Tesla, once the undisputed leader in the electric vehicle (EV) revolution, has seen its stock price face persistent downward pressure over recent quarters. After a meteoric rise that made it one of the most valuable automakers in the world, investors are now questioning whether Tesla can sustain its growth trajectory. While short-term volatility is normal in any high-growth stock, the sustained decline in Tesla’s share price points to deeper structural and strategic challenges. This article examines the multifaceted reasons behind Tesla’s falling stock, from weakening demand signals to internal leadership issues and intensifying global competition.

Declining Vehicle Deliveries and Missed Targets

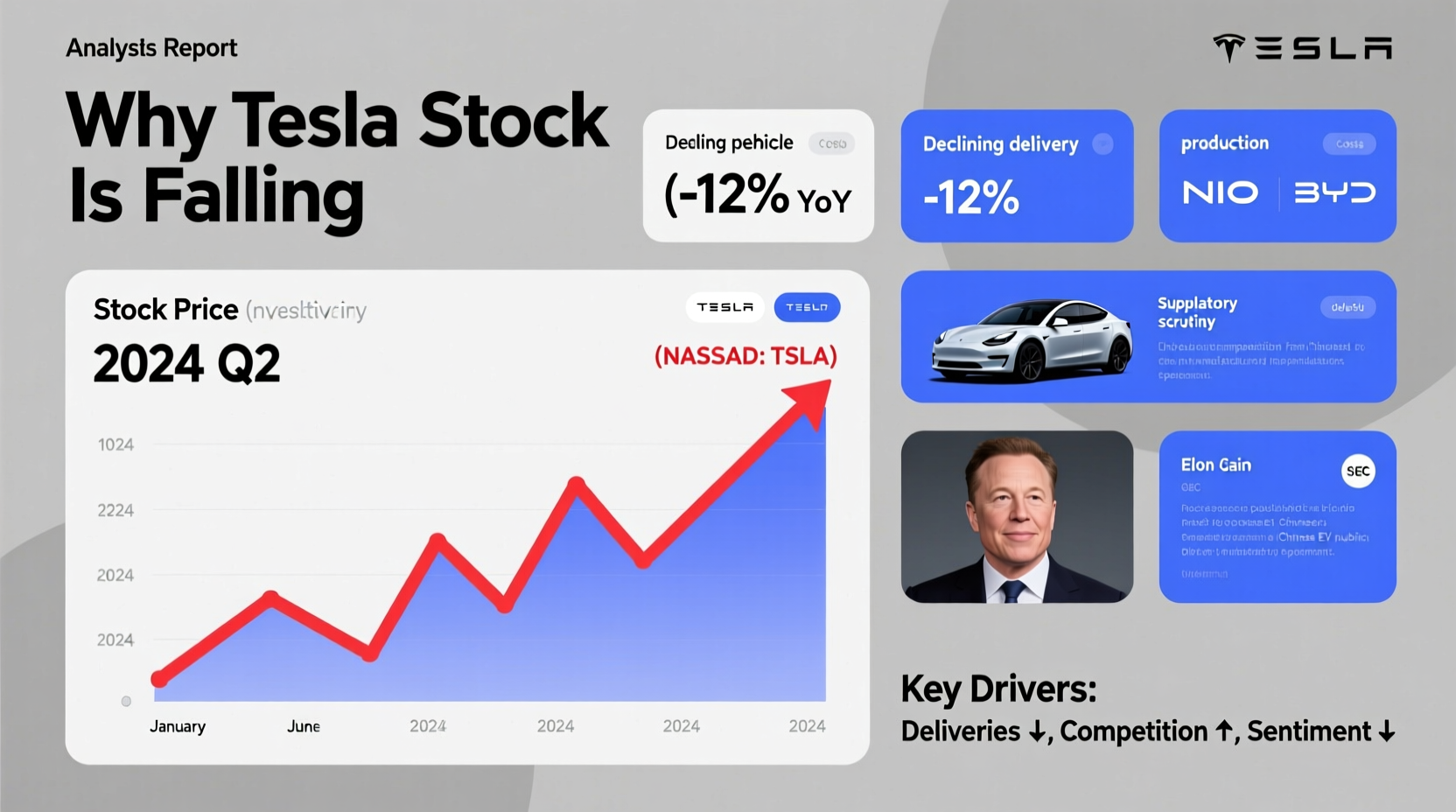

One of the most immediate indicators of Tesla’s struggles lies in its quarterly vehicle delivery reports. In 2023 and early 2024, Tesla missed delivery expectations for multiple consecutive quarters — a rare occurrence for a company known for beating forecasts. For example, Q1 2024 saw deliveries drop year-over-year despite broader EV markets stabilizing post-pandemic. Analysts interpreted this as a sign of weakening consumer demand and production bottlenecks.

The Model S and X refresh failed to generate significant traction, while the long-promised \"affordable\" $25,000 model remains delayed. Meanwhile, production ramp-ups at Gigafactories in Berlin and Texas have been slower than anticipated, limiting Tesla’s ability to scale globally.

Intensifying Global Competition in the EV Market

Where Tesla once enjoyed first-mover advantage, the EV landscape is now crowded with capable competitors. Legacy automakers like Ford, GM, Hyundai, and Volkswagen have accelerated their EV lineups with improved range, charging compatibility, and pricing. Chinese manufacturers such as BYD, NIO, and XPeng are not only dominating domestic sales but expanding into Europe and Southeast Asia with aggressively priced, feature-rich vehicles.

BYD surpassed Tesla in global EV sales volume in Q4 2023, marking a symbolic shift in market leadership. Unlike Tesla, which relies heavily on premium models, BYD offers a broad portfolio across price segments — giving it wider appeal.

| Company | Q4 2023 EV Sales | Key Competitive Advantage | Price Range Focus |

|---|---|---|---|

| BYD | 526,000 units | Battery vertical integration, affordability | $20k–$45k |

| Tesla | 484,000 units | Brand recognition, Supercharger network | $35k–$100k+ |

| Volkswagen Group | 117,000 units | Dealer network, EU presence | $30k–$70k |

| NIO | 50,000 units | Battery swapping, luxury design | $45k–$75k |

This growing competition has eroded Tesla’s pricing power. To maintain sales volume, Tesla implemented aggressive price cuts across major markets — particularly in China and the U.S. While these moves boosted short-term demand, they also compressed profit margins and raised concerns about long-term profitability.

Leadership Uncertainty and Governance Concerns

Elon Musk’s dual role as CEO of Tesla and owner of X (formerly Twitter), along with his involvement in SpaceX, Neuralink, and xAI, has sparked investor anxiety about focus and governance. His frequent public controversies — including political statements and legal battles — have increasingly been viewed as distractions that could harm Tesla’s brand and stakeholder confidence.

In 2023, a Delaware court invalidated Musk’s $56 billion compensation package, citing lack of board independence. Though Tesla plans to appeal, the ruling underscored longstanding concerns about corporate oversight. Institutional investors, including pension funds and ESG-focused asset managers, have expressed unease over the concentration of power in one individual.

“Governance matters when valuing growth companies. Tesla’s reliance on a single personality increases risk during periods of macroeconomic uncertainty.” — Sarah Lin, Senior Equity Analyst at Vanguard Capital

Economic and Macro Factors Impacting Demand

Beyond company-specific issues, broader economic conditions are weighing on Tesla’s performance. Rising interest rates have increased financing costs for car buyers, dampening demand for higher-priced vehicles like the Model S and Cybertruck. Inflation has also squeezed consumer budgets, making even mid-tier EVs less affordable without subsidies.

Tesla’s average selling price (ASP) remains above $45,000 — significantly higher than many new entrants. With federal tax credits in the U.S. limited to certain manufacturers and income thresholds, Tesla buyers often qualify for fewer incentives compared to rivals using union-made components under the Inflation Reduction Act.

Additionally, used EV prices have declined sharply due to oversupply and rapid technological turnover, undermining the resale value proposition of new Teslas — a factor that previously supported ownership economics.

Technological Promises vs. Execution Delays

Tesla continues to promote groundbreaking innovations: Full Self-Driving (FSD) Beta, robotaxis, Optimus humanoid robots, and next-generation platforms. However, repeated delays in delivering these technologies at scale have led to skepticism among investors.

FSD remains in beta testing with limited regulatory approval. Despite over-the-air updates, it has not achieved true autonomy, and safety concerns persist. The much-hyped robotaxi launch, initially expected in 2024, has been pushed back with no firm timeline. These unmet promises contribute to a perception of overhyping and underdelivering.

Meanwhile, competitors are advancing their own autonomous driving systems through partnerships with Mobileye, NVIDIA, and Qualcomm — some already deploying Level 2+ features more reliably.

Mini Case Study: The Cybertruck Rollout Challenges

The Cybertruck’s launch exemplifies Tesla’s execution gap. Hailed as a revolutionary all-electric pickup, it faced years of delays before limited deliveries began in late 2023. Early reviews praised its durability and performance but criticized its impractical design, high base price (~$61,000), and lack of towing efficiency compared to Ford F-150 Lightning or Rivian R1T.

Production ramp has been slow due to complex stainless-steel body manufacturing. As of Q1 2024, fewer than 10,000 units were delivered — far below initial projections. This highlights how innovation without scalable engineering can limit commercial success.

Actionable Investor Checklist: Evaluating Tesla’s Future Outlook

For current or prospective investors, here’s a checklist to assess Tesla’s viability amid ongoing challenges:

- Monitor Quarterly Deliveries: Look for consistent YoY growth and regional diversification.

- Analyze Gross Margins: Sustained drops below 18% signal pricing pressure or cost inefficiencies.

- Track FSD Regulatory Progress: Any approval for supervised autonomy in major markets (U.S., EU) would be a catalyst.

- Evaluate New Product Launches: Success of the next-gen platform and affordable model by 2025 is critical.

- Assess Leadership Stability: Watch for changes in executive team or board composition indicating strategic shifts.

- Compare Charging Network Advantage: Tesla’s Supercharger access for non-Tesla EVs may dilute exclusivity unless monetized effectively.

Frequently Asked Questions

Is Tesla still a leader in battery technology?

Yes, Tesla maintains an edge in battery efficiency and energy density, especially with its 4680 cells and dry electrode process. However, CATL, BYD, and Samsung SDI are closing the gap with cheaper, safer chemistries like LFP batteries now widely adopted across the industry.

Can Tesla recover its stock value in 2024?

Recovery is possible if Tesla meets delivery targets, launches the next-gen vehicle successfully, and demonstrates progress on cost reduction. However, given current valuation multiples and competitive pressures, significant upside depends on execution — not just vision.

Why did institutional investors sell Tesla shares?

Many institutions reduced exposure due to governance concerns, concentration risk, and lower relative growth forecasts. ESG funds, in particular, cited poor labor practices and leadership controversies as red flags.

Conclusion: Navigating Uncertainty with Informed Perspective

Tesla’s stock decline isn’t the result of a single failure but a convergence of operational, competitive, and strategic headwinds. While the company retains strengths — including brand loyalty, a robust charging network, and cutting-edge engineering — sustaining investor confidence requires more than innovation theater. It demands reliable execution, disciplined leadership, and adaptability in a rapidly evolving market.

For investors, the path forward means looking beyond headlines and focusing on tangible metrics: delivery trends, margin stability, product cadence, and governance reforms. The EV revolution isn’t slowing down — but Tesla must prove it can remain at the forefront.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?