It’s a common and frustrating experience: you finally pay off a credit card, loan, or other debt—celebrating financial progress—only to check your credit score a few weeks later and find it has dropped. This counterintuitive outcome leaves many consumers confused and discouraged. How can eliminating debt hurt your credit?

The truth is, while paying off debt is always financially sound, the mechanics of credit scoring don’t operate on simple arithmetic. Multiple factors influence your score, and some changes in your credit profile—even positive ones—can temporarily shift those metrics in unexpected ways.

Understanding why this happens, what specific factors are at play, and how to respond strategically can help you not only recover your score but strengthen your long-term credit health.

Why Paying Off Debt Can Lower Your Credit Score

Credit scores are calculated using complex algorithms that weigh several key components. When you pay off a debt, one or more of these factors may shift in a way that reduces your overall score—even though you’ve made a responsible financial decision.

Here are the most common reasons your score might dip after becoming debt-free:

1. Change in Credit Utilization Ratio

Your credit utilization ratio—the percentage of available credit you’re using—is one of the most influential factors in your FICO and VantageScore models, accounting for about 30% of your FICO score.

When you pay off and close a credit card, you eliminate that account’s credit limit from your total available credit. Even if your overall debt decreases, your utilization ratio may increase because your remaining balances now represent a higher percentage of your reduced total limit.

Example: Suppose you have two credit cards, each with a $5,000 limit ($10,000 total). You carry a $3,000 balance on one and zero on the other. Your utilization is 30% ($3,000 ÷ $10,000).

If you pay off the second card and close it, your total credit drops to $5,000. Your $3,000 balance now represents 60% utilization—a significant jump that can hurt your score.

2. Reduction in Credit Mix

Credit mix refers to the variety of credit types in your profile—such as installment loans (car loans, mortgages) and revolving credit (credit cards). It makes up about 10% of your FICO score.

Paying off an installment loan, like a personal loan or auto loan, removes that type of credit from your mix. If you no longer have any active installment accounts, your score may decline slightly due to less diversity.

This doesn’t mean you should keep unnecessary debt just for scoring purposes. But be aware that eliminating certain account types can have a short-term impact.

3. Shortened Credit History

The length of your credit history contributes roughly 15% to your FICO score. When you close an old account after paying it off, you may reduce the average age of your credit accounts.

For example, closing a credit card you’ve had for 12 years will lower your average account age, especially if your other accounts are newer. This effect compounds over time, so long-standing accounts are particularly valuable to keep open.

“Closing accounts, especially long-standing ones, can disrupt decades of credit-building momentum. Consumers often don’t realize how much history they’re sacrificing.” — Laura Adams, Credit Analyst and Author of *The Smart Woman’s Guide to Planning for Retirement*

4. Removal of Positive Payment History from Active Accounts

While closed accounts with positive histories remain on your credit report for up to 10 years, they stop actively contributing to your payment history once closed. Active accounts with consistent on-time payments are weighted more heavily in real-time scoring models.

Eliminating an account that was regularly reporting good behavior means losing that ongoing boost—especially if you don’t have other accounts generating fresh positive data.

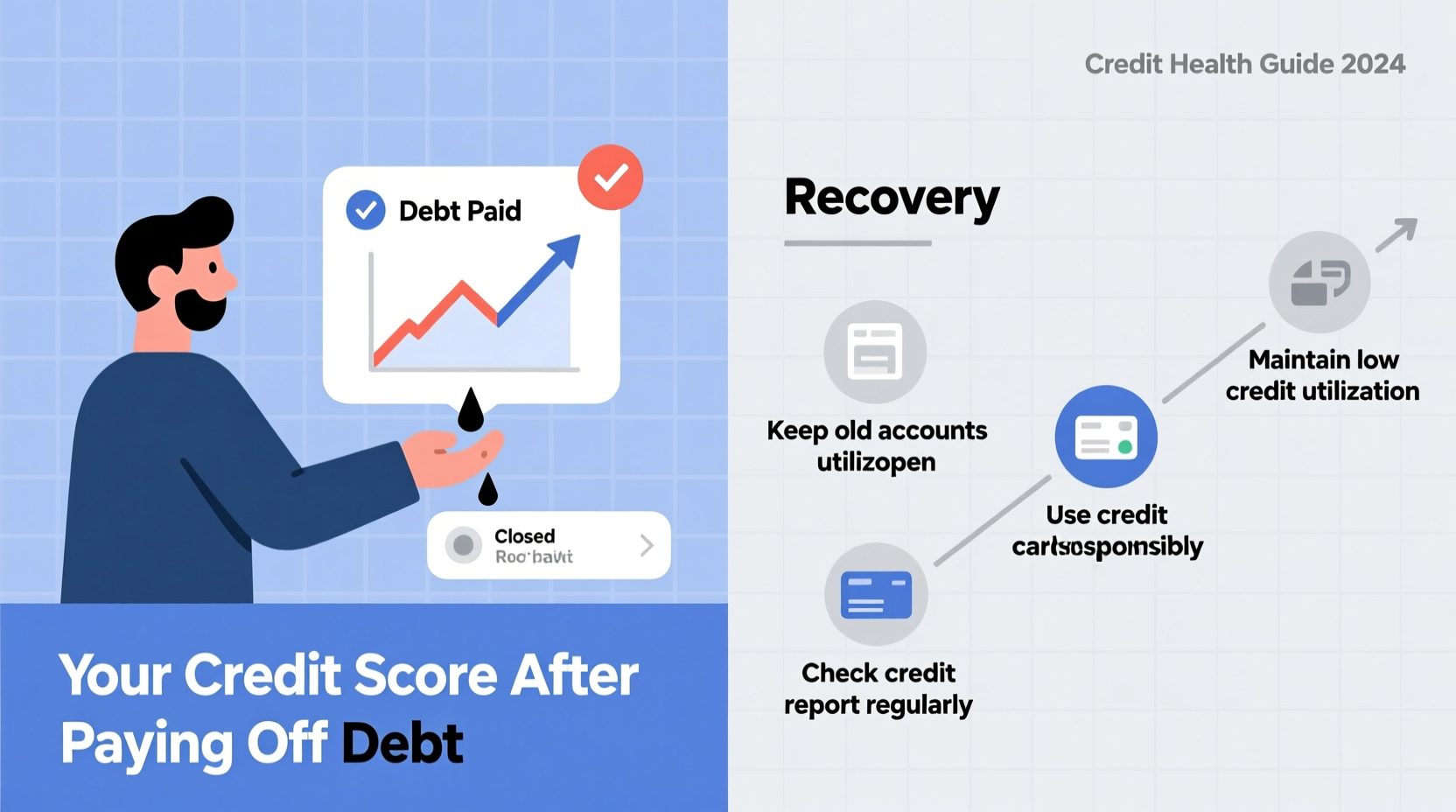

How to Rebound After a Credit Score Drop

A temporary dip in your credit score after paying off debt isn’t permanent. With intentional steps, you can recover—and even improve—your credit standing within a few billing cycles.

Step-by-Step Plan to Rebuild Your Score

- Do not close paid-off accounts. Especially if they’re old or have high credit limits, keeping them open preserves your credit history and utilization ratio.

- Maintain low balances on remaining cards. Aim to use less than 10% of your available credit per card and across all cards combined.

- Continue making on-time payments. Payment history is the largest factor in your score (35%). Set up autopay if needed to ensure consistency.

- Consider opening a new credit card—if appropriate. A new card increases your total credit limit, which can lower utilization. But only apply if you don’t need financing and can manage another account responsibly.

- Become an authorized user. Ask a family member or trusted friend with excellent credit to add you to one of their seasoned accounts. Their positive history can reflect on your report.

- Monitor your credit utilization monthly. Reporters typically update utilization based on your statement balance. Pay down balances before the statement date to keep reported usage low.

What Not to Do After Paying Off Debt

Reacting emotionally to a score drop can lead to decisions that worsen the situation. Avoid these common mistakes:

| Don’t | Why | Do This Instead |

|---|---|---|

| Close credit card accounts right after paying them off | Lowers total credit limit and average age of accounts | Leave them open; use occasionally for small purchases |

| Apply for multiple new credit cards | Hard inquiries and new accounts lower average age and increase risk | Apply for one new card only if needed and spaced out over time |

| Carry high balances on other cards | Increases utilization, which harms your score | Distribute charges lightly or pay mid-cycle to reduce reported balances |

| Ignore your credit reports | Mistakes or fraud could be dragging your score down further | Review reports annually at AnnualCreditReport.com |

Real-Life Example: Maria’s Credit Score Surprise

Maria, a 38-year-old graphic designer, worked hard for two years to pay off a $7,000 credit card balance. She used side gigs and budgeting apps to accelerate her payments and finally cleared the debt in June. Proud of her achievement, she canceled the card to avoid temptation.

Two weeks later, she checked her credit score and was shocked to see it had dropped from 762 to 724—a 38-point fall. Confused and discouraged, she contacted a nonprofit credit counselor for help.

The counselor explained that by closing her oldest card (open for 11 years), Maria had significantly reduced both her average account age and total available credit. Her utilization jumped from 18% to 42% overnight because her only remaining card had a $5,000 limit and a $2,100 balance.

With guidance, Maria took corrective action:

- She called the issuer and requested reinstatement of the closed account (not always possible, but sometimes successful).

- When reinstatement failed, she opened a new no-annual-fee card with a $6,000 limit, increasing her total available credit.

- She set up autopay for a recurring subscription on her remaining card to keep it active and reporting.

- She began paying her statement balance twice per month to keep reported utilization under 10%.

Within four months, Maria’s score recovered to 758 and continued rising. Her story highlights how well-intentioned actions can backfire without understanding credit dynamics—and how strategic adjustments can restore and exceed previous levels.

Actionable Tips to Maintain and Improve Credit Health

Credit Rebound Checklist

Use this checklist to stabilize and grow your credit after paying off debt:

- ✅ Confirm all paid-off accounts are reported as “closed” or “paid in full”

- ✅ Avoid closing any remaining credit card accounts

- ✅ Calculate your current credit utilization across all cards

- ✅ Aim to keep utilization below 10% for optimal scoring

- ✅ Make at least one small purchase on each open card monthly

- ✅ Set up autopay for minimum or full balance to prevent late payments

- ✅ Review your credit report for errors (via AnnualCreditReport.com)

- ✅ Consider a credit-builder loan or secured card if rebuilding from scratch

Frequently Asked Questions

Will my credit score go back up after paying off debt?

Yes, in most cases, your score will recover and often surpass its previous level—provided you maintain responsible credit habits. The initial drop is usually temporary and tied to shifts in utilization, credit mix, or account age. Consistent on-time payments and low balances will rebuild your score within 1–6 months.

Should I keep a small balance on my credit card to help my score?

No. This is a myth. Carrying a balance does not improve your credit score. In fact, it costs you interest and increases your utilization. The best practice is to pay your balance in full every month. What matters is that the card is used and paid on time—not that you owe money.

Can paying off collections hurt my credit score?

Yes, in some cases. Updating a collection account to “paid” can reset its last activity date, making it appear newer on your report. Since newer negative items weigh more heavily than older ones, this can cause a temporary drop. However, paying collections is still advisable if you’re applying for a mortgage or large loan, as lenders prefer resolved debts.

Conclusion: Turn a Setback into Long-Term Gains

Seeing your credit score drop after paying off debt can feel like a betrayal. But it’s not a reflection of poor financial choices—it’s a sign that the system is responding to structural changes in your credit profile.

By understanding the underlying mechanics—utilization, credit age, mix, and reporting—you gain control over outcomes. Strategic decisions like keeping accounts open, managing utilization proactively, and maintaining active credit relationships turn a short-term setback into a foundation for stronger credit.

Your financial discipline got you out of debt. Now, apply that same discipline to credit management. Monitor your habits, stay informed, and make intentional moves. Over time, your score won’t just rebound—it will reflect the stability and responsibility you’ve worked so hard to achieve.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?