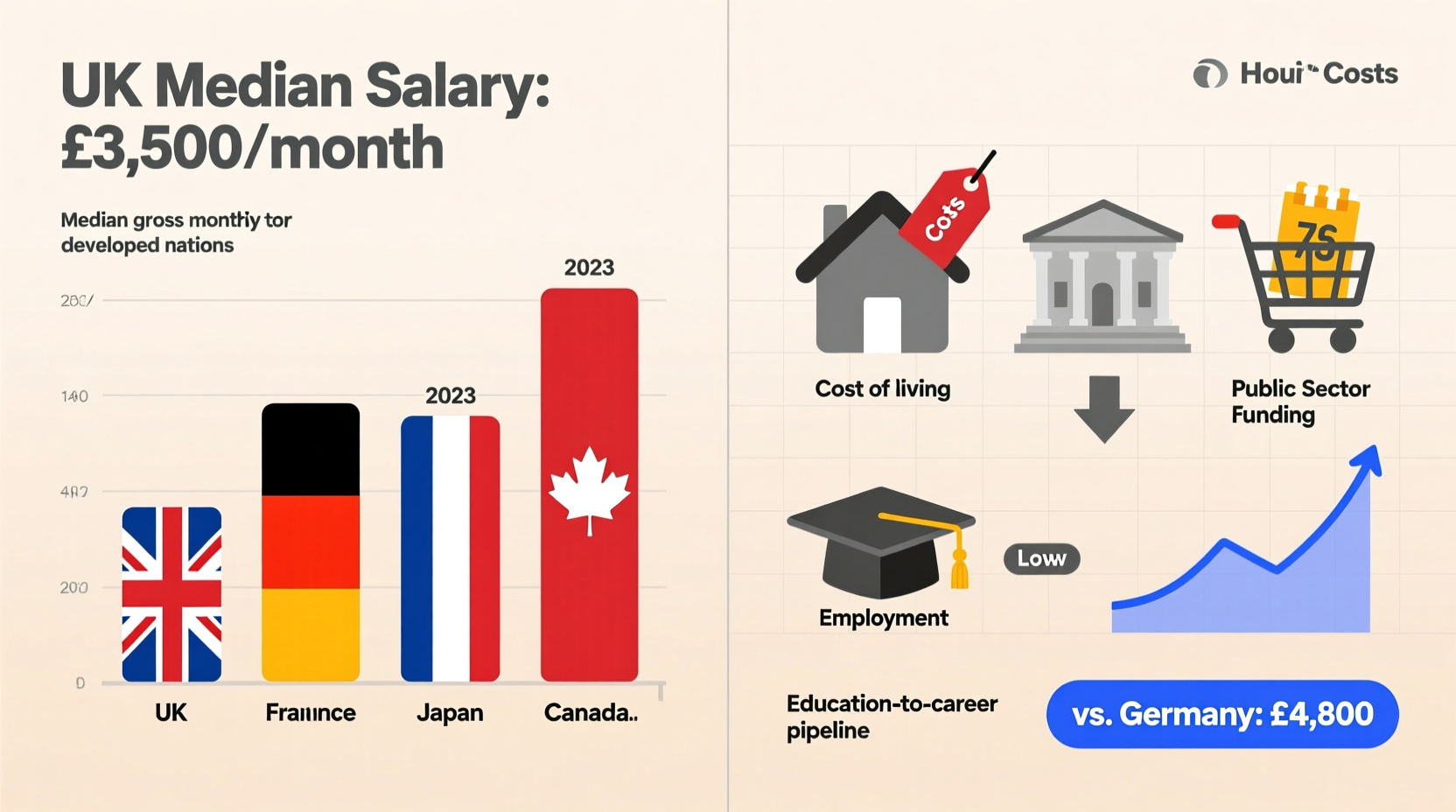

For many working professionals in the United Kingdom, the question isn't whether they earn enough—it's why their wages seem to lag behind rising costs and international peers. Despite being one of the world’s largest economies, the UK consistently ranks below countries like Germany, the US, and even Canada when it comes to average take-home pay. Wage growth has remained sluggish for over a decade, while inflation, housing costs, and living expenses have surged. Understanding why UK salaries are comparatively low requires examining structural economic forces, policy decisions, labour market dynamics, and global trends.

Economic Stagnation and Productivity Gaps

One of the most cited reasons for stagnant wages in the UK is its persistent productivity gap. Since the 2008 financial crisis, UK output per worker has grown far more slowly than in other advanced economies. According to the Office for National Statistics (ONS), UK productivity remains around 15–20% below that of France, Germany, and the US.

Low productivity means businesses generate less value per hour worked, which limits their ability to offer higher wages. Several factors contribute to this:

- Underinvestment in technology: Many UK firms, especially small and medium enterprises (SMEs), lag in adopting automation, AI, and digital tools.

- Skill mismatches: The education and training system doesn’t always align with industry needs, leaving gaps in technical and managerial expertise.

- Regional disparities: High productivity clusters exist in London and the South East, but large parts of the North, Midlands, and Wales remain underdeveloped economically.

“Productivity is the engine of wage growth. If we don’t fix the UK’s productivity puzzle, real wage increases will remain out of reach.” — Dr. Sarah Thompson, Senior Economist at the Resolution Foundation

Inflation and Real Wage Erosion

While nominal salaries may appear stable or slightly increasing, real wages—adjusted for inflation—have declined significantly. Between 2021 and 2023, UK inflation peaked at over 11%, driven by energy prices, supply chain disruptions, and post-pandemic demand shocks. During this period, average wage growth rarely exceeded 6–7%, meaning workers experienced a net loss in purchasing power.

The Bank of England estimates that real average weekly earnings fell by nearly 4% between 2022 and 2023—the sharpest decline in decades. This erosion affects everything from housing affordability to retirement planning.

Real Wage Growth vs Inflation (2020–2023)

| Year | Average Nominal Wage Growth (%) | Inflation Rate (CPI, %) | Real Wage Change (%) |

|---|---|---|---|

| 2020 | 2.1 | 0.9 | +1.2 |

| 2021 | 4.5 | 2.6 | +1.9 |

| 2022 | 6.8 | 9.1 | -2.1 |

| 2023 | 7.2 | 6.8 | +0.4 |

Even as inflation cools, the cumulative effect of years of negative real wage growth has left households financially strained. Employers often cite cost pressures as a reason not to raise salaries, creating a feedback loop of suppressed income and reduced consumer spending.

Labour Market Flexibility and the Rise of Low-Paid Work

The UK labour market is known for its flexibility—low barriers to hiring and firing, widespread use of zero-hour contracts, and minimal severance requirements. While this helps maintain low unemployment, it also weakens workers’ bargaining power.

Over 1 million people in the UK are employed on zero-hour contracts, many in hospitality, care, and retail—sectors notorious for low pay and irregular hours. These jobs often lack benefits, pensions, and career progression, trapping workers in cycles of financial insecurity.

Additionally, the UK’s minimum wage, while legally binding, still falls short of a true “living wage.” As of 2024, the National Living Wage (for those aged 23+) is £11.44 per hour. In contrast, the independently calculated Living Wage Foundation rate—which reflects actual living costs—is £12.00 in London and £11.15 elsewhere.

International Salary Comparison (Average Annual Gross)

| Country | Average Salary (USD) | Average Salary (GBP) | Purchasing Power Index |

|---|---|---|---|

| United States | $68,000 | £53,500 | 78 |

| Germany | $56,000 | £44,000 | 85 |

| Canada | $52,000 | £40,800 | 80 |

| UK | $46,000 | £36,200 | 72 |

| Australia | $58,000 | £45,600 | 83 |

The data shows the UK trailing behind comparable nations, even when adjusting for cost of living. A software developer in Manchester might earn 30% less than their counterpart in Berlin, despite similar skill levels and workloads.

Taxation, Benefits, and Net Take-Home Pay

It’s important to distinguish between gross salary and net income. The UK has a progressive tax system, with basic rate taxpayers paying 20% income tax and National Insurance contributions adding further deductions. For someone earning £35,000 annually, take-home pay is roughly £2,300 per month after tax and NI—less than what similar earners receive in some European countries due to more generous social benefits.

Unlike nations such as France or Sweden, the UK offers limited state support for childcare, eldercare, and housing. These out-of-pocket expenses reduce effective disposable income, making even modestly higher gross salaries in other countries more valuable in practice.

Mini Case Study: Emma, Marketing Executive in Leeds

Emma, 32, works full-time in digital marketing with five years of experience. Her annual salary is £34,000. After rent (£950/month), council tax, utilities, and transport, she has approximately £1,200 left for food, bills, and discretionary spending. She recently discovered a colleague in Amsterdam—with a similar role and experience—earns €48,000 (~£41,000) and pays less for healthcare and public transport. Despite the higher gross salary, Emma feels her UK income doesn’t stretch as far due to weaker public services and higher personal costs.

Actionable Steps to Navigate Low Salaries

While systemic change takes time, individuals can take steps to improve their financial resilience and earning potential.

Checklist: Boosting Your Earning Power in the UK

- Identify in-demand skills in your field (e.g., AI tools, project management certifications).

- Seek employers accredited by the Living Wage Foundation.

- Consider relocating to higher-wage regions—if feasible—or explore remote roles with international companies.

- Negotiate salary annually, using industry benchmarks as leverage.

- Invest in continuous learning through free or subsidized courses (e.g., FutureLearn, Coursera, government Skills Bootcamps).

- Track total compensation, including bonuses, pensions, and benefits—not just base salary.

Frequently Asked Questions

Are UK salaries really lower than Europe?

Yes, on average. While Nordic countries have high taxes, their wages and social benefits offset the cost. The UK lags in both gross pay and net disposable income compared to Germany, France, and the Netherlands.

Why haven’t salaries recovered since the 2008 crash?

The financial crisis triggered austerity policies, reduced public sector pay, weakened unions, and slowed investment. These effects compounded over time, leading to a prolonged period of wage stagnation unmatched in recent history.

Does Brexit affect UK salaries?

Indirectly, yes. Reduced access to EU talent pools has increased competition for skilled workers in some sectors, but overall economic uncertainty and trade friction have dampened investment and growth, limiting upward pressure on wages.

Conclusion: Time for Systemic Change and Personal Strategy

The issue of low UK salaries isn’t due to a single cause but a convergence of economic inertia, policy choices, and global shifts. Productivity lags, inflation, flexible labour markets, and insufficient wage floors all play a role. Internationally, the UK is falling behind peers in both compensation and quality of life metrics.

While waiting for broader reforms, workers must be proactive. Upskilling, seeking better-paying employers, and understanding total compensation can help bridge the gap. At the same time, policymakers must prioritize investments in education, infrastructure, and innovation to rebuild the foundation for sustainable wage growth.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?