It’s a common experience: you’re ready to download a free app from the App Store or Google Play, but before you can proceed, the system prompts you to enter your credit card or other payment information. At first glance, this may seem unnecessary—after all, the app is free. But behind this requirement lies a carefully designed ecosystem that balances user convenience, digital rights management, and platform security. Understanding why payment details are requested—even for free downloads—can help users make informed decisions about their digital privacy and purchasing habits.

How App Stores Use Payment Information

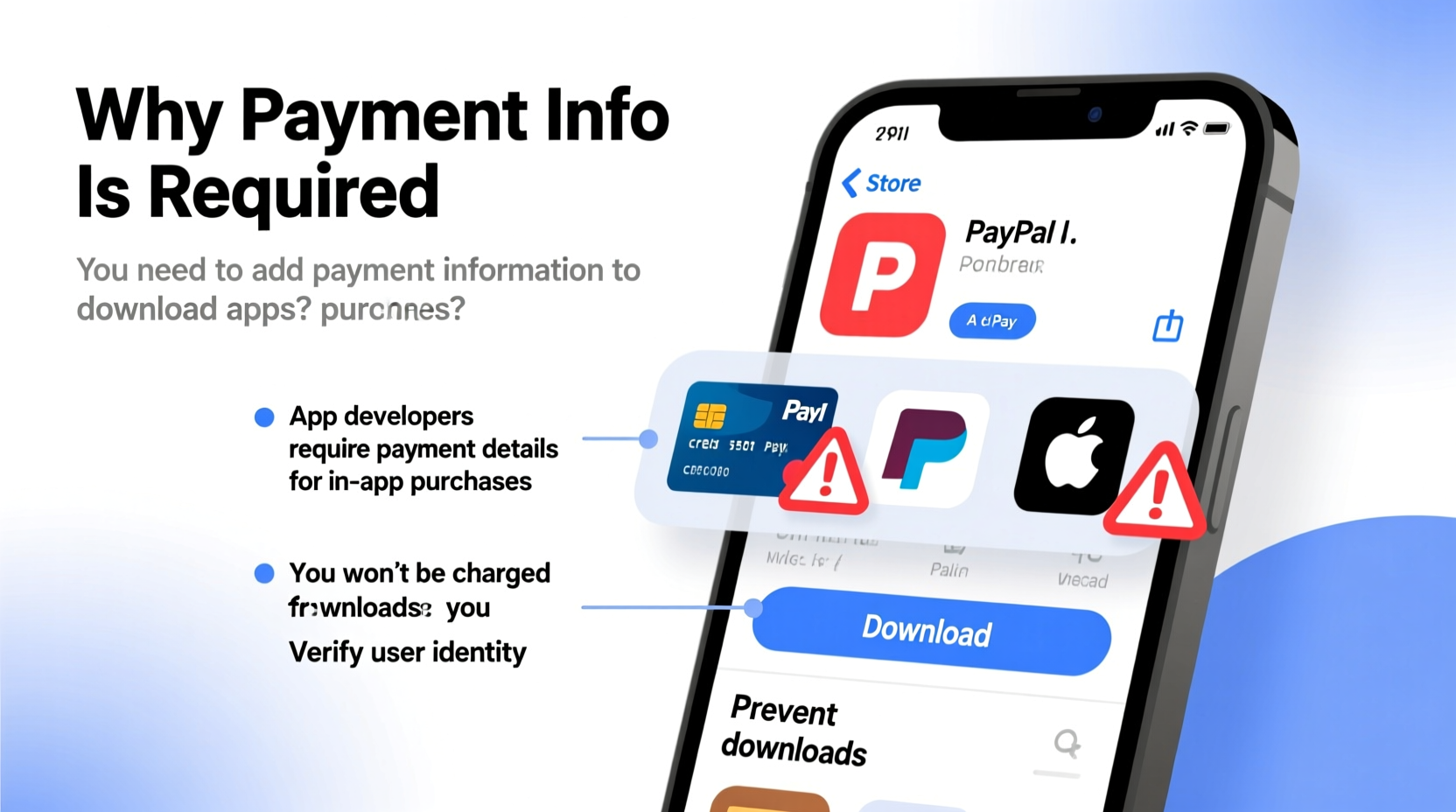

Major app distribution platforms like Apple’s App Store and Google Play operate under a unified account model. When you create an account, linking a payment method isn’t just about enabling purchases—it’s about establishing identity, trust, and transaction readiness within the ecosystem.

For example, both Apple and Google use your payment information as part of a verification process. This helps reduce fraudulent accounts and automated bots that could abuse the system. Even if you never intend to buy anything, providing payment details confirms you're a real user with a verifiable financial footprint.

Additionally, having payment info on file streamlines in-app purchases and subscriptions. Many apps labeled “free” include optional premium features, upgrades, or content unlocks. By pre-registering your payment method, the platform ensures these transactions can happen instantly when you decide to upgrade.

The Role of Account Verification and Security

One primary reason app stores require payment information is account verification. Platforms face constant threats from fake accounts used for spam, review manipulation, or mass downloading of pirated content. Requiring a valid payment method acts as a deterrent against such abuse.

According to industry analysts at Sensor Tower, over 95% of top-grossing mobile apps include in-app purchases. This business model relies on frictionless buying experiences. If users had to enter payment details every time they wanted to unlock a feature, conversion rates would plummet. Pre-registering payment methods removes that friction.

“Requiring payment info upfront enhances both security and user experience. It filters out bad actors while enabling seamless microtransactions.” — Sarah Lin, Mobile Ecosystem Analyst at TechInsight Group

Moreover, verified accounts are less likely to be suspended or restricted due to suspicious activity. This protects legitimate users from losing access to their downloaded apps, cloud backups, and subscription services.

Free Apps vs. Freemium Models: What You’re Really Downloading

The line between “free” and “paid” has blurred significantly in modern app design. Most so-called free apps operate under a freemium model—offering basic functionality at no cost while encouraging users to pay for enhanced features.

Examples include:

- A photo editing app that offers basic filters for free but charges for advanced tools.

- A game that allows free play but sells power-ups or ad removal.

- A music streaming service offering limited skips unless you subscribe.

In these cases, having payment info on file means the moment you decide to upgrade, the transaction happens instantly. The platform doesn’t have to re-authenticate your identity or redirect you through multiple checkout steps.

| App Type | Cost Model | Requires Payment Info? |

|---|---|---|

| Fully Free (No IAP) | No cost, no purchases | Sometimes (platform policy) |

| Freemium | Free base + paid upgrades | Yes (for upgrade readiness) |

| Paid Upfront | Lump sum purchase | Yes (mandatory) |

| Subscription-Based | Recurring fees | Yes (essential) |

Step-by-Step: How to Add Payment Info Safely

If you're uncomfortable entering your primary credit card, follow this secure process to minimize risk while complying with platform requirements:

- Create a dedicated email for your app store account to separate it from personal or work communications.

- Use a virtual or prepaid card with a small balance instead of linking your main bank account.

- Select \"None\" if available: On iOS, after choosing a country like the United States, you can sometimes select “None” as a payment option once you’ve added a valid method.

- Set up two-factor authentication to protect your account from unauthorized changes.

- Monitor statements monthly for unexpected charges, especially after trying new apps.

Real Example: Maria’s Experience With Unexpected Charges

Maria, a teacher from Portland, downloaded a meditation app she believed was free. She entered her debit card details during setup because the App Store required it. Two weeks later, she noticed a $12.99 charge on her statement.

Upon investigation, she realized the app offered a seven-day free trial of its premium plan—but automatically enrolled her in a subscription afterward. Because her payment method was already saved, the renewal went through silently.

This scenario highlights a crucial point: adding payment info doesn’t just enable purchases—it enables auto-renewals. Users must read terms carefully and cancel trials before they expire if they don’t want to be billed.

Do’s and Don’ts When Adding Payment Info

| Do | Don't |

|---|---|

| Review app permissions and privacy policies | Assume “free” means zero financial commitment |

| Use gift cards or prepaid options when possible | Share your password or let others manage your account |

| Check subscription settings regularly | Ignore confirmation emails or renewal notices |

| Enable purchase approval (e.g., Face ID prompt) | Store full credit card details on public devices |

Frequently Asked Questions

Can I download free apps without adding any payment method?

On some platforms and in certain regions, yes. For example, Apple allows users to select “None” as a payment option if there's no active subscription or pending balance. However, this option isn't available everywhere and may require switching your store region or using a workaround.

Will I be charged just for entering my card?

No. Simply adding payment information does not trigger any charges. However, some apps offer free trials that convert to paid plans unless canceled. Always check the terms before signing up.

Is it safe to add my credit card to the App Store or Google Play?

Yes, both platforms use encryption and secure tokenization to protect your data. However, no system is 100% immune to breaches. To stay safe, use strong passwords, enable two-factor authentication, and monitor your account activity regularly.

Conclusion: Taking Control of Your Digital Spending

Requiring payment information to download apps—even free ones—isn’t merely a sales tactic; it’s part of a broader strategy to ensure security, streamline user experience, and support modern monetization models. While the practice makes sense from a platform perspective, it places responsibility on users to stay vigilant about subscriptions, trials, and permissions.

You don’t have to avoid app stores altogether, but understanding the “why” behind the request empowers smarter choices. Whether you opt for prepaid cards, disable auto-renewals, or simply audit your installed apps monthly, small habits can prevent unwanted charges and enhance your digital safety.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?