In recent years, more people have noticed prices rising faster than usual. Groceries cost more. Gasoline feels expensive again. Rent keeps climbing. This widespread increase in prices is called inflation. While a little inflation is normal in a healthy economy, the rate we’ve seen since 2021 has been unusually high — leaving many consumers asking: Why is inflation so high?

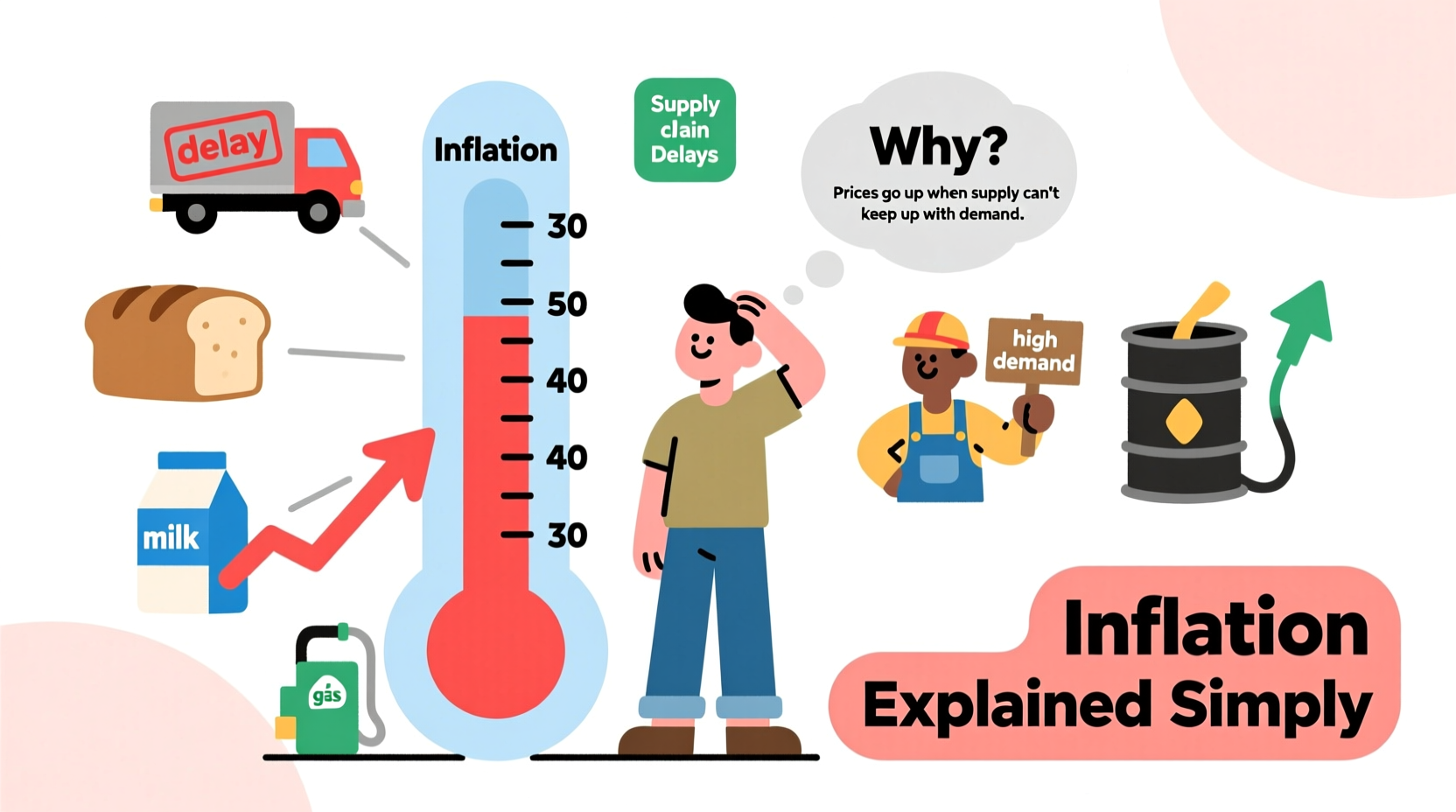

The answer isn’t simple, but it’s not mysterious either. Inflation happens when demand for goods and services outpaces supply, or when production costs rise sharply, or both. The current wave of high inflation stems from a perfect storm of global disruptions, policy decisions, and shifting consumer behavior. Understanding these forces helps you make smarter financial choices and reduces the anxiety that comes with rising prices.

What Is Inflation — And Why Should You Care?

Inflation measures how much more expensive a set of everyday goods and services becomes over time. It’s usually expressed as an annual percentage. For example, if inflation is 5%, then on average, what cost $100 last year now costs $105.

This matters because inflation erodes your purchasing power. Even if your income stays the same, you can buy less with it. Over time, unchecked inflation can undermine savings, strain household budgets, and reduce long-term financial security.

Central banks, like the U.S. Federal Reserve, aim for a moderate inflation rate — typically around 2% per year. This small amount encourages spending and investment without destabilizing the economy. But when inflation spikes well above that target, as it did reaching nearly 9% in 2022 in the U.S., it signals deeper imbalances.

The Main Causes of Today’s High Inflation

Several interconnected factors pushed inflation higher starting in 2021. No single cause explains everything, but together they created a powerful upward pressure on prices.

1. Pandemic-Driven Supply Chain Disruptions

When the pandemic hit in early 2020, factories shut down, shipping slowed, and ports backed up. By the time economies reopened in 2021, demand surged — but supply couldn’t keep up.

For example, car manufacturers needed computer chips, but chip factories were running at reduced capacity. That shortage limited new car production, driving up both new and used vehicle prices. Similar bottlenecks affected furniture, electronics, and even basic materials like lumber.

2. Surging Consumer Demand After Lockdowns

During lockdowns, many people saved money — either because they couldn’t spend (restaurants, travel) or received government stimulus checks. Once restrictions lifted, pent-up demand exploded.

People wanted vacations, new clothes, dining out, and home improvements all at once. Businesses struggled to meet this sudden spike in demand, especially with ongoing labor and supply issues. With more buyers chasing limited goods and services, prices went up.

3. Rising Energy and Food Prices

Energy is a key input in almost every product — from farming to transportation to manufacturing. When oil prices jumped due to geopolitical tensions (notably the war in Ukraine), the cost of moving goods increased across the board.

Similarly, food prices rose due to extreme weather damaging crops, higher fertilizer costs (linked to natural gas), and disrupted grain exports from Ukraine. These increases directly affect household budgets, as food and fuel are essential expenses.

4. Labor Shortages and Wage Growth

After the pandemic, many workers left the workforce — due to health concerns, early retirement, caregiving duties, or reevaluating their careers. Employers responded by raising wages to attract talent.

While higher wages are good for workers, they also increase business costs. Some companies pass those costs on to consumers through higher prices. Economists call this “wage-price spiral” when sustained — though evidence suggests it hasn’t become entrenched yet.

5. Expansionary Fiscal and Monetary Policy

To cushion the economic blow of the pandemic, governments spent heavily on relief programs (stimulus checks, unemployment boosts), and central banks kept interest rates near zero while buying bonds to inject cash into the economy.

These policies helped prevent a deeper recession, but they also increased the amount of money circulating in the economy. When too much money chases too few goods, inflation results.

“Inflation is always and everywhere a monetary phenomenon.” — Milton Friedman, Nobel Prize-winning economist

How Inflation Spreads Through the Economy

Inflation doesn’t just appear overnight. It spreads through feedback loops. Here’s how:

- Initial shock: A disruption (like a war or pandemic) affects supply or demand.

- Price increases: Companies raise prices to cover higher costs or meet strong demand.

- Expectations shift: Consumers and businesses expect prices to keep rising.

- Behavior changes: Workers ask for higher wages; companies plan future price hikes.

- Sustained inflation: These expectations become self-fulfilling, making inflation harder to stop.

This is why central banks act quickly when inflation threatens to become persistent. Letting it linger risks embedding high inflation into everyday decision-making.

Real-World Example: The Case of Used Cars in 2021–2022

In 2020, auto production slowed due to semiconductor shortages. By 2021, demand for vehicles rebounded fast — including rental car companies replacing fleets and individuals avoiding public transit.

With fewer new cars available, buyers turned to the used market. Demand skyrocketed. According to the U.S. Bureau of Labor Statistics, used car prices rose over 40% between April 2020 and March 2022 — one of the largest contributors to overall inflation during that period.

This wasn’t due to greed or corporate pricing tricks alone. It was classic economics: constrained supply meeting explosive demand. Only when chip supplies normalized and new car production resumed did used car prices begin to fall again in late 2022.

Coping Strategies for Consumers During High Inflation

You can’t control inflation, but you can adjust your habits to protect your budget and maintain financial stability.

Step-by-Step Guide to Managing Finances in High-Inflation Times

- Track your spending. Use apps or spreadsheets to see where your money goes. Identify areas where prices have risen most.

- Adjust your grocery strategy. Buy store brands, use coupons, shop later in the week when stores discount perishables, and plan meals to reduce waste.

- Delay big purchases. If possible, wait before buying appliances, cars, or electronics. Prices may stabilize or even drop as supply improves.

- Negotiate or refinance debt. If you have fixed-rate loans, you’re protected. But consider refinancing high-interest credit cards or variable-rate debt before rates go higher.

- Review subscriptions. Cancel unused services — streaming platforms, gym memberships, software tools — to free up cash.

- Build an emergency fund. Aim for 3–6 months of living expenses in a high-yield savings account to buffer against unexpected costs.

- Invest wisely. While cash loses value during inflation, diversified investments (like stocks, real estate, or TIPS) historically preserve wealth over time.

Do’s and Don’ts During High Inflation

| Do’s | Don’ts |

|---|---|

| ✔ Shop with a list to avoid impulse buys | ✖ Assume all price increases are permanent |

| ✔ Compare unit prices at the grocery store | ✖ Carry high-interest credit card balances |

| ✔ Consider energy-efficient appliances to cut utility bills | ✖ Panic-sell investments during market swings |

| ✔ Re-evaluate insurance plans annually for better rates | ✖ Ignore rising interest on savings accounts — move cash to high-yield options |

| ✔ Prioritize needs over wants in discretionary spending | ✖ Take on new debt without assessing long-term affordability |

Frequently Asked Questions

Is inflation the same as rising prices?

Not exactly. Rising prices for one item (like gasoline) don’t mean inflation. Inflation refers to a broad, sustained increase in the price level of many goods and services across the economy. It’s measured using indexes like the Consumer Price Index (CPI).

Will inflation ever go back down?

Yes — and it already has in many countries. As supply chains healed and central banks raised interest rates to cool demand, inflation began slowing. In the U.S., it fell from 9% in mid-2022 to around 3% by late 2023. Most economists expect it to return to the 2% target over time, though occasional spikes may occur due to new shocks.

Are companies just using inflation as an excuse to raise prices and boost profits?

Some research suggests that corporate profit margins expanded during the inflation surge, particularly in sectors like food and energy. While costs did rise, price increases sometimes exceeded those costs. This phenomenon, sometimes called “greedflation,” remains debated among economists. However, most agree that initial inflation was driven primarily by supply and demand imbalances, not corporate pricing power alone.

What Role Do Central Banks Play?

Central banks, like the Federal Reserve, are responsible for keeping inflation under control. Their main tool is interest rates.

When inflation is too high, they raise interest rates. This makes borrowing more expensive, which slows down spending by consumers and businesses. Less demand helps bring prices back into balance.

Conversely, when inflation is too low or the economy is weak, they lower rates to encourage borrowing and spending.

In 2022 and 2023, the Fed raised rates aggressively — the fastest tightening cycle in decades — to combat inflation. These moves contributed to slower economic growth and higher mortgage and loan rates, but were necessary to restore price stability.

“Our job is to ensure price stability so families and businesses can plan for the future with confidence.” — Jerome Powell, Chair of the Federal Reserve

Conclusion: Stay Informed, Stay Prepared

Inflation is high because of a rare combination of global shocks, economic policies, and shifts in consumer behavior. It’s not caused by any single factor, nor is it likely to disappear overnight. But understanding the root causes empowers you to respond thoughtfully rather than react emotionally.

Prices will continue to fluctuate. Some years will be higher than others. What matters most is building resilience — through smart budgeting, informed spending, and long-term financial planning. Inflation doesn’t have to derail your goals if you adapt proactively.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?