Online shopping, bill payments, and subscription renewals have become everyday activities. When a credit card transaction doesn’t go through immediately—or worse, takes days to process—it can be frustrating and disruptive. You’re not alone if you’ve ever stared at a “pending” status wondering, “Why isn’t this payment clearing?” The delay might not be due to your card being declined or your bank freezing activity. Instead, multiple behind-the-scenes factors in the payment processing chain could be responsible.

Understanding how online credit card payments work—and where delays commonly occur—can help you troubleshoot issues efficiently. Whether it’s a utility bill, a travel booking, or a recurring subscription, knowing what’s happening behind the scenes empowers you to act quickly and avoid late fees, service interruptions, or declined transactions.

How Online Credit Card Payments Actually Work

When you make an online purchase with a credit card, the transaction doesn’t settle instantly. It moves through a multi-step authorization and settlement process involving several parties:

- Cardholder (You): Initiates the transaction by entering card details on a website or app.

- Merchant: The business receiving the payment sends the transaction data to their payment processor.

- Payment Processor: Routes the request to the card network (Visa, Mastercard, etc.).

- Card Network: Transmits the authorization request to your issuing bank.

- Issuing Bank: Checks available credit, fraud risk, and account status before approving or declining.

- Authorization Response: If approved, a temporary hold is placed on funds, and the merchant receives confirmation.

- Settlement: The merchant submits the transaction for final payment, which typically takes 1–3 business days to complete.

The initial authorization may appear within seconds, but the actual transfer of funds from your bank to the merchant—the settlement—often takes longer. This gap explains why some transactions show as “pending” for days before appearing as “posted.”

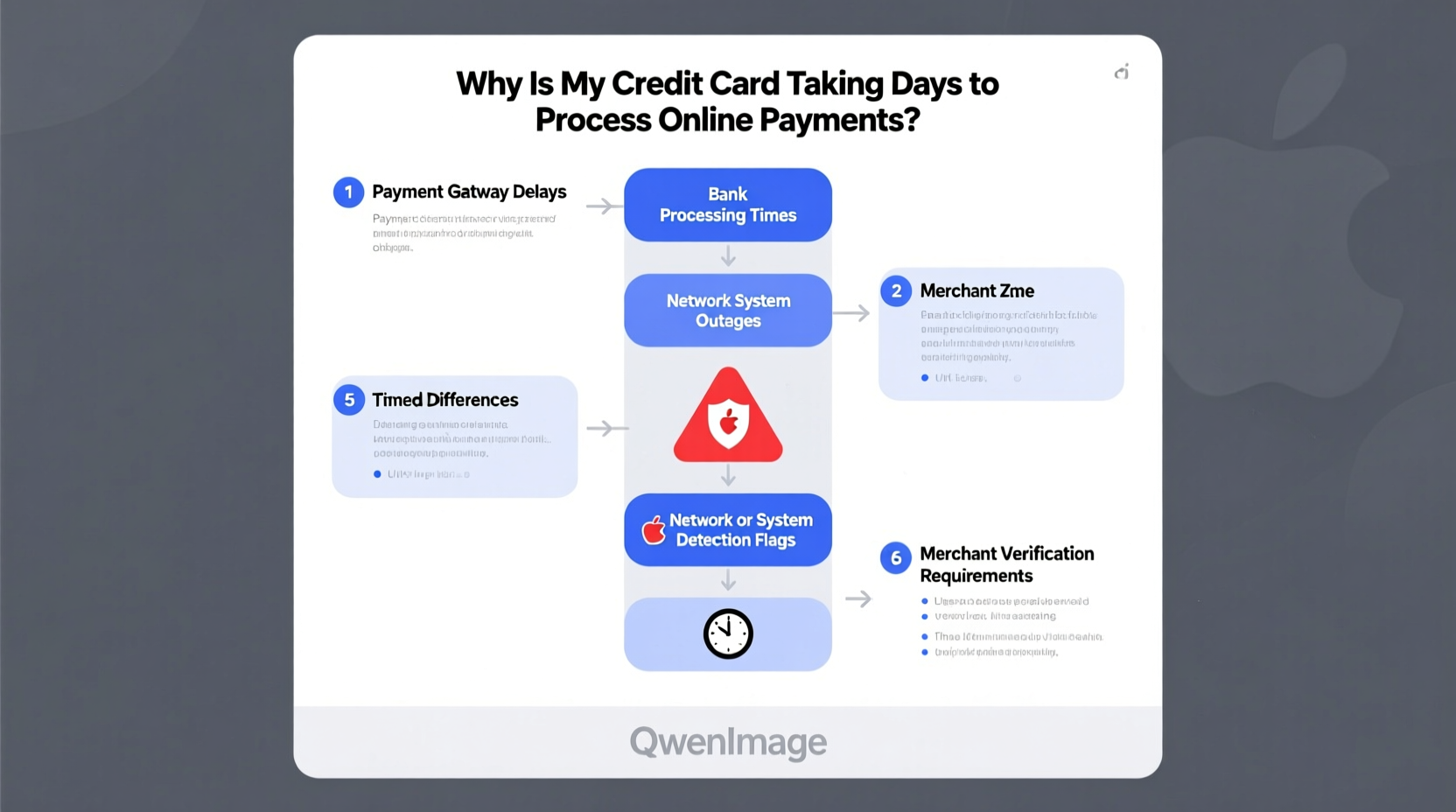

Common Reasons for Delayed Credit Card Processing

Not all delays are created equal. Some are normal; others signal deeper issues. Here are the most frequent causes of slow credit card processing times:

1. Merchant Batch Processing Schedule

Many small businesses don’t submit transactions for settlement daily. They may batch-process payments weekly or only when inventory syncs with accounting software. Until the merchant submits the transaction, it remains pending and won’t post to your statement.

2. Weekends and Public Holidays

Banks and payment networks don’t operate on weekends or holidays. A transaction initiated Friday evening may not begin processing until Monday, adding a 2–3 day delay even if everything else is functioning normally.

3. Fraud Prevention Holds

If your bank detects unusual activity—such as a large purchase, international transaction, or rapid-fire spending—it may place a temporary hold for manual review. These checks can last 24–72 hours while the issuer verifies legitimacy.

4. Insufficient Funds or Credit Limit Issues

Even if a transaction is initially authorized, a subsequent check during settlement might reveal insufficient credit or a limit exceeded by other pending charges. This can cause the transaction to stall or fail entirely.

5. Third-Party Payment Processors or Gateways

Sites using platforms like PayPal, Stripe, or Square add an extra layer to the payment flow. Each intermediary has its own processing timeline, increasing the chance of delay—especially during high-volume periods like holidays.

6. Technical Glitches or System Outages

Rare but possible, technical errors between the merchant, processor, or bank can interrupt the payment pipeline. These often resolve automatically but may require customer intervention if unresolved after 72 hours.

“Most credit card delays aren’t due to user error—they stem from timing mismatches between banks, merchants, and processors.” — David Lin, Senior Analyst at Financial Systems Review Group

Troubleshooting Checklist: What to Do When Payments Are Stuck

If your credit card payment is delayed beyond the expected timeframe (typically 3 business days), follow this step-by-step checklist to identify and resolve the issue:

- ✅ Confirm the transaction shows as “pending” in your online banking portal.

- ✅ Check if the merchant has sent a confirmation email or receipt.

- ✅ Verify your available credit limit hasn’t been exceeded by other charges.

- ✅ Call your bank’s customer service to confirm no fraud alerts are active.

- ✅ Contact the merchant directly to ask if they’ve submitted the payment for settlement.

- ✅ Review your billing cycle date—some payments only process on specific days.

- ✅ Document all communication (dates, names, reference numbers) for dispute purposes.

Real-World Example: A Delayed Subscription Renewal

Sarah renewed her cloud storage subscription on a Sunday night using her credit card. The site confirmed the order and charged her card, but two days later, the service was suspended due to “non-payment.” Confused, she checked her bank app and saw the transaction marked as “pending,” not “completed.”

She contacted her bank first. The representative confirmed no fraud flag and stated that the charge hadn’t settled yet. Then she reached out to the tech company’s support team. They explained that their payment processor only batches transactions on weekdays. Because Sarah’s payment was made Sunday, it wasn’t submitted until Monday morning—and wouldn’t settle until Tuesday afternoon.

The company reactivated her account manually after verifying the pending charge. Lesson learned: Always allow buffer time for automated services, especially near weekends. Sarah now renews subscriptions mid-week to avoid disruptions.

Do’s and Don’ts of Managing Pending Transactions

| Do’s | Don’ts |

|---|---|

| Monitor pending charges regularly via mobile banking. | Assume a pending transaction means funds are already deducted. |

| Contact the merchant if a charge remains pending beyond 72 hours. | Make additional purchases without accounting for pending holds. |

| Keep receipts and confirmation emails for disputed transactions. | Ignore notifications from your bank about suspicious activity. |

| Use calendar reminders for critical payments (rent, utilities). | Wait until the due date to pay important bills online. |

| Set up payment alerts for real-time updates. | Use expired or incorrect card details repeatedly. |

When to Escalate: Resolving Persistent Payment Delays

If a transaction remains unprocessed after five business days, it’s time to escalate. Start by gathering evidence: screenshots of the pending charge, order confirmation, and any correspondence with the merchant. Then proceed with the following steps:

- Contact Your Issuing Bank: Request a trace on the transaction. Banks can initiate a “chargeback inquiry” to determine where the payment stalled—whether with the merchant, processor, or network.

- Dispute the Charge (If Applicable): If the merchant claims payment was sent but your bank shows nothing, file a formal dispute. Under the Fair Credit Billing Act (FCBA), you have 60 days to contest unauthorized or erroneous charges.

- Escalate with the Merchant: Speak to a supervisor or billing department. Provide proof of the pending transaction and demand clarification or resolution.

- Report to Consumer Protection Agencies: If unresolved, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general office.

Remember: Most delays are resolved within 7–10 days once reported. But acting early prevents compounding issues like late fees, service cancellations, or negative credit reporting.

Frequently Asked Questions

Can a pending transaction be canceled?

Yes, but only by the merchant or your bank. If you want to cancel a pending charge, contact the merchant immediately to void the transaction. If they’ve already submitted it for settlement, you’ll need to wait for it to post and then request a refund.

Why does my available credit not update immediately after a refund?

Refunds follow a similar multi-day process. While merchants may issue refunds quickly, your bank must receive and process the reversal, which can take 3–7 business days. Some issuers apply refunds faster than others—check with your provider for typical timelines.

Does a long-pending transaction affect my credit score?

No, individual transaction delays don’t impact your credit score. However, if a delayed payment results in a late bill (e.g., your utility company doesn’t receive payment on time), that late payment could be reported to credit bureaus and harm your score.

Preventing Future Delays: Smart Payment Habits

While some delays are unavoidable, adopting proactive habits reduces risk and frustration:

- Pay Bills Early: Avoid submitting payments on due dates. Aim to pay at least 3–5 business days in advance, especially for rent, loans, or utilities.

- Update Card Details Promptly: If your card expires or is replaced, update saved information across all platforms (streaming services, subscriptions, autopay settings).

- Use Reliable Networks: Stick to major card networks (Visa, Mastercard) and trusted merchants. Lesser-known processors may have slower settlement times.

- Enable Transaction Alerts: Turn on push or email notifications for every charge. Immediate awareness helps you catch issues early.

- Maintain Buffer Credit: Avoid maxing out your card. Keep a healthy margin below your limit to prevent declines due to pending authorizations.

Conclusion: Take Control of Your Payment Experience

Delayed credit card processing doesn’t have to be a mystery or a source of stress. By understanding the mechanics behind online transactions and knowing how to respond when things go awry, you regain control over your financial workflow. Most delays are temporary and resolvable with timely communication and documentation.

Start today by reviewing your recent transactions, setting up alerts, and auditing your recurring payments. A few proactive steps now can save you hours of confusion—and potential fees—down the line. If you’ve faced a stubborn payment delay, share your experience in the comments. Your insight might help someone else navigate their own credit card challenge.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?