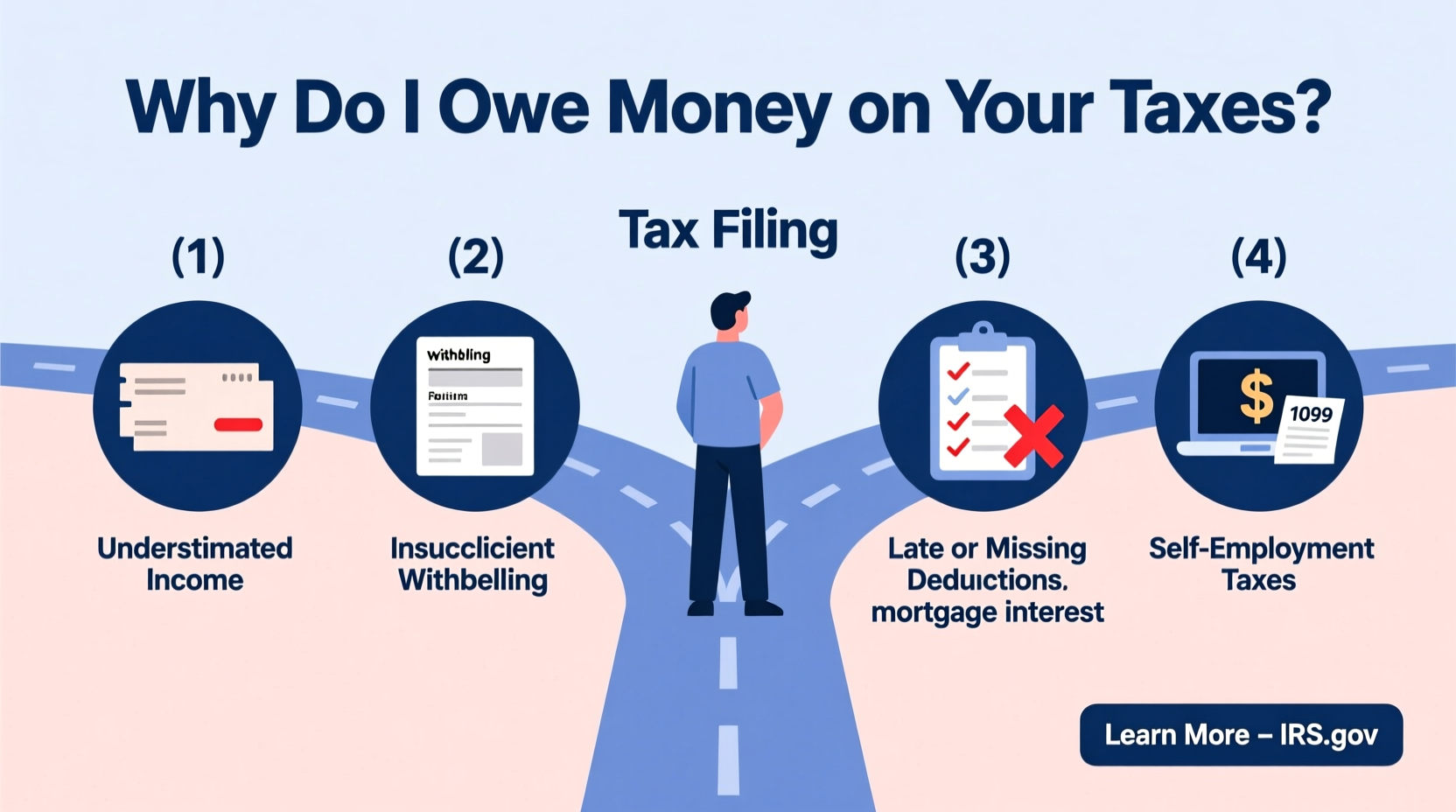

Tax season often brings a mix of anticipation and anxiety. While some look forward to a refund, others are surprised by a bill they didn’t expect. If you’ve recently found yourself owing money to the IRS, you’re not alone. Millions of taxpayers each year end up with a balance due—not because they did anything illegal, but due to misunderstandings about withholding, life changes, or overlooked income. Understanding why this happens is the first step toward avoiding it in the future.

Underwithholding from Paychecks

One of the most frequent causes of a tax bill is insufficient federal income tax being withheld from your paycheck. When you start a job, you fill out a Form W-4 that tells your employer how much tax to withhold based on your filing status, dependents, and other factors. If you claim too many allowances—or fail to update your W-4 after major life events—you may end up paying too little throughout the year.

For example, someone who marries, has a child, or takes on a second job without adjusting their withholding could see a significant gap between what was withheld and what they actually owe.

Freelance or Gig Economy Income Not Reported Correctly

If you earn money outside traditional employment—such as freelancing, driving for ride-share apps, selling goods online, or consulting—you may not have taxes automatically withheld. Many gig workers assume small earnings aren't reportable, but the IRS requires all income over $400 to be declared, regardless of source.

Even if you don’t receive a 1099 form (which platforms may not issue under certain thresholds), you're still responsible for reporting the income. Without quarterly estimated tax payments, this can lead to a large balance due when you file.

“Self-employed individuals often underestimate their tax obligations. Quarterly payments prevent year-end shocks.” — Lisa Tran, CPA and Small Business Tax Advisor

Life Changes That Impact Your Tax Bracket

Major life events can shift your tax situation significantly. Getting married, having a baby, buying a home, retiring, or receiving an inheritance all affect your taxable income and available credits. For instance, a promotion leading to higher income might push you into a higher tax bracket, increasing your overall liability.

Likewise, if you retired and began withdrawing from retirement accounts like a 401(k) or traditional IRA, those distributions are generally taxable. Without proper planning, these withdrawals can unexpectedly boost your adjusted gross income (AGI), reducing eligibility for certain deductions and creating a tax shortfall.

Common Life Events That Trigger Tax Surprises

- Marrying or divorcing

- Starting or leaving a job

- Receiving unemployment benefits

- Cash-out refinancing or home sale profits

- Inheriting assets or receiving gifts above exclusion limits

Missed Deductions and Credits

While missing deductions doesn’t directly cause you to owe more, it means you’re not taking full advantage of ways to reduce your tax bill. Some common overlooked opportunities include:

- Educator expenses (up to $300 for teachers)

- Student loan interest (even if you don’t itemize)

- Retirement contributions (like deductible traditional IRA contributions)

- Health Savings Account (HSA) contributions

- Child and dependent care credit

- Energy-efficient home improvement credits

Not claiming eligible credits—especially refundable ones like the Earned Income Tax Credit (EITC)—can turn what should have been a refund into a balance due, especially if combined with other issues like underwithholding.

Estimated Tax Payments Were Skipped or Miscalculated

If you’re self-employed, receive rental income, investment gains, or other non-wage earnings, you likely need to make quarterly estimated tax payments. These are due in April, June, September, and January. Skipping or underpaying them results in a larger tax bill at filing time—and possibly penalties.

The IRS generally expects you to pay at least 90% of your current year’s tax or 100% of the previous year’s tax (110% if your AGI exceeds $150,000) to avoid underpayment penalties.

Step-by-Step Guide to Avoid Owing Next Year

- Review your latest tax return to understand your total tax liability and sources of income.

- Adjust your W-4 with your employer to increase withholding if needed.

- Estimate side income and use Form 1040-ES to calculate quarterly payments.

- Schedule payment reminders for April 15, June 15, September 15, and January 15.

- Meet with a tax professional mid-year to reassess projections and adjust strategy.

| Reason for Owing Taxes | Prevention Strategy | Potential Penalty? |

|---|---|---|

| Insufficient paycheck withholding | Update W-4 form with employer | No, if minimum tax paid |

| Self-employment income not reported | File Schedule C + pay estimated taxes | Yes, late payment penalty + interest |

| Missed retirement contributions | Contribute to deductible IRA by tax deadline | No direct penalty |

| Capital gains from stock sales | Track cost basis; plan for tax impact | Possible underpayment penalty |

| Unemployment compensation taxed | Elect voluntary withholding when collecting | Yes, if not enough tax paid |

Real Example: Sarah’s Unexpected Tax Bill

Sarah, a graphic designer, transitioned to freelance work in 2023 after leaving her full-time job. She earned $68,000 through client projects but didn’t make any estimated tax payments, assuming her savings would cover whatever she owed. Come April, she filed her return and discovered she owed $9,200—plus a $470 penalty for underpayment.

After consulting a CPA, she learned that without withholding, she was responsible for both income tax and self-employment tax (15.3%). Going forward, she now sets aside 25–30% of each payment for taxes and makes timely quarterly deposits using the Electronic Federal Tax Payment System (EFTPS).

Frequently Asked Questions

Can I go to jail for owing taxes?

No, simply owing money is not a criminal offense. The IRS treats unpaid taxes as a civil debt. However, willful tax evasion—such as hiding income or falsifying returns—can lead to legal consequences.

What happens if I can’t pay what I owe?

The IRS offers several options, including installment agreements, offers in compromise, and temporary delay of collection if you’re experiencing financial hardship. It’s crucial to file your return on time even if you can’t pay immediately to avoid additional penalties.

Does getting a tax refund mean I did well?

Not necessarily. A refund means you overpaid during the year—essentially giving the government an interest-free loan. Ideally, your withholding should match your liability closely, leaving you neither owing nor receiving a large check.

Take Control of Your Tax Future

Owing money on your taxes doesn’t have to become an annual event. By understanding the root causes—underwithholding, unreported income, life changes, and missed credits—you can take proactive steps to align your payments with your actual liability. Whether you're a W-2 employee, a gig worker, or managing investments, staying informed and planning ahead reduces stress and keeps more of your money where it belongs—in your pocket.

Start today: pull your last tax return, review your current withholding, and consider meeting with a tax advisor before the next quarter ends. Small adjustments now can prevent big bills later.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?