Stock splits are a common corporate action that often captures the attention of investors and financial news outlets. While they don’t change the fundamental value of a company, stock splits can influence investor sentiment, accessibility, and trading dynamics. Understanding why companies choose to split their stock—and what it means for shareholders—is essential for making informed investment decisions.

A stock split increases the number of shares outstanding while reducing the price per share proportionally. For example, in a 2-for-1 split, each shareholder receives an additional share for every share they own, and the price per share is halved. The total market capitalization remains unchanged. Despite this mathematical neutrality, stock splits carry psychological and strategic significance.

What Happens During a Stock Split?

When a company announces a stock split, it adjusts the number of shares in circulation and recalibrates the share price accordingly. The most common types are 2-for-1, 3-for-1, and 3-for-2 splits, though reverse splits also exist (which consolidate shares).

Consider a hypothetical scenario: Company X trades at $600 per share with 10 million shares outstanding. Its market cap is $6 billion. If it executes a 3-for-1 split:

- Each shareholder receives two additional shares for every one held.

- The share price adjusts to approximately $200.

- Total shares increase to 30 million.

- Market capitalization remains $6 billion.

No new value is created—only the structure of ownership changes. However, this adjustment can make the stock more accessible and psychologically appealing to retail investors.

Why Do Companies Split Their Stock?

Companies typically initiate stock splits for strategic, psychological, and liquidity-related reasons. While not mandatory, these actions are deliberate and often signal confidence in future performance.

1. Improve Affordability for Retail Investors

As share prices rise, especially in high-growth companies like Amazon or Tesla, they can become prohibitively expensive for average investors. A split lowers the entry barrier, allowing more individuals to purchase shares—even if only symbolically.

2. Increase Liquidity and Trading Volume

Lower-priced shares tend to trade more frequently. With more shares available at a lower price point, trading volume often increases, enhancing market liquidity. This can attract institutional traders and algorithmic systems that favor higher-turnover stocks.

3. Signal Confidence in Future Growth

A stock split is often interpreted as a positive signal. Management typically won’t split shares unless they believe the price will continue rising. As Warren Buffett once noted:

“Stock splits are usually a sign that management is optimistic about the company’s prospects.” — Warren Buffett, Chairman & CEO, Berkshire Hathaway

4. Enhance Index Eligibility and Fund Inclusion

Some mutual funds and ETFs have guidelines limiting the maximum price per share they can hold. By keeping share prices within a certain range, companies improve their chances of being included in popular investment vehicles.

5. Psychological Appeal and Market Perception

Investors may perceive a $50 stock as “cheaper” than a $600 one—even if the underlying value is identical. This cognitive bias makes splits a tool for maintaining broad-based investor interest.

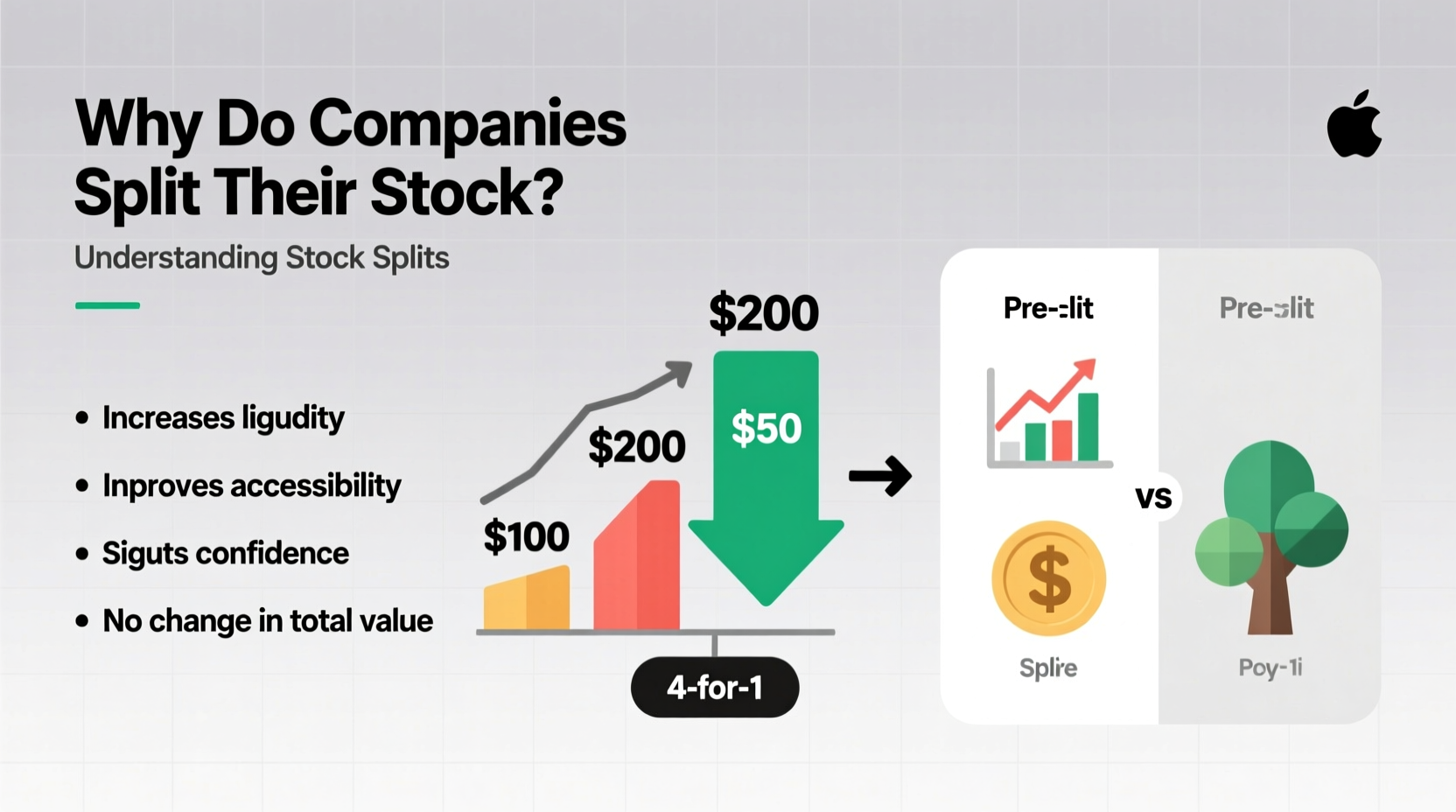

Real Example: Apple’s 2020 Stock Split

In August 2020, Apple executed a 4-for-1 stock split. Prior to the split, shares traded near $500; afterward, they opened around $125. The move came amid record highs and increasing retail participation in the stock market.

The split did not alter Apple’s fundamentals. However, it coincided with renewed investor enthusiasm. In the three months following the split, trading volume increased by over 30%, and retail ownership rose significantly, according to data from Fidelity and Charles Schwab.

This case illustrates how a split can amplify engagement without changing intrinsic value. It also reinforced Apple’s image as an investor-friendly company committed to accessibility.

Stock Splits vs. Reverse Splits: A Comparison

| Feature | Stock Split (e.g., 2-for-1) | Reverse Split (e.g., 1-for-10) |

|---|---|---|

| Purpose | Make shares more affordable | Boost share price to avoid delisting |

| Effect on Share Count | Increases | Decreases |

| Price Per Share | Decreases proportionally | Increases proportionally |

| Market Cap | Unchanged | Unchanged |

| Investor Perception | Generally positive | Often negative (signals distress) |

| Common In | Growth-oriented companies | Struggling or small-cap firms |

While forward splits are seen as bullish, reverse splits often raise red flags. They’re frequently used by companies trading below exchange minimums (e.g., NYSE requires $1 minimum). Though structurally similar, the context and intent differ sharply.

Step-by-Step: What Happens When a Stock Splits?

- Announcement: The board approves a split and discloses the ratio, effective date, and record date.

- Record Date: Investors who own shares on this date qualify for additional shares.

- Ex-Distribution Date: The split takes effect; new shares appear in accounts.

- Price Adjustment: The exchange adjusts the opening price based on the split ratio.

- Trading Resumes: Shares trade at the new, lower price with increased volume.

Throughout this process, no action is required from shareholders. Brokers automatically update holdings and adjust historical price charts.

Common Misconceptions About Stock Splits

Despite their frequency, stock splits are often misunderstood. Here are key myths clarified:

- Myth: A stock split is a free way to increase wealth.

Reality: Total investment value remains unchanged. - Myth: Splits guarantee future price growth.

Reality: They reflect optimism but don’t ensure performance. - Myth: All companies should split when prices rise.

Reality: Some, like Berkshire Hathaway, avoid splits to attract long-term investors.

Frequently Asked Questions

Does a stock split affect my total investment value?

No. While you own more shares, the price per share decreases proportionally. Your total equity position remains the same.

Should I buy a stock right before a split?

There’s no inherent advantage. Any short-term momentum is speculative. Focus on fundamentals rather than split timing.

Can a company split its stock multiple times?

Yes. Apple has split its stock four times since 1987. Amazon executed multiple splits in the 1990s and again in 2022. Frequency depends on growth trajectory and strategy.

Actionable Checklist for Investors

When a company you invest in announces a stock split, follow this checklist:

- Review the split ratio and effective dates.

- Confirm your holdings on the record date.

- Monitor your brokerage account for updated share count post-split.

- Adjust mental benchmarks—don’t mistake lower price for undervaluation.

- Reassess the company’s fundamentals, not just the split event.

- Watch for changes in trading volume and analyst commentary.

Conclusion

Stock splits are more than mechanical adjustments—they reflect corporate strategy, investor psychology, and market dynamics. While they don’t alter a company’s intrinsic value, they can enhance accessibility, boost liquidity, and signal confidence in future growth. Savvy investors recognize that a split alone isn’t a reason to buy or sell but can be part of a broader narrative about a company’s trajectory.

Understanding the rationale behind stock splits empowers you to look beyond price headlines and focus on what truly matters: business performance, competitive advantages, and long-term value creation. Whether you're holding shares in a tech giant or evaluating a smaller growth stock, knowing why and how splits happen equips you to make smarter, more informed decisions.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?