A negative Cash App balance can be alarming—especially if you weren’t expecting it. You check your account only to see a red number, possibly triggering stress about overdrafts, pending payments, or unauthorized transactions. While Cash App doesn't offer traditional overdraft protection like banks, there are several reasons why your balance might dip below zero. Understanding these causes is the first step toward resolution.

Cash App operates as a digital wallet that links to your bank account, debit card, or credit card. It allows instant transfers, peer-to-peer payments, direct deposits, and even investing in stocks and Bitcoin. But because of its speed and integration with multiple funding sources, errors or timing mismatches can lead to a temporarily negative balance. The good news: most situations are reversible with prompt action.

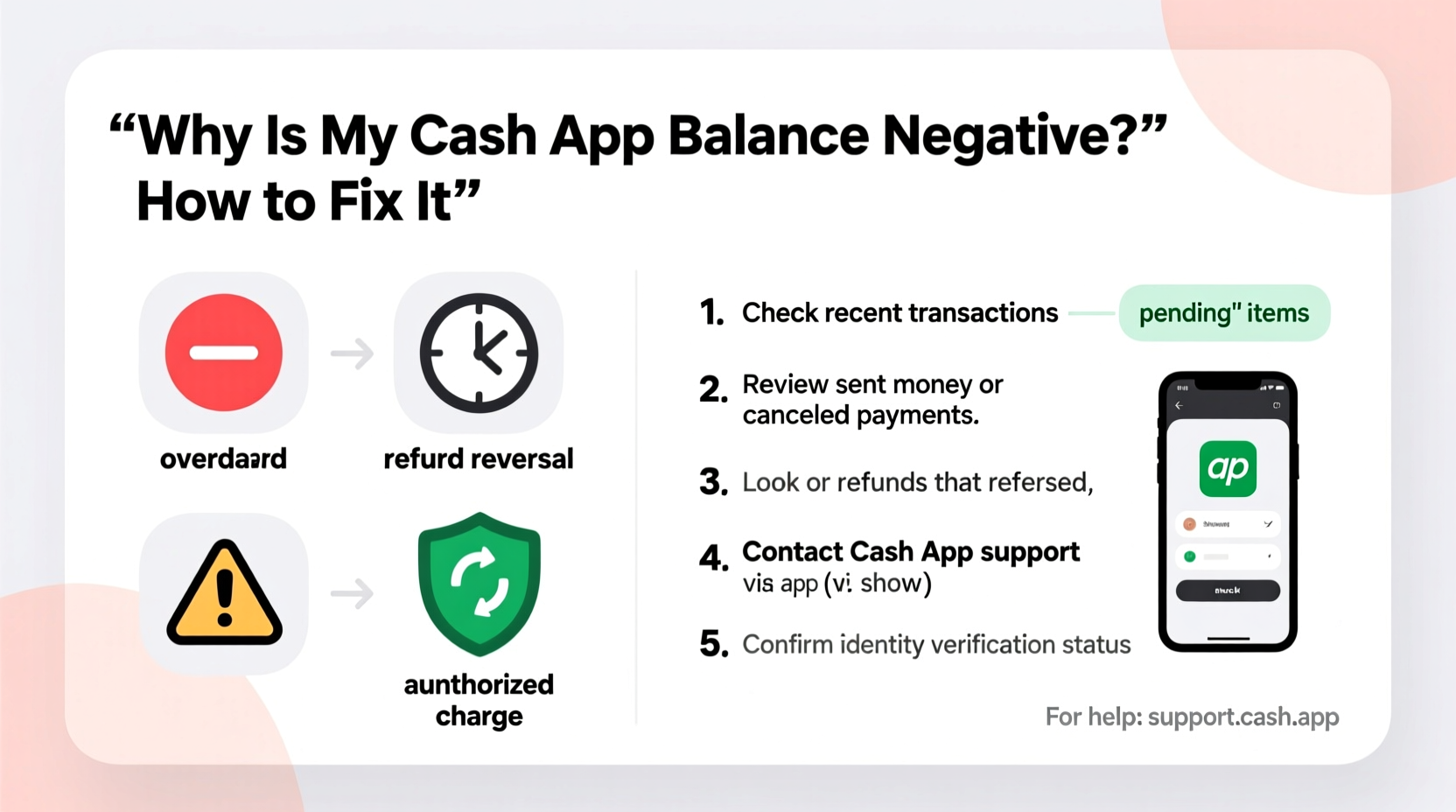

Common Causes of a Negative Cash App Balance

A negative balance doesn’t always mean you owe money permanently. In many cases, it reflects pending transactions, failed reversals, or timing lags between your linked accounts and Cash App’s system. Here are the most frequent triggers:

- Pending Transactions: When you send money or make a purchase, Cash App may reserve funds immediately, creating a temporary negative balance until the transaction settles.

- Failed Refunds or Reversals: If a payment you sent was declined or reversed after being deducted from your balance, the refund might take time to process.

- Insufficient Linked Funds: Attempting a transfer when your linked bank account or card has no available balance can cause a shortfall reflected in Cash App.

- Direct Deposit Overages: Rarely, early direct deposits from employers or government benefits may appear before your employer’s final settlement, leading to a reversal that results in a negative balance.

- Unauthorized or Fraudulent Activity: Though less common, scams or compromised accounts can lead to unexpected withdrawals.

How to Fix a Negative Cash App Balance: Step-by-Step Guide

Resolving a negative balance requires methodical troubleshooting. Follow this timeline to identify and correct the issue efficiently:

- Check Your Transaction History (Immediate): Open Cash App > Balance > Recent Activity. Look for recent sends, failed payments, or reversals.

- Identify Pending Items: Transactions labeled “Pending” or “Processing” may be holding funds. Wait 24–48 hours for them to clear.

- Verify Linked Account Status: Go to Settings > Linked Accounts. Confirm your bank or card isn’t frozen or overdrawn.

- Add Funds to Offset the Deficit: Tap “Add Cash,” then transfer money from a linked source to bring your balance back to zero or positive.

- Contact Support if Balance Doesn’t Correct: If the negative amount persists beyond 72 hours, reach out via the app’s Help Center.

“Cash App balances typically self-correct within 1–3 business days when issues stem from processing delays.” — Financial Tech Analyst, Maya Rodriguez

Do’s and Don’ts When Facing a Negative Balance

| Action | Do | Don't |

|---|---|---|

| Responding to a negative balance | Review transactions, wait 48 hours for processing, then add funds if needed | Panic or assume permanent debt without verification |

| Using linked cards | Ensure sufficient funds before sending payments | Use expired or maxed-out cards for transfers |

| Contacting support | Provide screenshots and transaction IDs for faster resolution | Submit duplicate tickets; it slows response time |

| Security | Enable two-factor authentication and monitor login attempts | Share your PIN, $Cashtag, or QR code publicly |

Real Example: How Sarah Fixed Her -$50 Balance

Sarah received a notification that her Cash App balance showed -$50. She hadn’t sent any large payments recently. Alarmed, she opened the app and checked her transaction history. She found a $50 payment to a friend marked “Failed,” but the amount had already been deducted.

She waited 24 hours, assuming it would auto-refund. When it didn’t, she tapped on the transaction and selected “Report Issue.” Within six hours, Cash App support confirmed the failure and processed a manual refund. Her balance returned to $0 the next morning.

The lesson? Not all failed transactions reverse instantly. Proactive reporting speeds up resolution.

Preventing Future Negative Balances: A Checklist

Maintaining a healthy Cash App balance starts with disciplined habits. Use this checklist weekly to avoid surprises:

- ✅ Monitor pending transactions daily

- ✅ Confirm availability in linked accounts before sending money

- ✅ Set up balance alerts under Notifications settings

- ✅ Avoid using credit cards for Cash Add (fees apply and can delay clearing)

- ✅ Regularly update the app to ensure bug-free performance

- ✅ Log out of unused devices to protect account integrity

Additionally, consider maintaining a small buffer—$5 to $10—in your Cash App account if you frequently send quick payments. This minimizes the chance of going negative due to timing gaps.

Frequently Asked Questions

Does a negative Cash App balance affect my credit score?

No. Cash App does not report to credit bureaus, and negative balances are treated as internal discrepancies, not loans or debts. However, unresolved issues could restrict app functionality until resolved.

Can I still receive money if my balance is negative?

Yes. Incoming payments will first offset the negative amount. For example, if you’re at -$20 and someone sends you $30, your new balance will be $10 after processing.

How long does it take for a negative balance to fix itself?

Most temporary negatives resolve within 24 to 72 hours. If caused by a failed transaction or pending reversal, allow three business days before contacting support.

Conclusion: Take Control of Your Digital Wallet

A negative Cash App balance is usually a temporary glitch, not a financial emergency. By understanding how transactions flow, monitoring your activity, and acting promptly when discrepancies arise, you can maintain full control over your digital finances. Most issues resolve automatically—but knowing when and how to intervene makes all the difference.

Stay proactive: audit your account weekly, secure your login, and never hesitate to contact support with evidence-ready inquiries. With the right habits, your Cash App experience can remain smooth, safe, and stress-free.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?