EBITDA—Earnings Before Interest, Taxes, Depreciation, and Amortization—is a widely cited metric in financial reporting, corporate valuation, and investment analysis. While not a GAAP (Generally Accepted Accounting Principles) measure, it offers a clear lens into a company’s operational profitability by stripping away non-operational expenses and accounting decisions. Understanding EBITDA goes beyond memorizing an acronym; it involves recognizing why analysts rely on it, how it’s calculated, and where its limitations lie.

What Is EBITDA and Why Does It Matter?

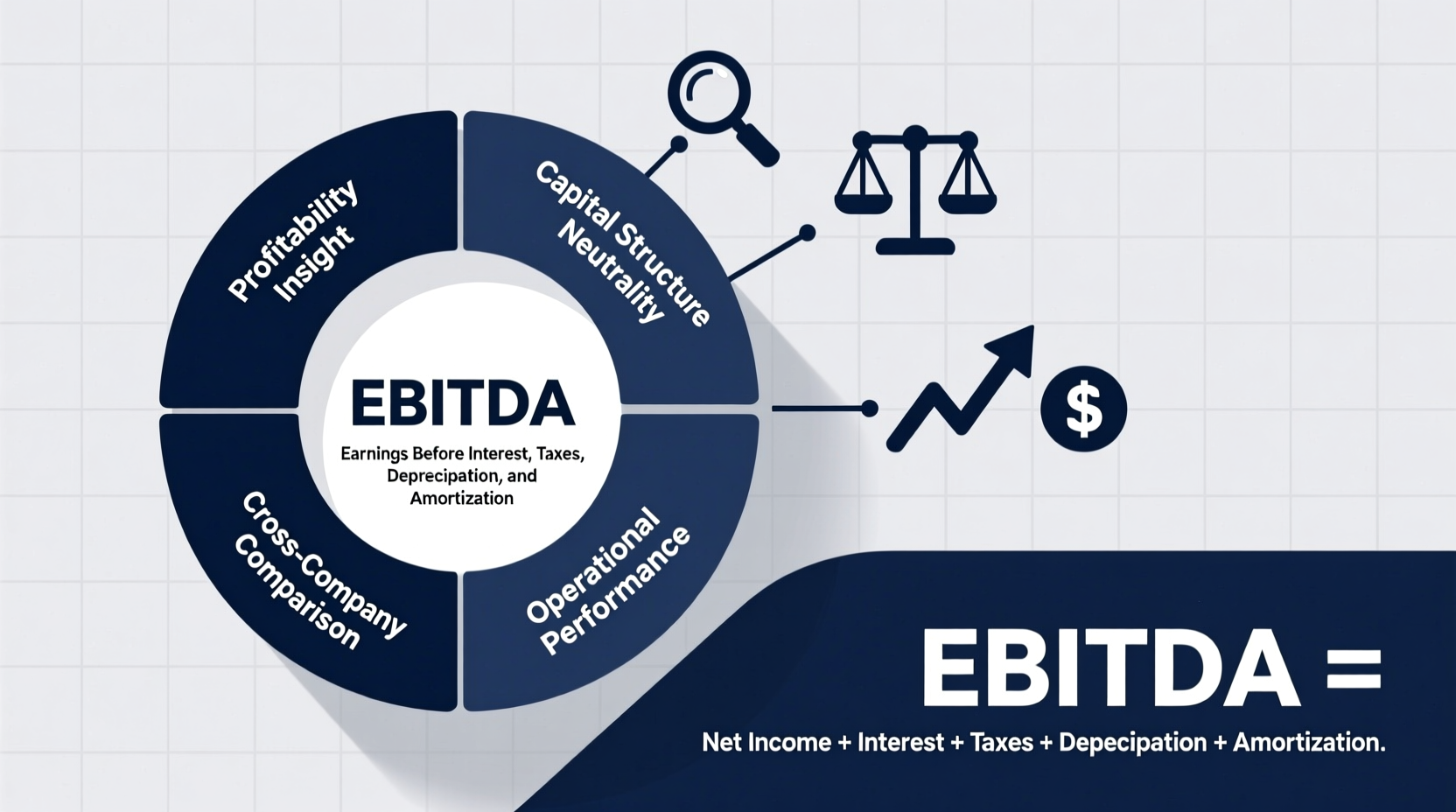

At its core, EBITDA measures a company’s ability to generate profit from its core operations. By excluding interest, taxes, depreciation, and amortization, EBITDA isolates earnings directly tied to business activities—making it easier to compare companies across different capital structures, tax environments, and industries.

This metric gained popularity in the 1980s during leveraged buyout booms, when investors needed a quick way to assess whether a target company could service new debt. Today, it remains a staple in financial modeling, M&A discussions, and performance benchmarking.

“EBITDA provides a clean view of operating efficiency, especially when comparing firms with varying financing strategies or tax jurisdictions.” — Michael Reynolds, Senior Financial Analyst at CapitalEdge Advisors

How to Calculate EBITDA: Step-by-Step

There are two common formulas to calculate EBITDA, depending on the financial data available:

- From Net Income:

- From Operating Profit (EBIT):

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

EBITDA = Operating Profit + Depreciation + Amortization

Both approaches yield the same result. The key is ensuring all components are taken from the same financial period and reported consistently.

Example Calculation

Consider a mid-sized manufacturing company with the following figures (in USD):

| Item | Amount ($) |

|---|---|

| Net Income | 500,000 |

| Interest Expense | 75,000 |

| Taxes Paid | 125,000 |

| Depreciation | 60,000 |

| Amortization | 40,000 |

Using the first formula:

EBITDA = 500,000 + 75,000 + 125,000 + 60,000 + 40,000 = $800,000

Why Is EBITDA Used? Key Benefits Explained

Despite criticism, EBITDA persists because it delivers practical advantages in specific contexts.

- Facilitates Comparisons Across Companies: Firms in the same industry may have different tax rates or levels of debt. EBITDA neutralizes these differences, allowing apples-to-apples comparisons of operational performance.

- Highlights Cash Flow Potential: While not a direct cash flow measure, EBITDA approximates the cash a business generates before financing and accounting decisions. This is valuable for assessing short-term liquidity and debt repayment capacity.

- Simplifies Valuation Multiples: The EV/EBITDA ratio is one of the most common valuation tools. It helps investors determine how much they’re paying for each dollar of operating earnings, particularly useful in capital-intensive industries like telecom or utilities.

- Useful in High-Growth or Restructuring Scenarios: Startups or turnaround companies often report net losses due to heavy upfront investments. EBITDA can show underlying operational strength even when net income is negative.

Real-World Example: Tech Startup Valuation

A SaaS startup reports a net loss of $2 million due to high R&D costs and depreciation from cloud infrastructure. However, its EBITDA is positive at $500,000. Investors interpret this as strong operational traction despite accounting losses, making the company attractive for funding rounds. Without EBITDA, the firm might be unfairly dismissed based on net income alone.

Common Misuses and Limitations of EBITDA

While powerful, EBITDA is not a substitute for net income or free cash flow. Overreliance can paint an overly optimistic picture.

Critics argue that EBITDA “ignores reality” by omitting essential costs. For instance:

- Depreciation and amortization are real expenses: Equipment wears out. Ignoring depreciation can inflate perceived profitability, especially in asset-heavy sectors like manufacturing or transportation.

- It doesn’t account for working capital needs: A company might have high EBITDA but poor cash flow due to inventory buildup or delayed receivables.

- No consideration of capital expenditures: EBITDA doesn’t reflect reinvestment required to maintain operations—critical for long-term sustainability.

“Calling EBITDA ‘cash flow’ is misleading. True cash generation includes capex, changes in working capital, and debt obligations.” — Laura Zhang, CFO at Nexa Analytics

Do’s and Don’ts of Using EBITDA

| Do’s | Don’ts |

|---|---|

| Use it to compare operational efficiency across similar firms | Use it as the sole measure of profitability |

| Combine it with free cash flow for a fuller picture | Ignore depreciation in capital-intensive industries |

| Apply it in valuation multiples like EV/EBITDA | Promote EBITDA over net income without context |

When to Use EBITDA: A Practical Checklist

Not every situation calls for EBITDA. Use this checklist to determine if it’s appropriate for your analysis:

- ✅ Assessing operational performance independent of financing structure

- ✅ Comparing companies across different tax regimes

- ✅ Evaluating businesses with significant non-cash charges

- ✅ Screening potential acquisition targets in leveraged buyouts

- ✅ Analyzing industries with high depreciation (e.g., telecom, energy)

- ❌ When analyzing firms with minimal fixed assets

- ❌ As a standalone indicator of financial health

- ❌ In place of free cash flow for dividend or debt coverage analysis

Frequently Asked Questions

Is EBITDA the same as operating income?

No. Operating income (or EBIT) includes depreciation and amortization, while EBITDA excludes them. Therefore, EBITDA is typically higher than operating income.

Can EBITDA be negative?

Yes. A negative EBITDA indicates that a company’s core operations are not generating enough revenue to cover basic operating costs. This is a red flag, especially if sustained over time.

Why do some companies emphasize EBITDA in press releases?

Companies often highlight EBITDA when net income is low or negative. While not inherently deceptive, this practice can divert attention from deeper financial issues. Always examine EBITDA alongside other metrics like net income and cash flow from operations.

Conclusion: Use EBITDA Wisely, Not Blindly

EBITDA is a valuable tool—but only when applied with context and caution. It simplifies complex financial statements into a single number that reflects operational strength, enabling smarter comparisons and faster decision-making. Yet, treating it as a comprehensive measure of profitability risks overlooking critical aspects like capital requirements and tax obligations.

The most effective financial analysis combines EBITDA with other indicators: net income, free cash flow, and balance sheet health. Whether you're an investor evaluating a stock, a manager tracking performance, or an entrepreneur seeking funding, understanding both the power and pitfalls of EBITDA is essential.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?