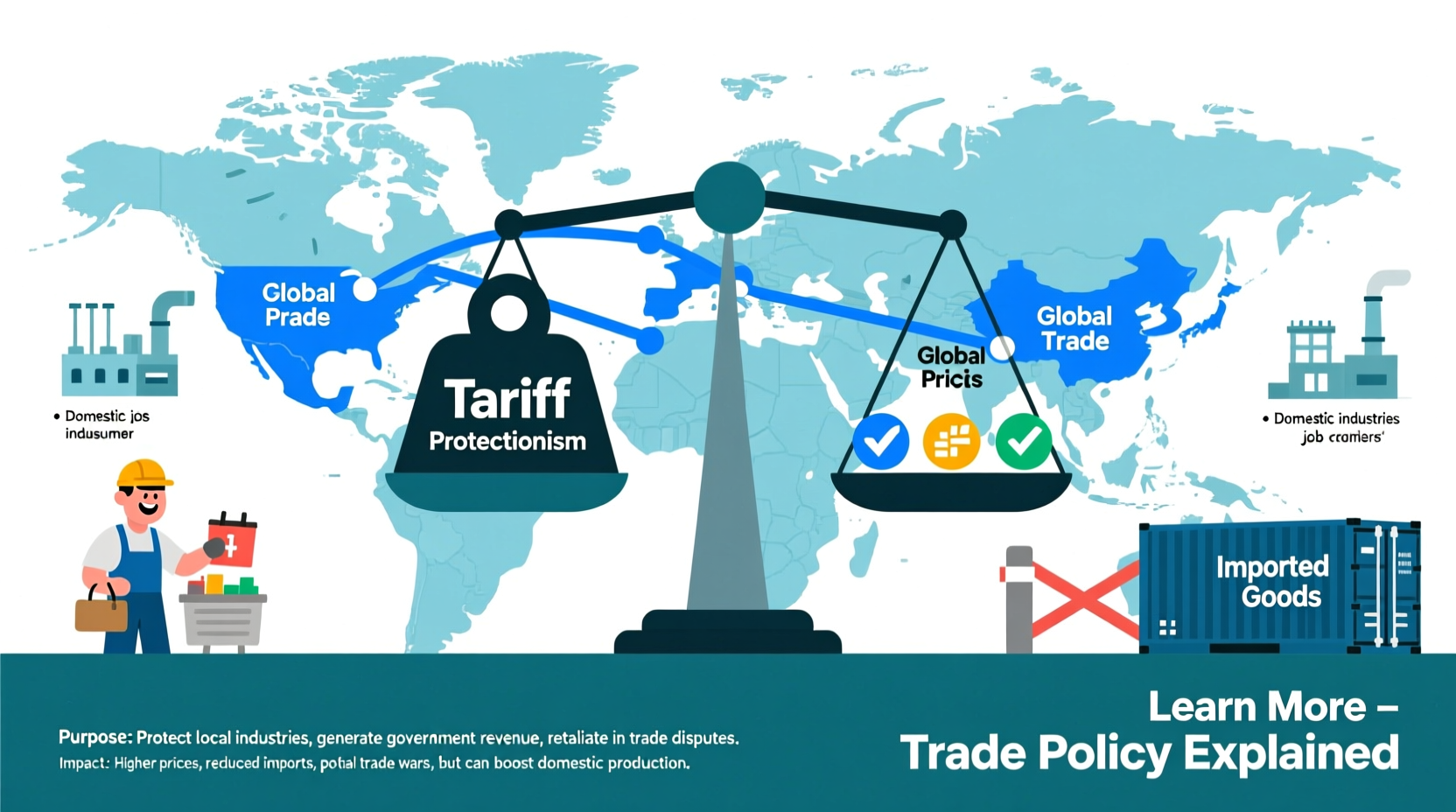

Tariffs—taxes imposed on imported goods—are a foundational tool in international trade policy. While often debated, they serve multiple strategic purposes beyond simple revenue generation. Governments use tariffs to protect domestic industries, respond to unfair trade practices, and influence geopolitical relationships. However, their application can lead to higher consumer prices, strained trade relations, and market distortions. Understanding why tariffs are used requires examining their economic rationale, historical context, and tangible effects on businesses and households.

The Primary Purposes of Tariffs

Tariffs are not arbitrary taxes. They are implemented with specific objectives in mind, often shaped by economic, political, and social considerations.

- Protecting Domestic Industries: One of the most common reasons for imposing tariffs is to shield local manufacturers from foreign competition. When cheaper imports flood a market, domestic producers may struggle to compete, leading to job losses and factory closures. A tariff increases the cost of imported goods, leveling the playing field.

- Generating Government Revenue: Historically, tariffs were a major source of income for governments, especially before the widespread adoption of income and sales taxes. In some developing nations, import duties still contribute significantly to national budgets.

- Correcting Trade Imbalances: Persistent trade deficits—when a country imports more than it exports—can prompt policymakers to impose tariffs as a way to reduce reliance on foreign goods and encourage domestic production.

- Retaliation and Negotiation Leverage: Tariffs are sometimes used as diplomatic tools. Countries may impose them in response to perceived unfair trade practices, such as dumping (selling goods below cost) or subsidies provided by foreign governments. These measures can pressure other nations into renegotiating trade terms.

- National Security Considerations: Strategic sectors like steel, aluminum, and semiconductors may be protected via tariffs to ensure supply chain resilience during times of crisis.

Economic Impact of Tariffs: Winners and Losers

The effects of tariffs ripple across economies, benefiting some sectors while harming others. Consumers often bear hidden costs, while protected industries gain short-term advantages.

| Stakeholder | Positive Impact | Negative Impact |

|---|---|---|

| Domestic Producers | Reduced competition, higher sales | Potential inefficiency due to lack of competition |

| Consumers | Supports local jobs | Higher prices, reduced product variety |

| Government | Increased revenue, policy leverage | Risk of retaliatory tariffs affecting exports |

| Exporters | None directly | Foreign retaliation can reduce export demand |

For example, when the U.S. imposed steel tariffs in 2018 under Section 232, citing national security, domestic steel producers saw improved margins. However, automakers and construction firms—which rely heavily on steel—faced higher input costs, leading to price increases and reduced competitiveness abroad.

Real-World Example: The U.S.-China Trade War

The trade conflict between the United States and China beginning in 2018 offers a compelling case study on tariff impacts. The U.S. imposed tariffs on over $450 billion worth of Chinese imports, citing intellectual property theft and forced technology transfers. China responded with counter-tariffs on American agricultural and industrial goods.

While the intention was to rebalance trade and protect strategic industries, the consequences were complex. American farmers, particularly soybean producers, lost significant market share in China. Meanwhile, U.S. manufacturers dependent on Chinese components faced supply chain disruptions and increased costs.

“Tariffs are a double-edged sword. They can defend industries, but they also risk triggering inflation and weakening global cooperation.” — Dr. Linda Chen, International Trade Economist, Peterson Institute

Ultimately, the Phase One trade deal in 2020 paused further escalation, but many tariffs remain. Studies estimate that U.S. consumers and businesses bore the majority of the cost—over $50 billion annually—through higher prices.

Best Practices for Policymakers and Businesses

Tariffs should not be deployed lightly. Their long-term success depends on careful design and complementary policies. Below is a checklist for responsible tariff implementation and adaptation.

Checklist: Responsible Use of Tariffs

- Conduct thorough cost-benefit analyses before imposing new tariffs

- Target specific sectors rather than broad-based measures

- Set clear expiration dates or review mechanisms to prevent dependency

- Pair protective tariffs with investment in innovation and workforce training

- Engage in multilateral dialogue to avoid trade wars

For businesses, adapting to a tariff-heavy environment means reevaluating supply chains, exploring alternative sourcing options, and advocating for stable trade policies.

Frequently Asked Questions

Do tariffs help the economy grow?

Not necessarily. While tariffs can protect certain industries and jobs in the short term, they often reduce overall economic efficiency. By distorting market signals and increasing costs, they can slow growth, reduce consumer choice, and provoke retaliatory actions that harm exporters. Most economists agree that free trade generates greater long-term benefits than protectionism.

Who pays for tariffs—the foreign country or domestic consumers?

Contrary to popular belief, the importing country’s consumers and businesses typically bear the cost. Although tariffs are collected at the border from foreign exporters, these costs are usually passed down through higher prices. A 2019 study by the Federal Reserve Bank of New York found that U.S. firms and households absorbed nearly the entire burden of China-related tariffs.

Are there alternatives to tariffs for protecting domestic industries?

Yes. Subsidies for innovation, worker retraining programs, anti-dumping investigations, and strengthening trade agreements can achieve similar goals without the negative side effects of tariffs. For instance, the European Union uses state aid rules and research grants to bolster key industries like renewable energy and aerospace.

Conclusion: A Tool, Not a Solution

Tariffs are a powerful instrument in economic policy, but they are best used sparingly and strategically. Their primary value lies in addressing specific imbalances, defending critical industries, or negotiating better trade terms—not as a general solution to complex economic challenges. Overreliance on tariffs risks inflation, reduced competitiveness, and damaged international relationships.

For citizens, understanding tariffs empowers informed discussion about trade policy. For businesses, anticipating tariff changes allows proactive supply chain planning. And for governments, the lesson is clear: effective trade policy balances protection with openness, using tariffs not as blunt weapons, but as calibrated tools within a broader economic strategy.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?