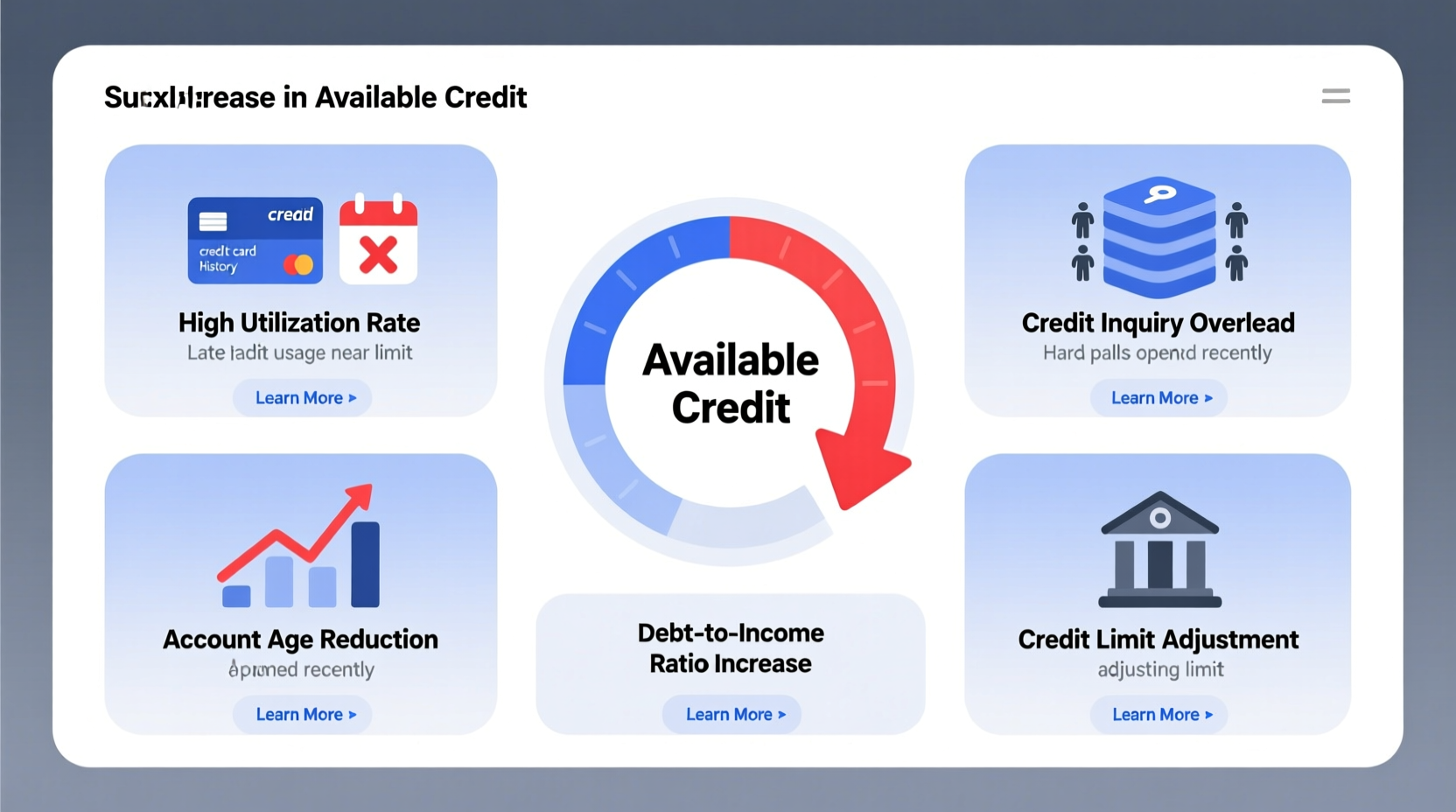

Your available credit is a key part of your financial health. It influences your credit utilization ratio, which makes up 30% of your FICO credit score. When you notice a sudden drop in your available credit, it can be confusing—and concerning. Unlike a missed payment, this change might not come with an alert, yet it can still impact your borrowing power and creditworthiness. Understanding the underlying causes helps you respond proactively and maintain control over your finances.

1. High Credit Card Balances After Purchases

One of the most common reasons your available credit decreases is recent spending. Every time you make a purchase on a credit card, that amount is subtracted from your total credit limit. For example, if you have a $5,000 limit and charge $1,200 on a vacation, your available credit drops to $3,800—until you pay it back.

This reduction isn’t inherently negative, but it becomes problematic when balances remain high relative to your limit. A high balance increases your credit utilization ratio, which lenders view as a risk factor.

2. Credit Limit Reduction by the Issuer

Occasionally, your credit card company may lower your credit limit without your request. This often happens due to:

- Inactivity on the account

- Missed or late payments

- A decline in your credit score

- Changes in the issuer’s risk assessment policies

Credit limit reductions are typically communicated via mail or email, but sometimes they appear only when you check your account online. A lowered limit directly reduces your available credit and can spike your utilization overnight—even if your spending hasn’t changed.

“Lenders periodically reassess risk, and a credit limit cut doesn’t always reflect poor behavior—it can be part of automated portfolio management.” — Lisa Tran, Consumer Credit Advisor at FairCredit Insights

3. New Hard Inquiries and Credit Applications

Applying for new credit—such as a loan, mortgage, or additional credit card—triggers a hard inquiry on your credit report. While the inquiry itself doesn’t reduce your available credit immediately, multiple applications in a short period signal higher financial risk to lenders.

More importantly, if you’re approved for new credit, your total available credit might increase—but only if you use it responsibly. However, if you max out the new line quickly, the net effect could still be higher utilization and less breathing room across all accounts.

4. Account Closure (By You or the Issuer)

Closing a credit card account—whether voluntarily or by the issuer—removes its entire credit limit from your total available credit pool. This can sharply increase your overall credit utilization, even if your spending stays the same.

For example:

| Scenario | Total Credit Limit | Total Balance | Utilization Rate |

|---|---|---|---|

| Before closure | $15,000 | $3,000 | 20% |

| After closing a $5K card | $10,000 | $3,000 | 30% |

As shown, simply closing one account pushes utilization into a range that can negatively affect your credit score.

5. Fraudulent Charges or Identity Theft

Unauthorized charges can silently drain your available credit. If someone gains access to your card details and makes large purchases, your available credit plummets—and you may not notice until your next statement or credit report check.

Fraudulent activity not only reduces available credit but can also lead to disputes, temporary holds, and even account freezes, further limiting access to funds.

What to Do If You Suspect Fraud

- Contact your card issuer immediately to report unauthorized transactions.

- Freeze or close the compromised account if necessary.

- Place a fraud alert on your credit reports through one of the three major bureaus (Equifax, Experian, TransUnion).

- Monitor your other accounts for similar breaches.

Mini Case Study: How Sarah’s Credit Score Dropped Unexpectedly

Sarah had a stable credit score of 760 for years. She used her two credit cards moderately and paid them off monthly. Then, she noticed her score dropped by 40 points. Confused, she pulled her credit report and discovered the reason: her oldest card issuer had reduced her limit from $8,000 to $3,000 due to inactivity.

Even though Sarah hadn’t made new charges, her utilization jumped from 12% to 32% because her existing balance ($1,000) now represented a much larger portion of her reduced limit. She called the issuer, explained her responsible usage, and successfully had the limit restored. Her score recovered within six weeks.

Sarah’s case illustrates how passive changes—beyond your control—can still impact your credit health.

Step-by-Step Guide to Diagnose a Drop in Available Credit

If you’ve noticed a decrease in available credit, follow this timeline to identify and resolve the issue:

- Check all active credit card statements – Look for recent large purchases or cash advances.

- Review account notices – Log into each card issuer’s portal to see if a credit limit change was announced.

- Pull your credit reports – Visit AnnualCreditReport.com to get free reports from all three bureaus. Check for closed accounts or new inquiries.

- Scan for fraudulent activity – Review transaction histories for unrecognized charges.

- Contact issuers directly – If a limit was reduced or an account closed unexpectedly, ask for reinstatement or clarification.

- Adjust spending or payment timing – Make mid-cycle payments to lower reported balances.

Preventive Checklist: Protect Your Available Credit

- ✅ Monitor credit card balances weekly

- ✅ Set up alerts for large transactions or limit changes

- ✅ Avoid closing old credit cards unnecessarily

- ✅ Use credit cards lightly even if not needed, to prevent inactivity closures

- ✅ Keep overall credit utilization under 30%, ideally under 10%

- ✅ Dispute unjustified limit reductions with supporting payment history

FAQ

Does paying my bill early increase my available credit?

Yes. If you pay part or all of your balance before the statement closing date, many issuers report a lower balance to the credit bureaus. This effectively lowers your utilization and can boost your credit score, even if you don’t wait for the due date.

Can I request a credit limit increase to offset a drop?

Yes, but proceed carefully. A hard inquiry may temporarily lower your score. Only request an increase if you’ve had steady income, a good payment history, and haven’t applied for other credit recently. Some issuers offer pre-approved increases with no credit check.

Will my available credit go down if I don’t use my card?

Possibly. Inactive accounts may be closed by the issuer, especially after 12–18 months of non-use. This removes the associated credit limit and reduces your total available credit. To avoid this, use the card for a small recurring expense (like a subscription) and set up automatic payments.

Conclusion: Take Control of Your Credit Health

A drop in available credit isn’t always a sign of financial missteps—it can stem from external decisions, system updates, or overlooked habits. But regardless of the cause, understanding the mechanics behind your credit gives you power to respond wisely. Regular monitoring, timely payments, and strategic account management are simple yet effective ways to maintain strong credit health.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?