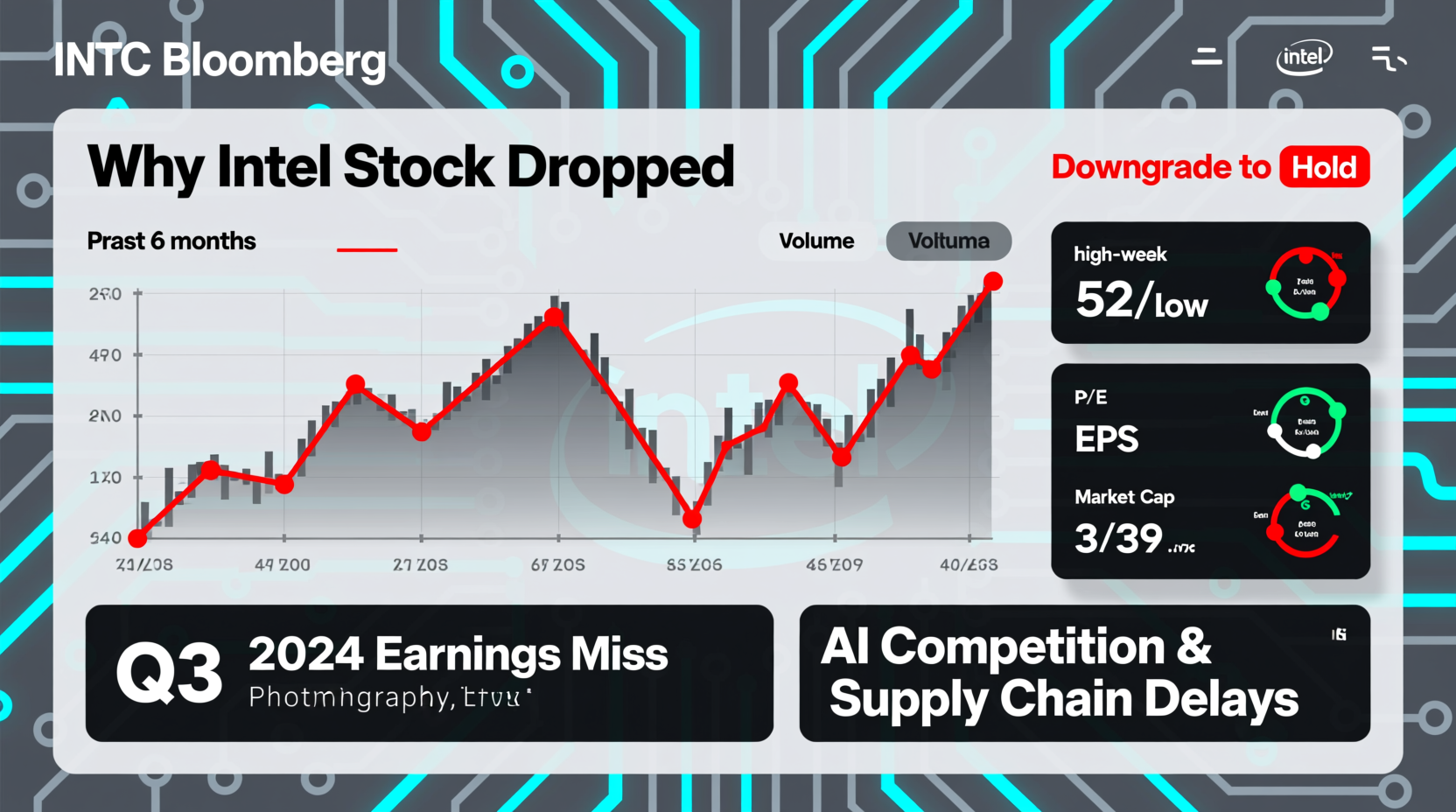

In recent months, Intel Corporation (NASDAQ: INTC) has faced significant headwinds that have contributed to a notable decline in its stock price. Once a dominant force in the semiconductor industry, Intel’s share value has struggled amid intensified competition, execution missteps, and broader market pressures. Investors and analysts alike are asking: Why did Intel stock drop? This article breaks down the critical factors behind INTC’s recent underperformance, analyzes quarterly results, and evaluates what lies ahead for one of tech’s legacy giants.

1. Competitive Pressure from AMD and NVIDIA

One of the most persistent challenges facing Intel is the rise of competitors, particularly Advanced Micro Devices (AMD) and NVIDIA. Over the past five years, AMD has gained substantial market share in both the CPU and server processor segments thanks to its superior chip architecture based on TSMC’s advanced manufacturing nodes. Meanwhile, NVIDIA has surged ahead in AI accelerators and high-performance computing, capitalizing on the generative AI boom—a space where Intel remains a distant follower.

Intel’s inability to match AMD’s performance-per-watt efficiency or NVIDIA’s GPU dominance has weakened investor confidence. In data centers, AMD’s EPYC processors now power major cloud platforms, eroding Intel’s long-held leadership. According to Mercury Research, AMD’s server CPU market share rose to over 25% in 2023, up from less than 10% just four years prior—market gains largely taken from Intel.

“Intel’s competitive position has deteriorated not because of weak demand, but because rivals are simply delivering better products at scale.” — Jim Handy, Semiconductor Analyst at Objective Analysis

2. Manufacturing Delays and Process Node Challenges

At the heart of Intel’s struggles is its lagging semiconductor manufacturing capability. While TSMC and Samsung have successfully transitioned to 3nm and are preparing for 2nm production, Intel has faced repeated delays in rolling out its next-generation process technologies.

The company's 7nm (now called Intel 4) node was delayed by nearly two years due to yield issues, disrupting product roadmaps and giving rivals a crucial time-to-market advantage. Even with the launch of Meteor Lake in late 2023—the first client processor built on Intel 4—the rollout was limited in scale and impact, failing to shift momentum meaningfully.

These setbacks have forced Intel to rely more heavily on external foundries like TSMC for certain chips, undermining its identity as an integrated device manufacturer (IDM). The credibility of its ambitious IDM 2.0 strategy—which includes building foundry services to compete with TSMC—is now under scrutiny.

3. Weak Financial Performance and Guidance Cuts

Intel’s financial reports in 2023 and early 2024 revealed deep structural issues. Revenue declined year-over-year across multiple quarters, driven by weakening PC demand and reduced data center spending. More concerning were repeated downward revisions to future guidance.

In Q4 2023, Intel reported a net loss of $675 million, a stark contrast to the $4.5 billion profit it posted in the same period the previous year. Gross margins contracted significantly, falling below 40%, reflecting higher costs and lower pricing power.

The company also slashed its dividend by nearly 60% in early 2024 to preserve cash for ongoing investments in fabs and R&D. While necessary for long-term survival, this move alarmed income-focused investors who had relied on Intel’s historically generous payout.

| Quarter | Revenue (YoY) | Net Income | Gross Margin | Dividend Change |

|---|---|---|---|---|

| Q4 2022 | $13.1B (-28%) | $4.5B | 48% | $1.36/share |

| Q4 2023 | $12.5B (-12%) | -$675M | 38% | Cut to $0.55/share |

4. Strategic Shifts and Leadership Uncertainty

Under CEO Pat Gelsinger, Intel launched an aggressive turnaround plan involving massive capital expenditures—over $100 billion committed to new fabrication plants in Arizona, Ohio, and Germany. However, these investments require years to yield returns, and their success depends on flawless execution and sustained technological innovation.

Meanwhile, internal reorganization, project cancellations (such as the discontinuation of several GPU initiatives), and layoffs have created uncertainty about the company’s strategic direction. Some analysts argue that Intel is trying to do too much at once: revive its core CPU business, build a foundry division, and enter the discrete GPU and AI accelerator markets—all while playing catch-up technologically.

This complexity increases execution risk. As one institutional investor noted during a recent earnings call: “We admire the ambition, but we need proof that Intel can deliver on even half of what it’s promising.”

Mini Case Study: The Meteor Lake Gamble

Intel pinned hopes on its Meteor Lake processors—launched in late 2023—as a turning point. Marketed as the company’s most innovative laptop chip in years, it featured chiplet design, integrated AI accelerators, and was built on the Intel 4 process. Despite strong technical specs, adoption remained sluggish.

Major OEMs like Dell and Lenovo prioritized AMD Ryzen and Apple Silicon designs for premium notebooks, citing better battery life and thermal efficiency. By early 2024, third-party sales data showed Meteor Lake-powered laptops accounted for less than 15% of new Windows ultrabook shipments. The outcome underscored a harsh reality: even when Intel delivers technically competitive products, market inertia and brand perception work against it.

5. Broader Market and Sector Trends

External factors have also weighed on INTC stock. Rising interest rates made high-P/E growth stocks more attractive relative to mature tech companies with flat earnings. Intel, no longer seen as a growth play, suffered from capital rotation into AI leaders like NVIDIA and Microsoft.

Additionally, the post-pandemic normalization of PC demand hit Intel hard. After record-breaking sales during 2020–2021, global PC shipments fell by over 25% between 2022 and 2023 (per IDC), directly impacting Intel’s Client Computing Group, which historically contributed the largest portion of revenue.

The company’s attempt to pivot toward AI and data-centric workloads has been slow. Its Gaudi AI chips, designed to rival NVIDIA’s Hopper GPUs, captured less than 2% of the AI training market by mid-2024. Without a breakout success in emerging fields, Intel remains overly dependent on shrinking legacy markets.

Checklist: What to Monitor in Intel’s Turnaround

- Progress on Intel 18A and 14A process nodes (targeting 2024–2025)

- Foundry customer wins beyond Microsoft and Qualcomm

- Quarterly gross margin trends and free cash flow generation

- Market share changes in desktop, laptop, and server CPUs

- Adoption rate of next-gen AI chips like Gaudi 3

- Execution consistency in fab construction timelines

FAQ

Is Intel stock a buy right now?

Opinions are divided. Value investors see potential given Intel’s low P/E ratio and strong IP portfolio. However, growth-oriented investors remain cautious due to execution risks and lack of near-term catalysts. A buy decision should consider your risk tolerance and belief in management’s turnaround timeline.

Will Intel ever regain its tech leadership?

It’s possible, but not guaranteed. Success hinges on achieving consistent process node advancements, winning external foundry customers, and establishing relevance in AI. If Intel executes well through 2025–2026, a resurgence could occur—but the window is narrowing.

Why did Intel cut its dividend?

To conserve approximately $3 billion annually in cash, which is being redirected toward capital expenditures for new fabs and R&D. The cut reflects a strategic shift from shareholder returns to reinvestment, acknowledging that long-term survival requires heavy upfront investment.

Conclusion: Navigating Intel’s Uncertain Path Forward

Intel’s recent stock decline is not the result of a single event but a confluence of technological delays, competitive erosion, financial strain, and shifting market dynamics. While the company retains valuable assets—including vast intellectual property, government support through the CHIPS Act, and a global manufacturing footprint—its ability to translate these into sustainable growth remains unproven.

For investors, INTC represents a high-risk, potentially high-reward scenario. The current valuation suggests pessimism is already priced in. The real question isn’t why the stock dropped, but whether Intel can execute its ambitious vision with enough speed and precision to reclaim relevance in a rapidly evolving semiconductor landscape.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?