Filing taxes is a mandatory responsibility for individuals and businesses alike, but not everyone can meet the April 15 deadline. While some scramble to complete their returns last minute, others choose to file a tax extension. But what does that actually mean? Is it a smart move or a risky delay? Understanding why to file a tax extension—and when not to—can save you stress, penalties, and even money.

A tax extension gives you additional time to prepare and submit your tax return, typically pushing the deadline from April 15 to October 15. It’s important to note: an extension to file is not an extension to pay. If you owe taxes, the IRS still expects payment by the original due date to avoid interest and penalties. With that in mind, let’s explore the real reasons people file extensions, the advantages and drawbacks, and how to decide if it’s right for you.

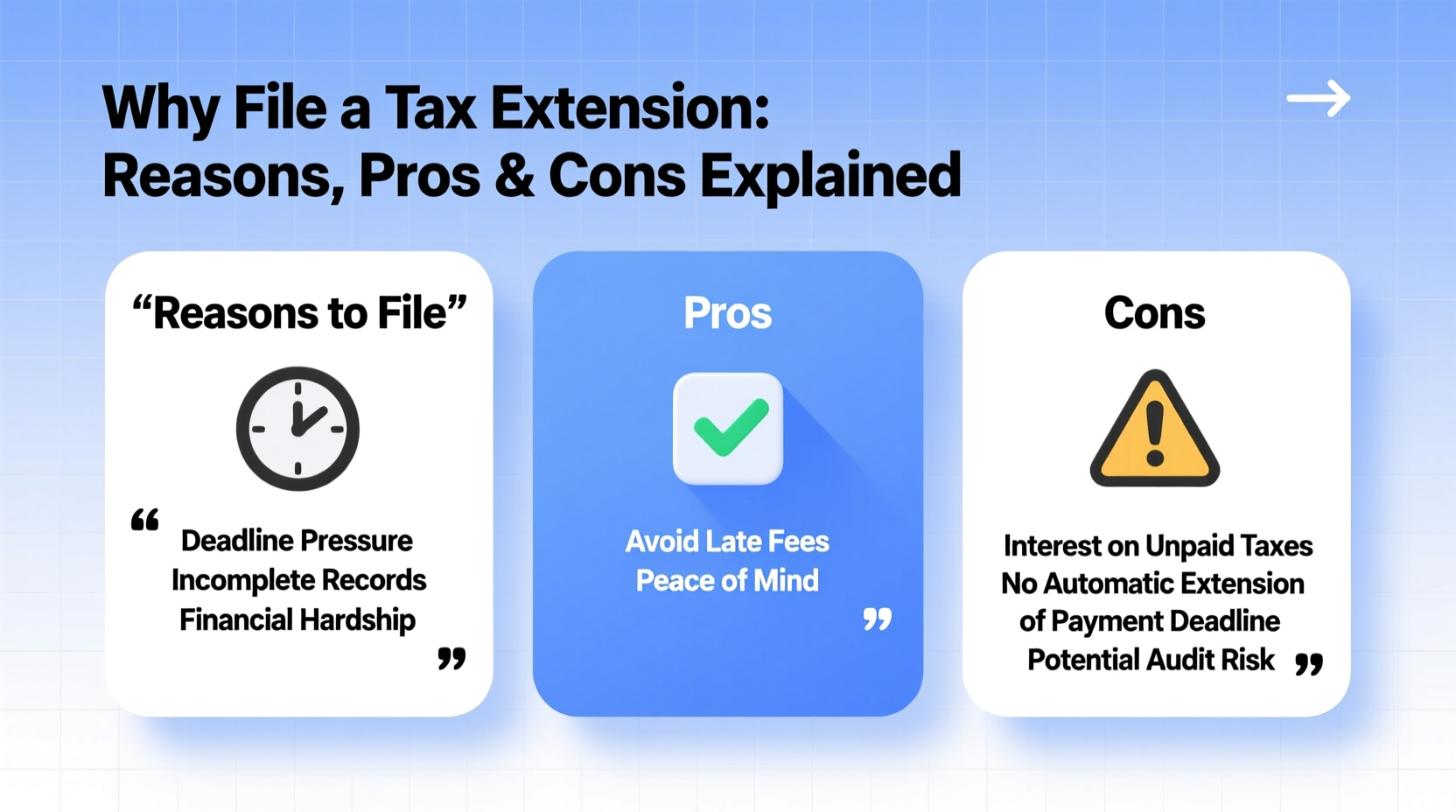

Common Reasons People File Tax Extensions

Life gets busy, and tax season often collides with other major events. Many taxpayers opt for an extension not out of negligence, but necessity. Here are some of the most legitimate and common reasons:

- Incomplete records: Missing W-2s, 1099s, or investment statements can make accurate filing impossible by April.

- Self-employment complexity: Freelancers and small business owners often need more time to reconcile income, expenses, and deductions.

- Life events: Moving, illness, travel, or family emergencies can disrupt tax preparation.

- Waiting on a dependent’s information: If a child’s scholarship or tuition data isn’t ready, it can delay the entire return.

- Maximizing deductions: Some use the extra time to gather receipts, charitable contribution records, or medical expense documentation.

- Audit concerns: Taxpayers who suspect errors on prior returns may request more time to review everything carefully.

Pros of Filing a Tax Extension

When used wisely, a tax extension can be a strategic tool. Here’s how it benefits taxpayers:

- Reduces filing errors: Rushing increases the risk of mistakes. More time allows for thorough review and accuracy.

- Lowers stress: Avoiding the April 14 midnight panic can improve mental well-being and decision-making.

- Improves refund accuracy: A well-prepared return ensures you claim all eligible credits and deductions.

- No penalty for late filing (if extension is granted): As long as you file Form 4868 by the deadline, you won’t face the 5% monthly failure-to-file penalty.

- Buys time for financial planning: Business owners may use the extra months to evaluate retirement contributions or estimated tax payments.

“Filing an extension isn’t admitting defeat—it’s practicing responsible tax management.” — Lisa Nguyen, CPA and Tax Strategist

Cons and Risks of Filing a Tax Extension

While extensions offer breathing room, they come with potential downsides that many overlook.

- Interest on unpaid taxes: The IRS charges interest (currently around 8% annually) on any balance due after April 15, even with an extension.

- Penalties still apply for underpayment: If you don’t pay enough by the original deadline, you could face a failure-to-pay penalty of 0.5% per month.

- Delayed refunds: If you’re owed money, you won’t receive it until you actually file—not when the extension is submitted.

- State requirements may differ: Some states don’t automatically accept federal extensions and require separate forms.

- False sense of security: Procrastination can turn six extra months into a last-minute scramble in October.

Tax Extension: Do’s and Don’ts

| Do’s | Don’ts |

|---|---|

| Estimate your tax liability before April 15 | Assume an extension cancels your payment obligation |

| Pay what you owe by the original deadline | Ignore state-specific extension rules |

| Use the extra time to organize records | Forget to file by October 15—even with an extension |

| File Form 4868 online quickly and easily | Wait until the last minute to request the extension |

Step-by-Step Guide to Filing a Tax Extension

If you decide an extension is right for you, follow this process to do it correctly:

- Calculate your estimated tax liability using last year’s return or current-year estimates. Use IRS Form 1040-ES for guidance.

- Gather available documents such as income statements, expense logs, and deduction records—even if incomplete.

- Submit Form 4868 by the April 15 deadline via:

- IRS Free File (free for most taxpayers)

- Certified e-file providers (e.g., TurboTax, H&R Block)

- Your tax professional

- Pay any taxes owed using Direct Pay, EFTPS, or credit card through the IRS website.

- Keep proof of submission—save confirmation numbers and receipts for payments.

- Set a personal filing deadline (e.g., July or August) to avoid October chaos.

- Complete and file your return by October 15, or request another extension if you qualify (rare).

Real Example: When an Extension Saved a Taxpayer

Samantha, a freelance graphic designer, realized in early April that her 1099 income from three platforms hadn’t been fully reported. Her client in Canada was delayed in sending final paperwork, and her home office deduction required detailed square footage calculations. Instead of guessing numbers, she filed Form 4868 and paid $3,200 based on her estimate. Over the next few weeks, she gathered all missing forms, maximized her retirement contribution (reducing taxable income), and filed her return in mid-July. She ended up owing only $1,800—getting a $1,400 overpayment back. By extending, she avoided errors, reduced her tax bill, and kept her peace of mind.

FAQ: Common Questions About Tax Extensions

Does filing an extension increase my chance of an audit?

No. The IRS does not flag returns simply because they were filed with an extension. Audit selection is based on data matching, income reporting, and red flags in your return—not filing timing.

Can I get more than six months?

Generally, no. The standard extension is to October 15. Additional time is only granted in rare cases like natural disasters or military deployment in combat zones.

What if I miss the extension deadline?

If you don’t file Form 4868 by April 15, you lose the benefit. The failure-to-file penalty applies: 5% of unpaid taxes per month (up to 25%). However, if you’re due a refund, there’s no penalty for late filing—but you won’t get your money until you file.

Final Thoughts: Is a Tax Extension Right for You?

Filing a tax extension isn’t about avoiding responsibility—it’s about managing it wisely. For those juggling complex finances, self-employment, or unexpected delays, it offers a practical solution to file accurately and confidently. But it’s not a free pass. You must still estimate and pay what you owe by April 15 to avoid compounding interest and penalties.

The key is proactive planning. Use the extension as a tool, not a crutch. Estimate your tax burden early, make a payment, and set internal deadlines to stay on track. Whether you're a freelancer, retiree, or household filer, a well-managed extension can reduce stress and improve outcomes.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?