Tax season often brings unexpected news—especially when you realize you owe state taxes instead of receiving a refund. While federal tax issues receive more attention, state-level liabilities can catch even careful filers off guard. Unlike the IRS, each state operates under its own rules, tax rates, and withholding requirements, making it easy to miscalculate or overlook key details. Understanding why you owe can help you adjust your financial habits, avoid penalties, and plan better for next year.

How State Taxes Differ from Federal Taxes

Federal income tax is standardized across the U.S., but state taxes vary significantly. Nine states—including Texas, Florida, and Nevada—don’t levy a personal income tax at all. Others, like California and New York, have progressive rates that can exceed 10%. Some states impose flat rates, while others tax specific types of income differently. This patchwork system means your tax liability depends heavily on where you live, work, or earn income.

Additionally, states don’t always follow federal deadlines or definitions. For example, what counts as taxable income federally may be treated differently at the state level. If you moved during the year, worked remotely for an out-of-state employer, or received income from multiple sources, these discrepancies can lead to underpayment and unexpected balances due.

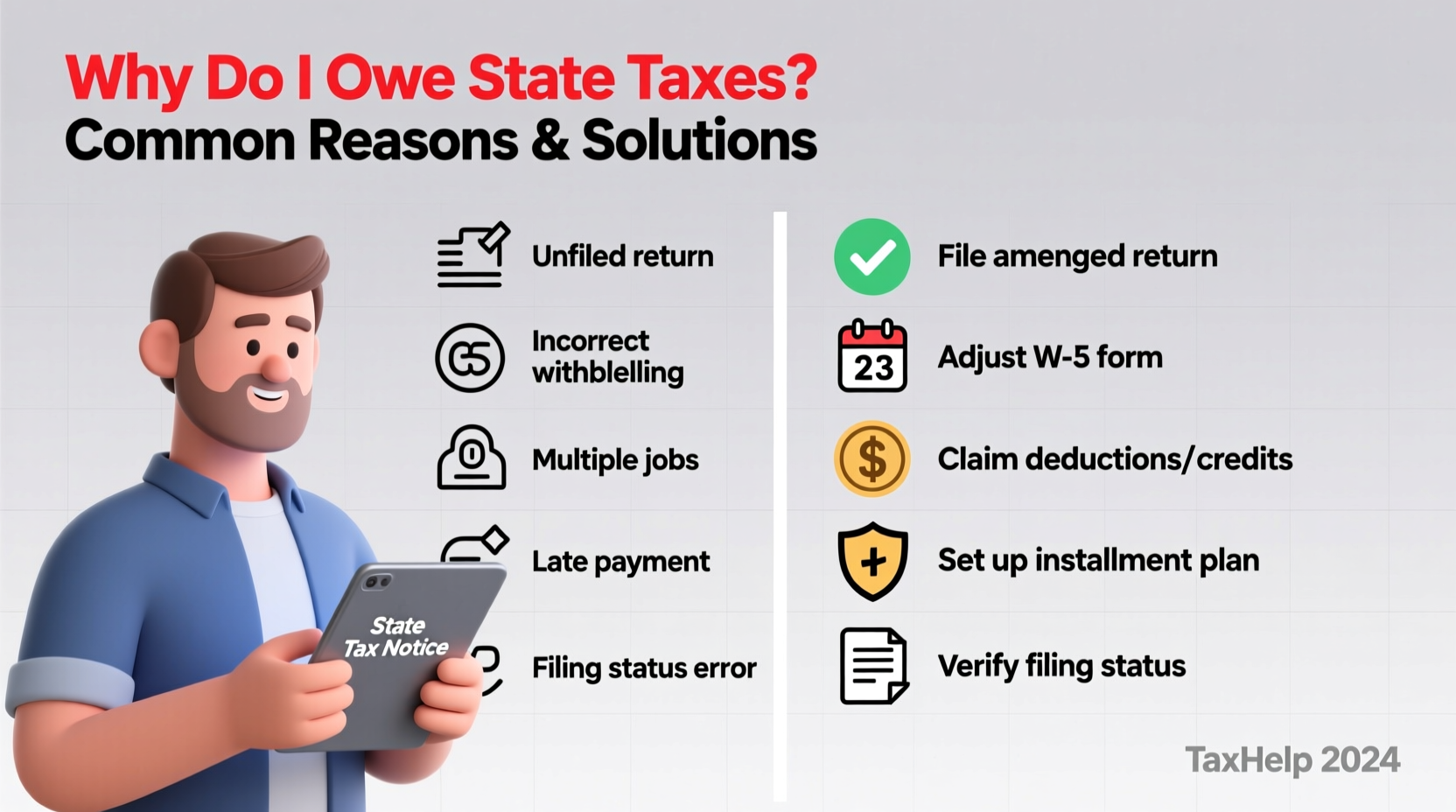

Common Reasons You Owe State Taxes

Several factors contribute to owing money on your state return. Identifying them early helps prevent recurrence.

- Insufficient withholding: If too little was withheld from your paycheck, you’ll likely owe. This often happens after a raise, starting a new job, or failing to update your W-4 and state equivalent (like a DE-4 in California).

- Freelance or gig income not reported: Independent contractors rarely have taxes automatically withheld. Without quarterly estimated payments, this income accumulates into a large tax bill come filing time.

- Working in a different state than where you reside: If you commute across state lines or worked remotely for a company based elsewhere, you may need to file in both states—and credits aren’t always full or automatic.

- Life changes not reflected in tax forms: Marriage, divorce, having a child, or retirement can shift your tax bracket or eligibility for credits, affecting your liability.

- Underestimating tax obligations on investments: Capital gains, dividends, and retirement account withdrawals are taxable in most states and may not have sufficient backup withholding.

Real Example: Sarah’s Remote Work Surprise

Sarah lived in Pennsylvania but accepted a remote position with a company headquartered in New York. She assumed her taxes would be handled as usual through PA withholding. However, New York required her to file a non-resident return and pay taxes on income earned while working for a NY-based employer. Because no taxes were withheld by New York, she faced a $1,200 balance due—plus late payment interest since she didn’t make estimated payments.

After consulting a tax professional, Sarah learned she could claim a credit on her PA return for taxes paid to NY, reducing double taxation. Going forward, she adjusted her withholding and began making estimated payments when necessary. Her experience highlights how remote work can create complex multi-state tax situations—even when unintentional.

Step-by-Step Guide to Resolving and Preventing State Tax Debt

- Review your filing status and residency rules: Determine if you’re a resident, part-year resident, or non-resident in your state. States like Virginia and Maryland have strict criteria based on physical presence and domicile.

- Check all sources of income: Include wages, freelance earnings, rental income, stock sales, unemployment benefits, and retirement distributions. Each may be taxed differently.

- Verify withholding accuracy: Access your state’s revenue department website and use their withholding calculator. Adjust your allowances using the state-specific form.

- Make estimated payments if needed: If you expect to owe more than $500 in state taxes, consider quarterly payments using Form 1040-ES (or your state’s equivalent).

- File on time and explore payment options: If you can’t pay in full, most states offer installment agreements with minimal setup fees and lower interest than credit cards.

Do’s and Don’ts When Facing a State Tax Bill

| Do’s | Don’ts |

|---|---|

| File your return even if you can’t pay. Avoids failure-to-file penalties. | Ignore the notice. Penalties and interest will accumulate quickly. |

| Set up a payment plan online through your state’s Department of Revenue. | Use high-interest credit cards without comparing costs. |

| Adjust W-4 and state withholding forms after filing. | Assume last year’s settings still apply without review. |

| Keep records of all communications and payments. | Forget to check for available credits like renter’s relief or low-income offsets. |

“Many taxpayers are shocked by state tax bills because they focus only on federal returns. Proactive withholding and awareness of multi-state rules are essential.” — Laura Simmons, CPA and State Tax Advisor

Checklist: Avoid Owing State Taxes Next Year

- ☐ Confirm your state residency status for tax purposes

- ☐ Review all income sources, including side gigs and investments

- ☐ Update your state withholding form (e.g., CA DE-4, NY IT-2104) with your employer

- ☐ Use your state’s withholding calculator to estimate needs

- ☐ Sign up for quarterly estimated payments if self-employed or under-withheld

- ☐ Track deadlines for estimated payments (typically April 15, June 15, September 15, January 15)

- ☐ Consult a tax professional if you work across state lines or have complex income

Frequently Asked Questions

Can I be taxed by two states on the same income?

In some cases, yes—but most states offer a tax credit for amounts paid to another state to prevent double taxation. For example, if you live in Indiana but work in Ohio, you’ll file a non-resident return in Ohio and claim a credit on your Indiana return for taxes paid. Always verify reciprocity agreements; states like Pennsylvania and New Jersey have special arrangements with neighboring regions.

What happens if I don’t pay my state tax bill?

Unpaid balances accrue interest daily and may trigger penalties. The state can place liens on property, freeze bank accounts, or withhold future refunds. In extreme cases, wage garnishment is possible. It’s far better to contact the state agency early to negotiate a manageable payment plan.

Do I have to pay state taxes if I moved mid-year?

Yes. You’ll likely file as a part-year resident, reporting income earned while living in the state. Some states prorate exemptions and deductions; others require separate calculations for resident and non-resident periods. Keep detailed records of relocation dates and employment timelines to support your filing.

Take Control of Your State Tax Obligations

Owing state taxes doesn’t mean you made a mistake—it often reflects life changes, evolving income streams, or gaps in understanding local rules. The key is turning surprise into strategy. By reviewing your withholding, tracking income sources, and planning ahead, you can transform next year’s filing from stressful to seamless. Knowledge is power, especially when it comes to keeping more of what you earn.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?