Many people assume that writing a will is something only the elderly or wealthy need to consider. In reality, creating a last will and testament is one of the most responsible decisions any adult can make—regardless of age, income, or family status. A will ensures your final wishes are honored, reduces stress for loved ones, and prevents legal complications after your passing. Without one, state laws decide who inherits your assets, which may not reflect your intentions. Understanding the true importance of a will empowers you to take control of your legacy.

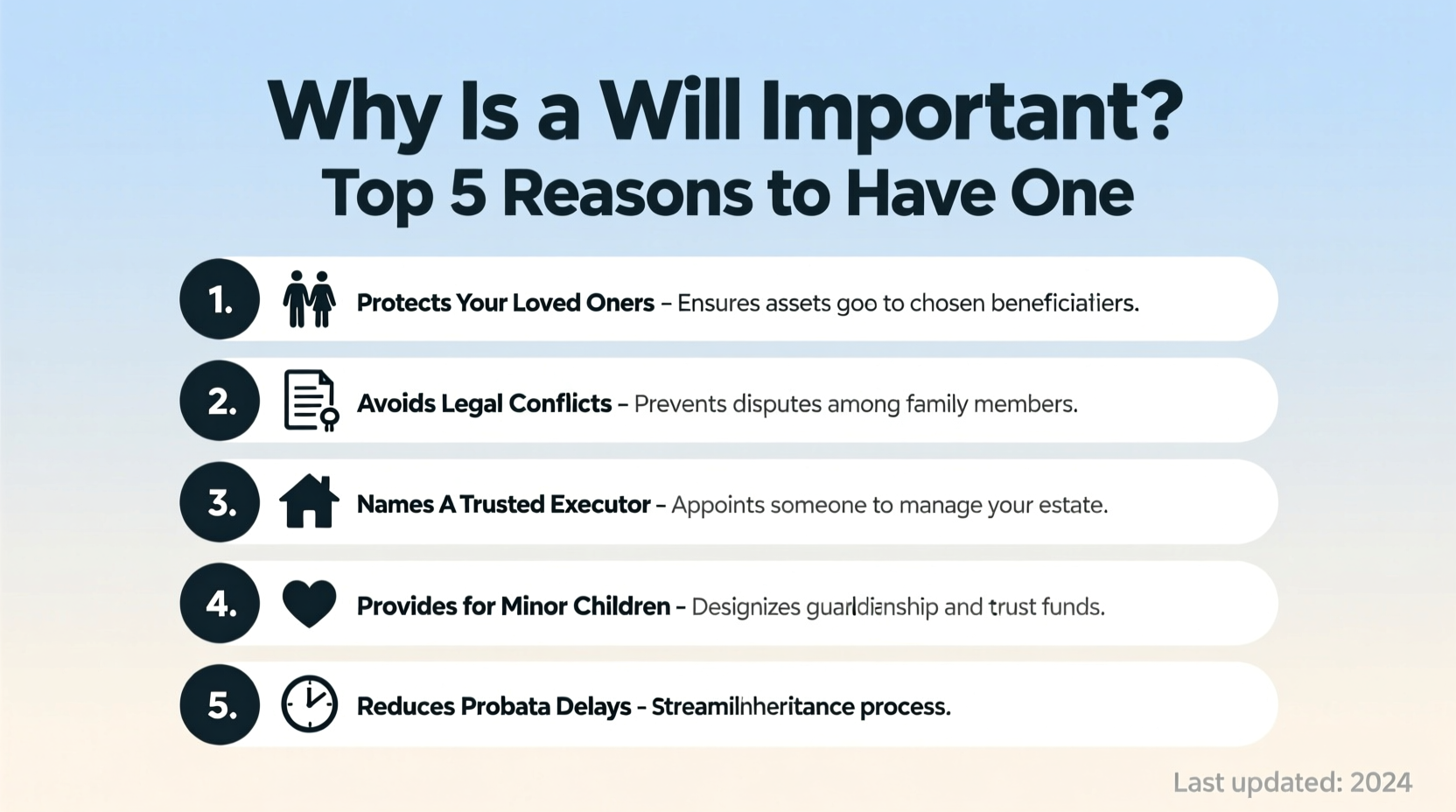

Protect Your Family and Loved Ones

One of the most compelling reasons to create a will is to protect the people you care about. If you pass away without a will—referred to legally as dying \"intestate\"—your estate is distributed according to your state’s default inheritance laws. These laws typically prioritize spouses and blood relatives, but they don’t account for unique family dynamics, blended households, or close friends you may want to include.

For example, if you're unmarried but in a long-term partnership, your partner has no automatic right to inherit under intestacy rules. Similarly, stepchildren or foster children may be excluded unless formally adopted. A will allows you to specify exactly who receives what, ensuring fairness and clarity during an emotionally difficult time.

“Without a will, families often face prolonged disputes and unexpected outcomes. A simple document can prevent years of conflict.” — Laura Simmons, Estate Planning Attorney with over 20 years of experience

Appoint Guardians for Minor Children

If you have children under the age of 18, naming a legal guardian in your will is one of the most critical decisions you’ll ever make. Should both parents pass away unexpectedly, the court will appoint a guardian based on what it deems to be in the child’s best interest—if no guardian is named in a will.

This process can lead to disagreements among family members, especially if multiple relatives believe they should raise the child. By clearly stating your preference in a legally binding will, you maintain control over your children’s future. It also gives the court strong guidance, increasing the likelihood that your chosen guardian is approved.

Avoid Probate Delays and Reduce Legal Costs

Probate is the legal process through which a deceased person’s estate is validated and distributed. While some assets bypass probate (like life insurance policies with named beneficiaries), many do not. Dying without a will often extends the probate process significantly because the court must determine asset distribution, appoint an executor, and resolve disputes.

With a valid will, the probate process becomes more streamlined. You name an executor—the person responsible for managing your estate—who can act quickly to settle debts, pay taxes, and distribute property according to your instructions. This not only speeds up the process but also reduces legal fees and administrative costs that would otherwise come out of your estate.

Typical Probate Timeline: With vs. Without a Will

| Situation | Average Duration | Estimated Legal Costs |

|---|---|---|

| Dying with a will | 6–9 months | $2,000–$5,000 |

| Dying without a will | 12–24 months | $7,000–$15,000+ |

The longer probate takes, the more emotional and financial strain is placed on surviving family members. A clear will minimizes uncertainty and accelerates closure.

Ensure Your Wishes Are Respected

Your will is more than just a list of who gets your money or possessions—it’s a personal declaration of your values and priorities. Whether you want to leave heirlooms to specific family members, donate to charity, or provide for a pet, a will gives you the power to express these intentions clearly.

Some individuals use their wills to address non-financial matters, such as funeral preferences or digital asset access. Including these details helps relieve your loved ones from making guesses during grief. For instance, specifying burial versus cremation or requesting a modest service can guide your family in honoring your wishes accurately.

Mini Case Study: The Smith Family Dispute

The Smiths were a close-knit family until John Smith passed suddenly at age 52 without a will. He had two adult children from a previous marriage and was remarried with no joint children. His wife assumed she would inherit everything, while his children believed they were entitled to half. State law eventually awarded the wife 50% of the estate, with the remainder split between the children. However, the lack of clarity led to a bitter three-year legal battle, draining the estate of nearly 40% in attorney fees and permanently fracturing family relationships. Had John created a simple will outlining his intentions, this conflict could have been avoided entirely.

Plan for Complex Assets and Business Interests

If you own real estate, investment accounts, a business, or other significant assets, a will becomes even more essential. These assets often require specific handling to avoid disruption or loss in value. For example, if you co-own a small business, your will can designate who receives your share and whether it should be sold, transferred, or held in trust.

Business owners should also consider pairing their will with a succession plan. This ensures smooth leadership transition and operational continuity. Without clear instructions, ownership disputes can arise, potentially forcing the sale or closure of a company built over decades.

- Real estate: Specify whether properties should be sold or passed down.

- Investments: Outline how brokerage or retirement accounts should be managed posthumously.

- Digital assets: Include login information or directives for social media, email, and cryptocurrency wallets.

Step-by-Step Guide to Creating a Valid Will

Writing a will doesn’t have to be complicated. Follow these steps to ensure your document is legally sound and reflects your intentions:

- Take inventory of your assets: List all property, bank accounts, investments, valuables, and debts.

- Decide on beneficiaries: Identify who will receive each asset or portion of your estate.

- Name an executor: Choose a trustworthy individual to manage your estate after death.

- Designate guardians (if applicable): Appoint someone to care for minor children or dependents.

- Draft the will: Use a reliable template, online service, or consult an estate attorney for complex situations.

- Sign and witness properly: Most states require two disinterested witnesses and notarization for validity.

- Store it safely: Keep the original in a fireproof safe or with your attorney; inform your executor of its location.

- Review periodically: Update your will after major life events like marriage, divorce, birth, or relocation.

Frequently Asked Questions

Can I write my own will without hiring a lawyer?

Yes, in most states you can create a DIY will using online tools or templates, provided it meets legal requirements (such as being signed and witnessed). However, if you have a large or complex estate, blended family, or business interests, consulting an estate attorney is strongly recommended to avoid errors.

Does a will cover all my assets?

No. Certain assets pass outside of a will, including retirement accounts, life insurance policies, and jointly owned property with rights of survivorship. These transfer directly to named beneficiaries. That’s why it’s crucial to keep beneficiary designations updated across all accounts.

How often should I update my will?

Review your will every 3–5 years or after major life changes—marriage, divorce, birth of a child, moving to a new state, or significant changes in wealth. Outdated provisions can lead to unintended consequences.

Final Thoughts: Don’t Wait Until It’s Too Late

A will is not a morbid document—it’s a practical tool for peace of mind. It reflects your care for your family, your respect for your responsibilities, and your desire for order in uncertain times. Procrastination is the biggest obstacle to estate planning, yet the process is simpler and more affordable than most realize.

Whether you draft a basic will today or schedule a consultation with an estate planner, taking action now protects your legacy and eases the burden on those you leave behind. Life is unpredictable, but your final wishes don’t have to be.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?