aware of rate trends puts you ahead of passive savers.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?