ChargePoint Holdings (CHPT), once hailed as a leader in the electric vehicle (EV) charging infrastructure sector, has seen its stock price struggle since its peak in early 2021. Once trading above $50 per share, CHPT now hovers around single-digit prices, raising concerns among investors and analysts alike. While the broader EV market continues to grow, ChargePoint’s underperformance reflects deeper operational, financial, and strategic challenges. Understanding the key factors behind this sustained decline is essential for current shareholders and potential investors evaluating the company's future prospects.

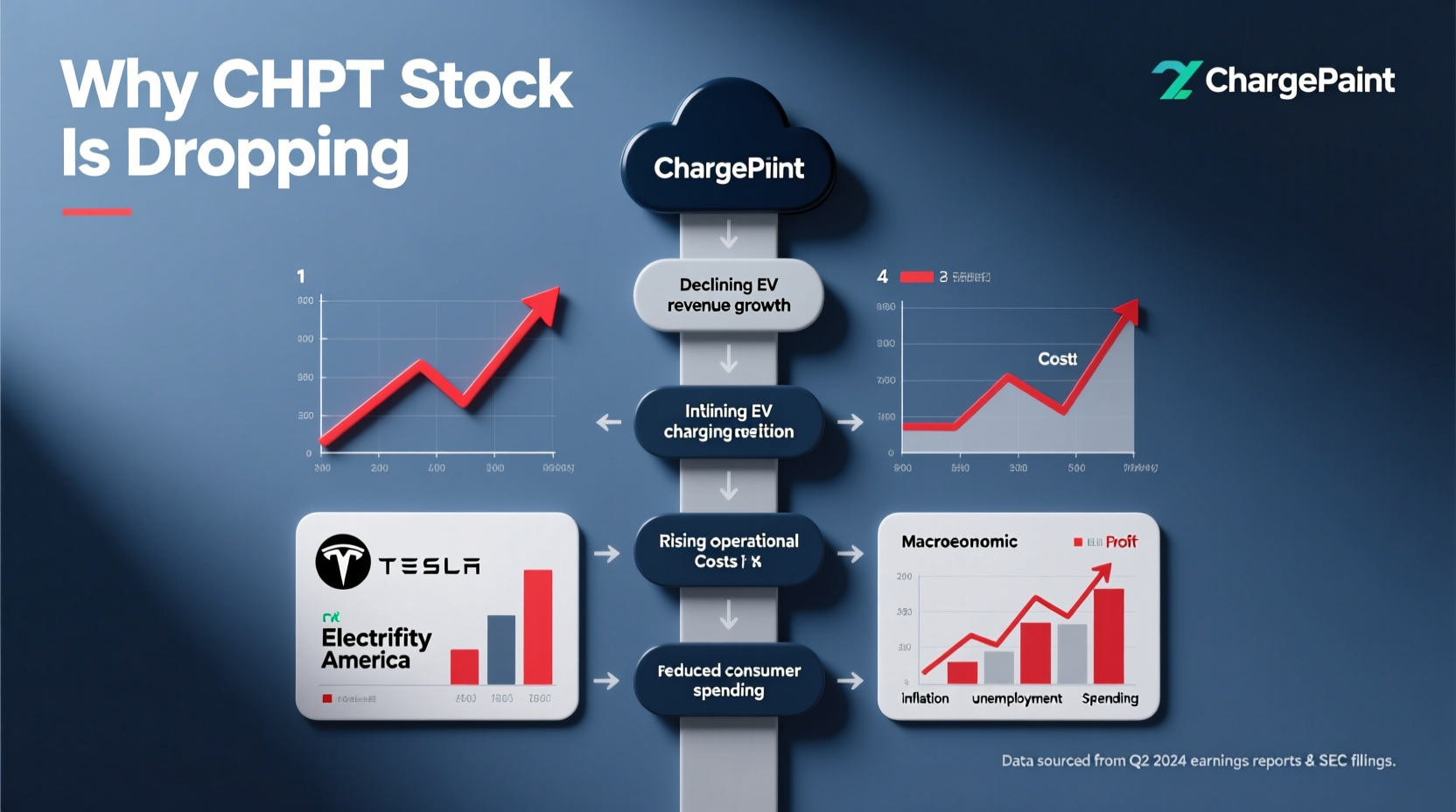

Market Saturation and Intensifying Competition

The EV charging landscape has evolved rapidly over the past few years. What was once a niche market with limited players has become increasingly crowded. Companies like Tesla, Electrify America, Blink Charging, and EVgo have expanded aggressively, while automakers such as Ford and GM are integrating proprietary networks. This surge in competition has diluted ChargePoint’s first-mover advantage.

Unlike Tesla, which controls both vehicles and charging hardware, ChargePoint operates primarily as a B2B-focused network provider. Its reliance on partnerships with municipalities, businesses, and fleet operators makes it vulnerable to pricing pressure and slower adoption cycles. As competitors offer bundled hardware, software, and installation services at lower margins, ChargePoint struggles to maintain pricing power.

“ChargePoint built a strong brand early, but execution gaps and rising competition have eroded investor confidence.” — Sarah Chen, Senior Analyst at Clean Energy Insights

Financial Performance and Cash Burn

One of the most pressing concerns for investors is ChargePoint’s ongoing financial losses. Despite increasing revenue year-over-year, the company has yet to achieve profitability. In its latest fiscal reports, ChargePoint reported a net loss exceeding $300 million, driven by high operating expenses and aggressive expansion efforts.

The company continues to burn through cash to scale manufacturing, expand service offerings, and enter new markets. With over $600 million in cash reserves as of Q1 2024, the runway is limited unless revenue growth accelerates significantly or additional funding is secured. The lack of a clear path to profitability raises red flags for long-term investors.

Slower-than-Expected Adoption of Public Charging

A core assumption behind ChargePoint’s valuation was rapid adoption of public and commercial EV charging. However, real-world deployment has lagged expectations. Many businesses and local governments have delayed infrastructure investments due to budget constraints, permitting delays, and uncertain return on investment.

Additionally, the rise of home charging solutions—especially among personal EV owners—has reduced reliance on public networks. According to the U.S. Department of Energy, nearly 80% of EV charging occurs at home. This trend limits the addressable market for companies like ChargePoint that depend heavily on public and workplace installations.

Fleet electrification, another growth pillar, has also progressed more slowly than anticipated. Municipalities and logistics companies face hurdles such as grid capacity limitations, high upfront costs, and workforce training, all of which delay large-scale rollouts.

Leadership Transitions and Strategic Uncertainty

In late 2023, ChargePoint underwent a leadership change, with former CEO Pasquale Romano stepping down. Leadership transitions often create uncertainty, especially during periods of financial strain. Investors watched closely as the new management team recalibrated strategy, shifting focus from aggressive growth to cost discipline.

This pivot, while necessary, signals a retreat from earlier ambitions. The revised guidance included slower revenue projections and restructuring plans affecting approximately 10% of the workforce. Such moves, though prudent, reinforce perceptions of internal instability and missed targets.

Moreover, the company’s decision to delay certain product launches—particularly next-generation ultra-fast chargers—has allowed competitors to capture mindshare and market share in the fast-charging segment, a critical battleground for future dominance.

Macroeconomic and Investor Sentiment Pressures

Beyond company-specific issues, broader economic conditions have weighed heavily on CHPT stock. Rising interest rates have made capital more expensive, particularly for growth-stage companies without profits. High-growth tech stocks, especially in clean energy, were revalued downward across the board starting in 2022.

Investor appetite for speculative assets diminished as inflation and recession fears grew. ChargePoint, lacking near-term profitability, became a target for portfolio de-risking. Additionally, skepticism about the pace of EV adoption in the U.S.—influenced by policy delays and consumer affordability concerns—has dampened enthusiasm for EV infrastructure plays.

| Factor | Impact on CHPT Stock | Duration |

|---|---|---|

| Intense competition | High – Eroding market share | Ongoing |

| Negative earnings & cash flow | Very High – Core investor concern | Long-term until turnaround |

| Slow EV infrastructure rollout | Moderate to High | Medium-term |

| Leadership changes | Moderate – Short-term uncertainty | Short to medium-term |

| Macroeconomic headwinds | High – Affects valuation multiples | Depends on Fed policy |

Real-World Example: The Fleet Electrification Delay

In 2022, ChargePoint announced a major contract with a regional delivery fleet operator to deploy 500 Level 2 and DC fast chargers across five states. The project was expected to generate $45 million in revenue over three years and serve as a flagship case study for commercial adoption.

However, by mid-2023, only 120 chargers had been installed. The delay stemmed from utility interconnection bottlenecks, site acquisition issues, and unexpected equipment supply chain disruptions. The customer scaled back initial plans, citing higher-than-expected upgrade costs to electrical infrastructure. This real-world bottleneck highlighted the gap between sales forecasts and on-the-ground deployment realities—a recurring theme in ChargePoint’s operations.

Action Plan for Investors: What to Watch

Despite the challenges, ChargePoint remains one of the largest EV charging networks in North America, with over 200,000 active ports. For investors considering a position or reassessing holdings, here’s a checklist of key indicators to monitor:

- Gross Margin Trends: Look for improvement as economies of scale kick in.

- Revenue Growth Rate: Sustained YoY growth above 20% signals market traction.

- Cash Runway: Track quarterly cash burn and any new financing activities.

- New Contracts: Major fleet or municipal deals indicate renewed confidence.

- Product Launches: Timely release of 350kW+ chargers is critical for competitiveness.

- EBITDA Milestones: Any move toward positive EBITDA would be a bullish signal.

Frequently Asked Questions

Is ChargePoint going out of business?

No, ChargePoint is not going out of business. It remains operational with significant infrastructure and contracts in place. However, it faces financial and competitive pressures that require successful execution to ensure long-term viability.

Can CHPT stock recover?

Potential for recovery exists if the company achieves cost efficiency, secures large-scale deployment contracts, and benefits from accelerated EV adoption. However, recovery depends on execution and macroeconomic improvements. It remains a high-risk, high-volatility investment.

Why is ChargePoint stock so low compared to its IPO?

CHPT went public via SPAC in 2020 at a peak of EV enthusiasm. Since then, unmet growth expectations, persistent losses, increased competition, and tighter monetary policy have led to a sharp revaluation of its stock.

Conclusion: Navigating the Road Ahead

ChargePoint’s stock decline is not the result of a single event but a confluence of structural, financial, and market-driven factors. While the long-term outlook for EV charging remains positive, success will favor companies that execute efficiently, control costs, and adapt quickly to changing conditions. ChargePoint has the network footprint and brand recognition to compete, but turning those assets into profitability is the next critical challenge.

For investors, the path forward requires careful monitoring, realistic expectations, and a tolerance for volatility. The EV revolution isn’t slowing down—but winning a meaningful share of it demands more than early leadership. It demands resilience, innovation, and flawless execution.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?