Eli Lilly (LLY) has long been a standout performer in the pharmaceutical sector, known for its innovation in diabetes, obesity, and neuroscience treatments. However, even strong stocks experience volatility. If you're checking your portfolio and wondering why Eli Lilly stock is down today, you're not alone. Investors are reacting to a mix of earnings signals, competitive pressures, regulatory developments, and broader market dynamics. This article breaks down the key factors behind the current dip in LLY stock, offering clarity for both short-term traders and long-term investors.

Recent Market Movement: What’s Happening to LLY?

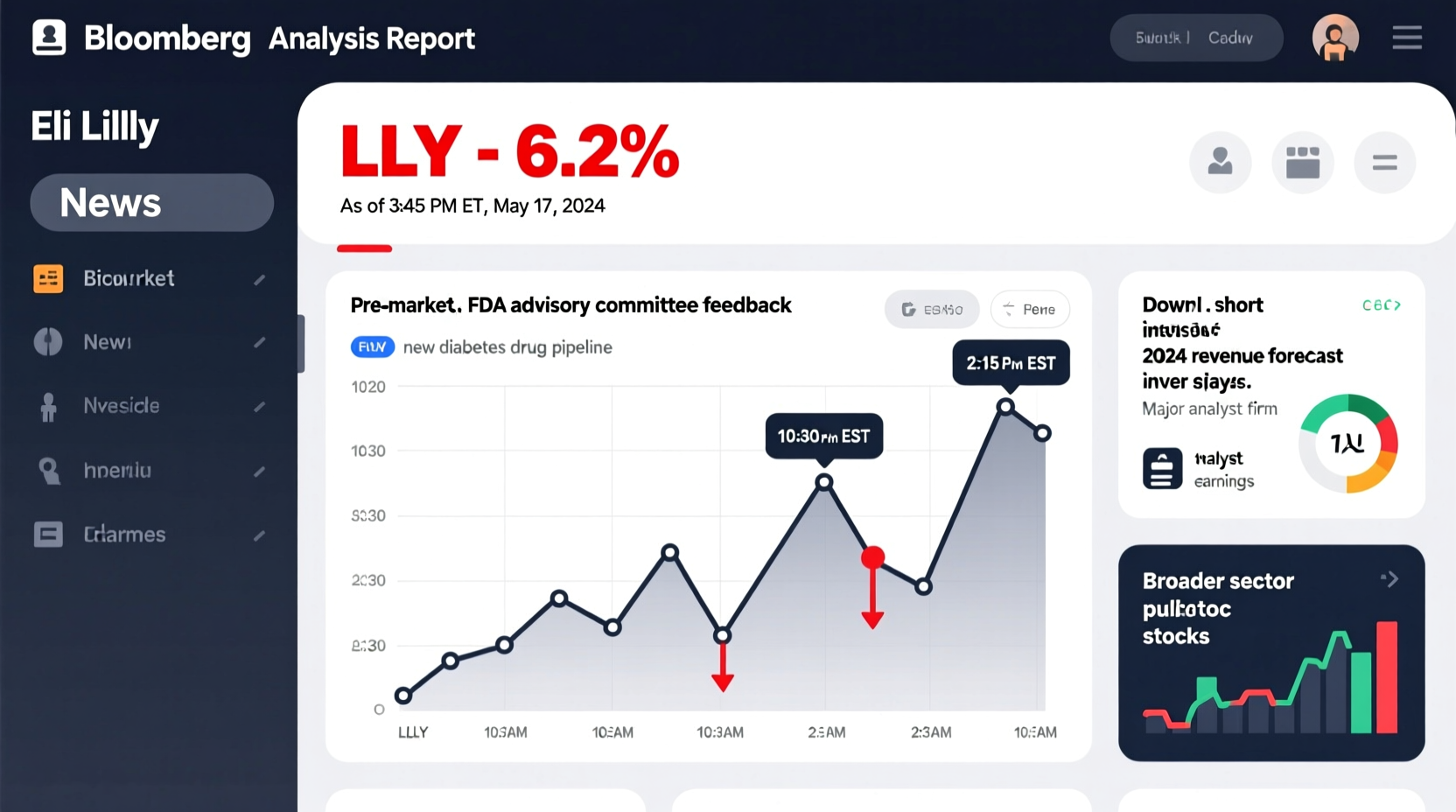

As of today, Eli Lilly shares are trading lower, with the decline ranging between 3% and 5% depending on intraday fluctuations. The drop comes amid heightened scrutiny from analysts and institutional investors following recent corporate announcements and macroeconomic shifts. While LLY remains one of the best-performing healthcare stocks over the past two years—fueled largely by blockbuster drugs like Mounjaro (tirzepatide) and Zepbound—the market appears to be pricing in caution rather than panic.

The sell-off isn't isolated to Eli Lilly. Broader biotech indices, including the NASDAQ Biotechnology Index (NBI), have also pulled back due to rising Treasury yields and speculation about delayed FDA approvals across the sector. Still, company-specific news plays a central role in today’s movement.

Key Drivers Behind the LLY Stock Dip

- Disappointing Guidance on Upcoming Earnings Call: During its latest quarterly report, Eli Lilly maintained strong revenue growth but offered conservative forward guidance. Executives cited supply chain constraints for Mounjaro and Zepbound as a limiting factor for near-term sales expansion.

- Increased Competition in the Obesity Drug Market: Novo Nordisk recently announced positive late-stage trial results for its next-generation GLP-1 drug, CagriSema, which could challenge Lilly’s dominance in weight-loss therapeutics.

- Pricing Pressure and Insurance Pushback: Major insurers, including UnitedHealth Group, have begun tightening prior authorization requirements for GLP-1 agonists, potentially slowing prescription adoption.

- Profit-Taking After Strong Run-Up: LLY stock surged nearly 90% over the past 12 months. Some institutional investors may be locking in gains ahead of potential volatility.

- Broader Market Risk-Off Sentiment: Rising bond yields have made growth stocks less attractive. High-flying pharma names like LLY are particularly sensitive to discount rate changes.

Supply Constraints: A Temporary Hurdle or Structural Issue?

One of the most significant factors contributing to today’s dip is Eli Lilly’s ongoing struggle to meet demand for its flagship obesity and diabetes medications. Despite record-breaking sales, the company has repeatedly acknowledged production bottlenecks. In its Q2 2024 earnings call, CFO Anat Ashkenazi stated, “We are scaling manufacturing rapidly, but global demand continues to outpace our ability to supply.”

This imbalance creates a paradox: stellar product efficacy and market demand are undercut by an inability to fully capitalize on them. Analysts at Morgan Stanley noted that unmet demand could exceed $2 billion annually if not resolved by late 2025.

“Supply constraints are the single biggest overhang on Eli Lilly’s valuation right now. Until they show consistent inventory growth, investors will remain cautious.” — Sarah Chen, Senior Biotech Analyst at Morgan Stanley

Lilly is investing heavily in new facilities, including a $2.8 billion plant in North Carolina dedicated to peptide production. But these projects take time. Until supply stabilizes, the stock may face headwinds despite robust underlying fundamentals.

Competitive Landscape: Is the Moat Narrowing?

Eli Lilly’s leadership in the GLP-1 space was once seen as unassailable. But the competitive environment is evolving quickly. Novo Nordisk, the maker of Wegovy and Ozempic, continues to dominate market share, and its pipeline includes CagriSema—a dual-acting therapy that showed superior weight loss in early trials compared to tirzepatide.

Meanwhile, smaller players like Zealand Pharma and Hanmi Pharmaceutical are advancing candidates that could enter niche segments of the metabolic disease market. Though none threaten Lilly’s core business immediately, the perception of increased competition is enough to rattle investor sentiment.

| Company | Drug | Indication | Weight Loss (Avg %) | Status |

|---|---|---|---|---|

| Eli Lilly | Mounjaro / Zepbound | Type 2 Diabetes / Obesity | 15–20% | Approved & Commercial |

| Novo Nordisk | Ozempic / Wegovy | Type 2 Diabetes / Obesity | 12–17% | Approved & Commercial |

| Novo Nordisk | CagriSema | Obesity | 24% (Phase 2) | Phase 3 Ongoing |

| AstraZeneca | CEM107535 | Obesity | 18% (Preclinical) | Early Development |

The data suggests that while Eli Lilly still holds a strong position, the window of exclusivity is shrinking. Any delay in launching next-gen formulations or expanding indications could allow rivals to gain ground.

What Should Investors Do Now? A Strategic Checklist

Volatility can create opportunity. Before making any move, consider this checklist to assess whether the LLY dip is a buying opportunity or a warning sign.

- Review Earnings Quality: Look beyond headline EPS. Are margins expanding? Is R&D investment sustainable?

- Assess Supply Chain Updates: Has Lilly provided clear timelines for resolving shortages?

- Monitor Prescribing Trends: Use third-party data (e.g., Symphony Health) to track weekly prescription growth for Zepbound and Mounjaro.

- Check Institutional Ownership: Are major funds increasing or reducing positions? Sudden outflows signal deeper concerns.

- Evaluate Valuation Metrics: LLY trades at ~45x forward P/E. Is this justified given growth trajectory and pipeline strength?

- Watch Regulatory Calendar: Upcoming FDA decisions on new indications (e.g., Alzheimer’s drug donanemab) could be catalysts.

Real Example: How One Investor Navigated a Similar Dip

In early 2023, LLY stock dropped nearly 7% after the FDA delayed review of Zepbound due to incomplete manufacturing data. Jane R., a long-term investor from Colorado, saw the dip as an opportunity. She reviewed Lilly’s clinical trial results, confirmed the delay was procedural—not safety-related—and doubled her position at $320 per share. Within six months, the stock rebounded to $450. “I focused on the science, not the headlines,” she said. “The obesity pipeline was too strong to ignore.”

This case illustrates the importance of distinguishing between temporary setbacks and fundamental deterioration.

Frequently Asked Questions

Is Eli Lilly stock a buy after today’s drop?

For long-term investors, yes—provided you believe in the durability of its GLP-1 franchise and pipeline. Short-term traders should wait for clearer signs of supply normalization and stable reimbursement policies.

When will Eli Lilly resolve its drug shortages?

Company executives project partial relief by Q4 2024, with full supply-demand balance expected by mid-2025. Expansion of manufacturing sites in Indiana, Puerto Rico, and Europe is underway.

Could donanemab approval boost LLY stock?

Absolutely. If approved for early Alzheimer’s, donanemab could become a multi-billion-dollar asset. Positive CMS coverage decisions would amplify the impact. Watch for Medicare’s final ruling in late 2024.

Conclusion: Navigating Volatility with Confidence

The dip in Eli Lilly stock today reflects a confluence of operational challenges and market sentiment shifts—not a collapse in fundamentals. The company continues to lead in high-growth therapeutic areas, backed by a deep pipeline and strong cash flow. While near-term volatility is likely, especially around supply updates and competitor news, the long-term outlook remains compelling.

Rather than reacting emotionally to price swings, investors should use this moment to reassess their thesis. Is Eli Lilly still innovating? Are patients benefiting? Is management executing? The answers, for now, remain strongly affirmative.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?