Receiving a “Payment Failed” message on Cash App can be frustrating—especially when you're trying to send money quickly or make a time-sensitive purchase. While the error may seem random, most failures stem from predictable causes tied to connectivity, account status, funding sources, or security protocols. Understanding these root causes empowers you to resolve the issue swiftly and prevent future disruptions.

Cash App is one of the most widely used peer-to-peer payment platforms in the U.S., processing billions of dollars annually. Its ease of use makes it ideal for splitting bills, paying rent, or sending gifts. But like any digital financial service, it’s not immune to technical hiccups or user-related errors. The key is knowing what went wrong and how to fix it—without unnecessary stress or delays.

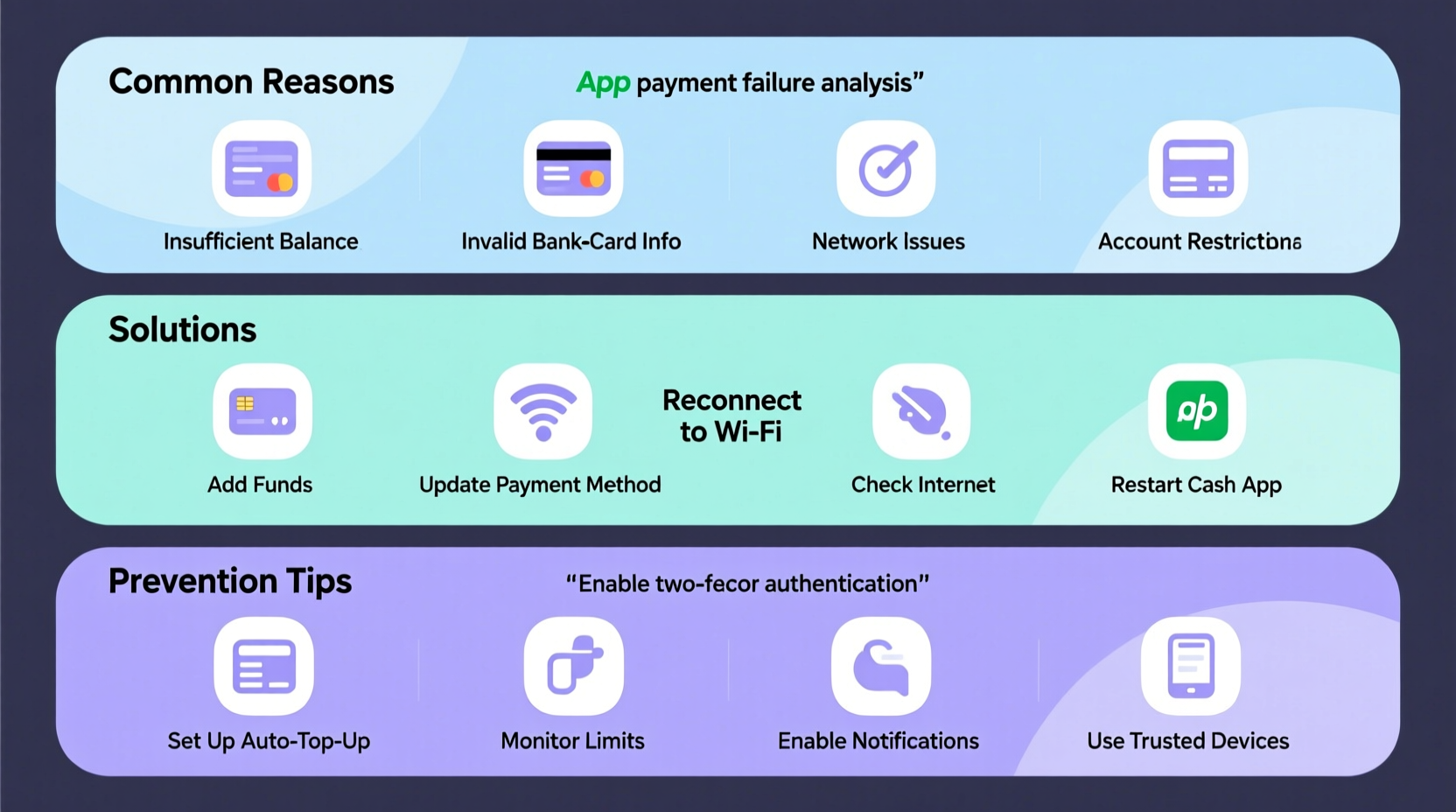

Common Reasons Why Cash App Payments Fail

Before jumping to conclusions, it's important to recognize that payment failures are rarely due to a single factor. They often result from a combination of network conditions, verification status, or financial constraints. Below are the most frequent culprits behind failed transactions.

- Insufficient funds – Your linked bank account, debit card, or Cash App balance doesn’t have enough money to cover the transaction.

- Expired or invalid card – If you’re using a debit or credit card, an outdated expiration date or incorrect CVV can cause rejection.

- Poor internet connection – A weak or unstable network prevents the app from communicating with Cash App servers.

- Account limitations – Unverified accounts have lower sending limits and may face temporary restrictions.

- Bank or card issuer decline – Your bank might block the transaction due to fraud detection or regional settings.

- Server outages or maintenance – Cash App occasionally experiences downtime, especially during peak usage times.

- Incorrect recipient information – Sending to a wrong $Cashtag, email, or phone number can result in failure or return.

Step-by-Step Guide to Fix a Failed Payment

When a payment fails, follow this structured approach to identify and resolve the issue efficiently.

- Check the error message – Cash App usually provides a brief reason (e.g., “Insufficient Funds” or “Card Declined”). Use this clue to narrow down the cause.

- Verify your internet connection – Switch between Wi-Fi and mobile data to test stability. Restart your router if needed.

- Confirm available balance – Open your Cash App dashboard to see your current balance and ensure your linked card or bank has sufficient funds.

- Update card details – Go to Settings > Linked Banks & Cards and re-enter your card’s expiration date and CVV if recently expired.

- Ensure account verification – Fully verify your identity by providing your full name, date of birth, and the last four digits of your SSN under the Security section.

- Contact your bank – Call your card issuer to confirm they aren’t blocking Cash App transactions. Some banks flag P2P payments as suspicious.

- Restart the Cash App – Close the app completely and reopen it, or reinstall it if the problem persists.

- Wait and retry later – If server issues are suspected, wait 30–60 minutes and attempt the payment again.

Do’s and Don’ts When Troubleshooting Payment Issues

| Do | Don’t |

|---|---|

| Verify your account to increase sending limits | Ignore low-balance warnings before sending |

| Use updated card information with correct expiry | Attempt multiple rapid retries after a failure |

| Check Cash App’s system status online | Share your login PIN or two-factor codes |

| Contact support via the app for unresolved issues | Use public Wi-Fi to send sensitive payments |

| Enable notifications to catch declines early | Assume the recipient received funds without confirmation |

Real Example: A Case of Repeated Payment Failures

Sarah, a freelance designer in Austin, tried to pay her assistant $150 via Cash App on a Friday evening. The payment failed three times with the vague message: “Transaction declined.” Frustrated, she considered switching apps but decided to investigate.

She first checked her internet—solid signal. Then she confirmed her Cash App balance was empty, so the payment should pull from her linked debit card. She reviewed the card details and noticed the expiration date hadn’t been updated after receiving a new card last month.

After updating the card information, she retried the payment—and it went through instantly. Later, she called her bank and learned they had also flagged Cash App activity as “high risk” due to lack of prior usage. She added Cash App as a trusted merchant, preventing future blocks.

This case highlights how multiple small issues—a stale card date and silent bank restrictions—can combine to disrupt a simple transaction.

“Most payment failures on fintech platforms stem from outdated user data or uncoordinated bank policies. Keeping your info current is half the battle.” — Marcus Tran, Digital Finance Analyst at FinTech Watch

Preventive Checklist for Smooth Transactions

To minimize the risk of future payment failures, follow this actionable checklist regularly:

- ✅ Verify your Cash App account with accurate personal information

- ✅ Update card expiration dates and CVV immediately after receiving new cards

- ✅ Maintain a small positive balance in your Cash App wallet as a backup

- ✅ Confirm your internet connection is stable before initiating payments

- ✅ Whitelist Cash App with your bank or credit union

- ✅ Monitor your sending limits and upgrade verification if needed

- ✅ Enable push notifications to receive instant alerts about failed attempts

Frequently Asked Questions

Why does Cash App say “Payment Failed” even though I have money in my account?

This can happen if the funds are pending from a recent deposit. Cash App holds some deposits for up to 3 business days before making them spendable. Check your balance details to see if funds are labeled as “Pending.”

Can a recipient reject my Cash App payment?

No, recipients cannot actively reject a sent payment. However, if they don’t accept it within 14 days, the money is automatically returned to your account. Also, if their account is deactivated or suspended, the payment will fail immediately.

Does Cash App charge for failed payments?

No. Cash App only deducts money when a transaction is successfully completed. Failed payments do not incur fees, though your bank might display a temporary hold that clears within 1–3 business days.

Conclusion: Stay Proactive to Avoid Payment Disruptions

A failed Cash App payment doesn’t have to derail your plans. Most issues are fixable within minutes once you know where to look. By maintaining up-to-date payment methods, verifying your identity, and understanding how your bank interacts with digital wallets, you can ensure smooth, reliable transactions every time.

The best defense against payment failures is preparation. Take five minutes each month to review your linked cards, check your verification status, and confirm your network reliability. These small habits save time, reduce stress, and keep your money moving seamlessly.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?