Amazon (AMZN) has long been a cornerstone of growth investing, celebrated for its dominance in e-commerce, cloud computing, and innovation across industries. However, even the most resilient stocks face periods of decline. In recent months, AMZN shares have experienced notable volatility, leaving many investors asking: why is AMZN stock down? This article breaks down the multifaceted reasons behind Amazon’s recent underperformance, analyzes key financial and market dynamics, and offers insight into what could shape its future trajectory.

Market Conditions and Broader Economic Pressures

One of the primary forces influencing Amazon’s stock price lies beyond the company itself—broader macroeconomic conditions. Rising interest rates, inflation concerns, and fears of economic slowdown have shifted investor sentiment across the technology sector. As a high-growth stock with significant future earnings expectations, Amazon is particularly sensitive to changes in discount rates used in valuation models.

When the Federal Reserve raises interest rates, the present value of future cash flows decreases. Since Amazon’s valuation relies heavily on anticipated long-term growth—especially from AWS and international expansion—higher rates make those future profits less valuable today. This dynamic contributed to a sell-off in tech stocks during 2022 and resurfaced in moments of rate-hike speculation in 2023 and early 2024.

“Tech valuations are inherently tied to interest rates. When yields rise, momentum shifts away from growth stocks—even strong ones like Amazon.” — Sarah Lin, Senior Equity Analyst at Beacon Capital Research

In addition, global supply chain disruptions and fluctuating consumer spending patterns post-pandemic have created uncertainty in retail sectors. While Amazon remains a leader, softer discretionary spending impacts its core marketplace revenue, especially in categories like electronics and apparel.

Company-Specific Factors Affecting AMZN Stock

Beyond macro trends, several internal developments have influenced investor confidence in Amazon’s short-term outlook.

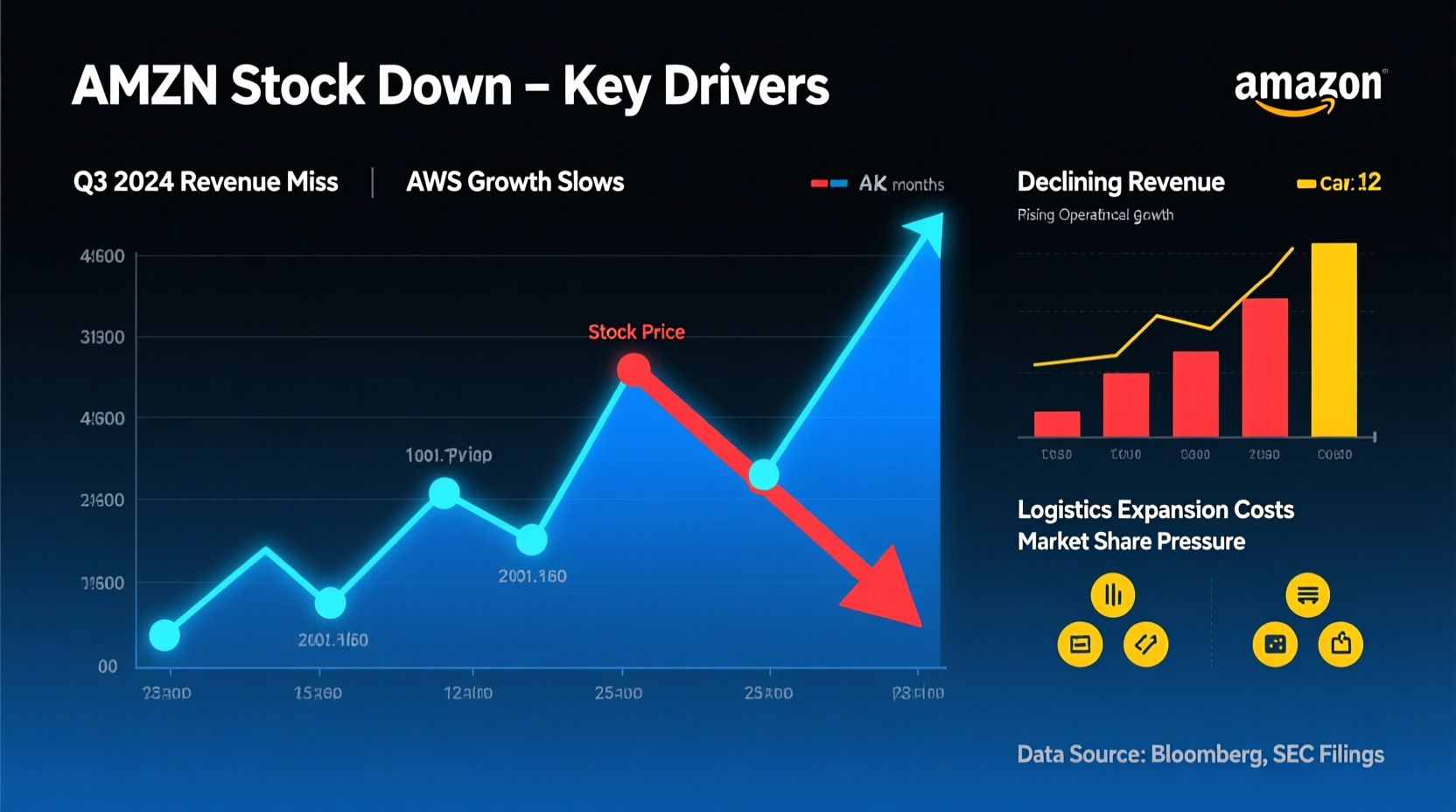

Slowing Revenue Growth

After explosive pandemic-era growth, Amazon’s top-line expansion has normalized. In its most recent quarterly reports, year-over-year revenue growth hovered around 10–12%, a sharp contrast to the 20%+ increases seen in previous years. While still solid, this deceleration signals a maturing business model, prompting some investors to reevaluate expectations.

Advertising and Cloud Margin Pressures

Amazon Web Services (AWS), once the profit engine of the company, has shown signs of slowing growth. Increased competition from Microsoft Azure and Google Cloud, coupled with enterprise cost-cutting in uncertain economic times, has led to tighter margins and reduced demand for premium cloud services.

Similarly, while Amazon’s advertising segment continues to grow, increased ad inventory and algorithmic changes have led to lower click-through rates for some sellers, dampening enthusiasm among digital marketers and reducing ad revenue per impression.

Operational Costs and Labor Investments

Amazon has made substantial investments in warehouse automation, same-day delivery infrastructure, and employee wages. While these moves improve long-term efficiency and brand reputation, they weigh on near-term profitability. Operating expenses rose significantly as the company expanded fulfillment capacity and enhanced worker benefits, leading to narrower operating margins in consecutive quarters.

Competitive Landscape and Strategic Challenges

Amazon no longer operates in a vacuum. Competitors are gaining ground in critical areas:

- Walmart and Target have strengthened their e-commerce platforms and curbside pickup options, capturing budget-conscious shoppers.

- TikTok Shop and Shopify are reshaping how consumers discover and purchase products, especially among younger demographics.

- Microsoft and Google continue to challenge AWS in enterprise cloud contracts, particularly in AI and machine learning workloads.

Meanwhile, Amazon’s foray into healthcare (One Medical, PillPack) and entertainment (Prime Video) has yet to deliver clear profitability. These ventures require sustained investment without guaranteed returns, raising questions about capital allocation priorities.

Regulatory and Legal Risks

Antitrust scrutiny remains a persistent overhang. The U.S. Federal Trade Commission (FTC) filed a major lawsuit against Amazon in 2023, alleging anti-competitive practices in its marketplace and pricing policies. Though legal battles may take years to resolve, the mere existence of regulatory risk can depress investor sentiment and limit multiple expansion.

Financial Performance Snapshot

| Quarter | Revenue (B) | Net Income (B) | AWS Growth (YoY) | Stock Price (End of Quarter) |

|---|---|---|---|---|

| Q1 2023 | $127.4 | $3.2 | 17% | $101.83 |

| Q2 2023 | $134.4 | $6.7 | 12% | $144.51 |

| Q3 2023 | $143.1 | $9.9 | 11% | $125.72 |

| Q4 2023 | $149.2 | $10.1 | 20% | $175.83 |

| Q1 2024 | $143.3 | $10.4 | 17% | $156.22 |

The table shows that while Amazon maintained strong net income and solid revenue, AWS growth fluctuated, and the stock corrected after a Q4 2023 rally. The dip in Q1 2024 coincided with guidance that fell slightly below aggressive growth expectations.

Investor Sentiment and Market Psychology

Stock prices are not just reflections of fundamentals—they’re also shaped by perception. After Amazon’s stock surged from $100 in early 2023 to nearly $180 by late 2023, some analysts labeled it “overbought.” A natural pullback followed as traders took profits.

Sentiment indicators such as put/call ratios and short interest spiked in early 2024, suggesting growing skepticism. However, institutional ownership remained stable, signaling that long-term holders still believe in Amazon’s ecosystem strength.

Mini Case Study: The April 2024 Pullback

In April 2024, AMZN stock dropped nearly 7% in a single week following earnings. Despite beating revenue estimates, management cautioned about upcoming advertising revenue softness and higher-than-expected logistics costs. Algorithmic trading systems reacted swiftly, triggering stop-loss orders and amplifying the decline. Retail investors, many of whom had bought near the peak, panicked and sold. Within two weeks, the stock stabilized as value investors stepped in—demonstrating how sentiment can drive short-term volatility even amid solid underlying performance.

What Investors Should Watch Going Forward

To understand whether Amazon’s stock will rebound or face further pressure, investors should monitor several key indicators:

- AWS Growth Rate: Sustained double-digit growth here is essential for maintaining premium valuation.

- Operating Margin Trends: Improvements suggest cost discipline and operational leverage.

- Free Cash Flow Generation: Strong FCF supports reinvestment and potential share buybacks.

- Regulatory Developments: Escalation in antitrust actions could impact business model flexibility.

- Consumer Spending Data: Especially in discretionary categories where Amazon holds significant share.

Checklist: Evaluating AMZN Stock Health

- ✅ Review quarterly revenue growth vs. prior periods

- ✅ Check AWS segment performance and guidance

- ✅ Analyze operating income margin trend

- ✅ Assess free cash flow and capital expenditure ratio

- ✅ Monitor news for regulatory or litigation updates

- ✅ Compare valuation multiples (P/E, P/S) to historical averages

Frequently Asked Questions

Is Amazon still a good long-term investment?

Many analysts believe so. Amazon’s scale, AWS leadership, and expanding ecosystem in healthcare and advertising provide durable competitive advantages. While short-term volatility persists, its ability to innovate and dominate new markets supports long-term upside.

Why did AMZN drop after a good earnings report?

Even when earnings beat expectations, stocks can fall if future guidance is cautious or certain segments underperform (e.g., advertising or international sales). Market expectations often outpace reality, leading to “sell the news” reactions.

How does interest rate policy affect Amazon’s stock?

Higher interest rates reduce the present value of future earnings, which disproportionately affects growth-oriented companies like Amazon. Conversely, rate cuts tend to boost tech valuations by making future profits more attractive in discounted cash flow models.

Conclusion: Navigating Volatility with Clarity

Amazon’s stock downturn is not the result of a single failure but a confluence of macroeconomic pressures, evolving growth rates, competitive challenges, and shifting investor psychology. While the pace of ascent has slowed, the foundation of Amazon’s business—its logistics network, cloud infrastructure, and vast customer base—remains robust.

For investors, the current phase offers an opportunity to reassess rather than retreat. Understanding the drivers behind AMZN’s performance allows for more informed decisions, whether holding through volatility or adjusting position size based on risk tolerance.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?