Inflation isn't just a number reported in financial news—it's a powerful force shaping everyday life. From grocery bills to mortgage rates, inflation quietly influences how far your money goes and how economies function. Understanding its importance helps individuals make smarter financial decisions, businesses plan for the future, and governments maintain economic stability. While moderate inflation is normal, unchecked increases can erode purchasing power and destabilize markets. This article explores why the inflation rate matters, how it affects different aspects of life, and what you can do to respond effectively.

What Inflation Really Means

Inflation refers to the sustained increase in the general price level of goods and services over time. When inflation rises, each unit of currency buys fewer products than before. For example, if inflation is 5% annually, a $100 grocery bill today will cost $105 next year for the same items. Central banks, like the U.S. Federal Reserve or the European Central Bank, typically aim for a target inflation rate—usually around 2%—to encourage spending and investment without triggering runaway prices.

Inflation is measured using indices such as the Consumer Price Index (CPI) or Producer Price Index (PPI), which track changes in the cost of a basket of commonly purchased goods and services. These metrics help policymakers assess economic health and adjust monetary policy accordingly.

“Moderate inflation signals a growing economy, but high or unpredictable inflation undermines confidence and distorts decision-making.” — Dr. Janet Yellen, Former U.S. Treasury Secretary and Federal Reserve Chair

How Inflation Affects Your Purchasing Power

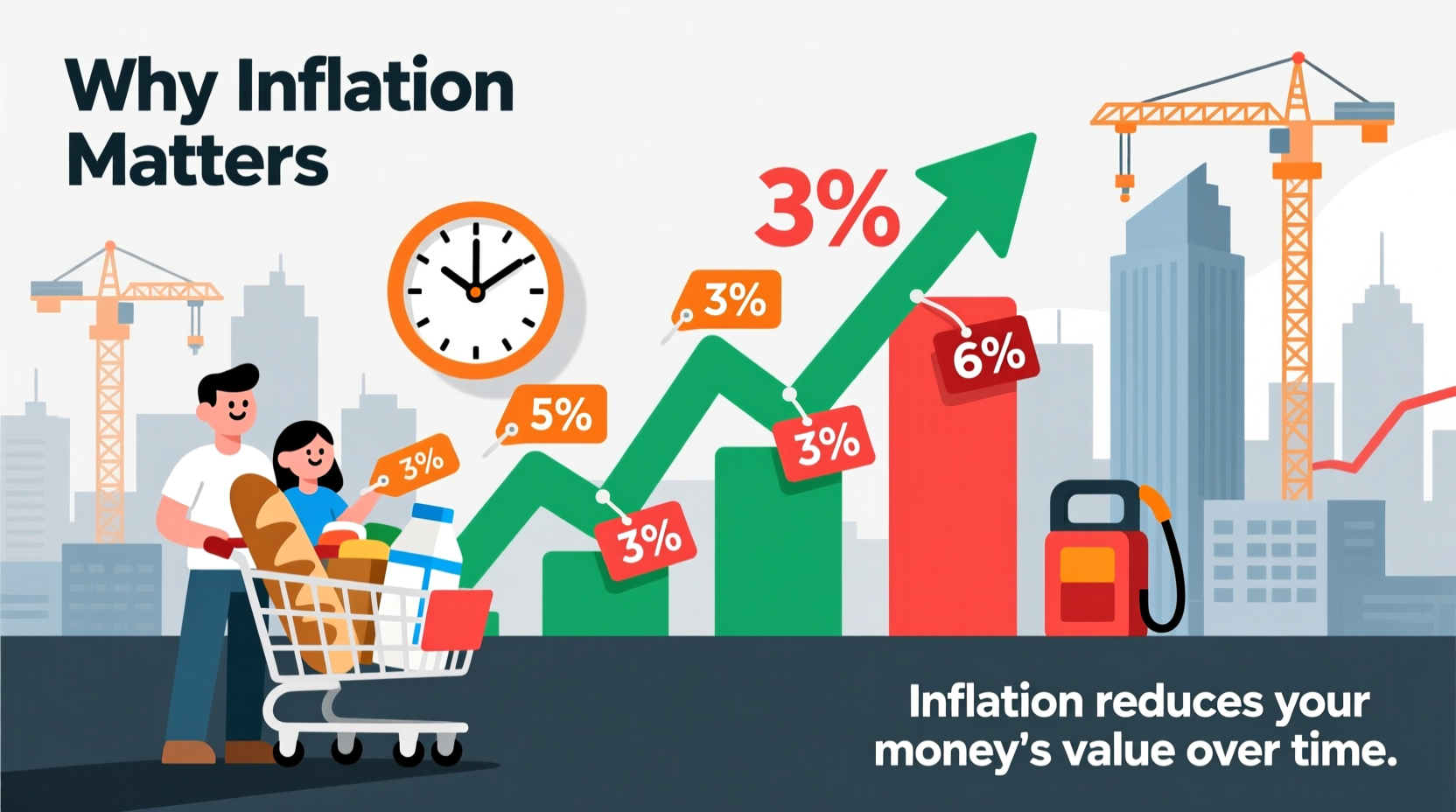

The most direct impact of inflation is on your real income—the actual value of what your money can buy. Even if your salary remains unchanged, rising prices reduce your ability to afford necessities. Over time, persistent inflation can significantly diminish savings, especially if those funds are held in low-interest accounts that don’t keep pace with price increases.

Consider this: if inflation averages 3% per year, the purchasing power of $10,000 will drop to about $7,400 in ten years. That means retirees living on fixed incomes face particular risks, as their pensions may not stretch as far over time.

Economic Stability and Monetary Policy

Central banks monitor inflation closely because it serves as a key indicator of economic balance. Too little inflation—or deflation—can signal weak demand, leading to layoffs and reduced business activity. Conversely, rapid inflation often reflects overheated demand, supply shortages, or excessive money supply growth.

To manage inflation, central banks use tools like interest rate adjustments. Raising interest rates makes borrowing more expensive, which tends to slow consumer spending and business expansion, helping cool down inflation. Lowering rates has the opposite effect, stimulating growth during downturns.

This balancing act is crucial. The Federal Reserve’s dual mandate—to promote maximum employment and stable prices—relies heavily on accurate inflation data. Misjudging inflation trends can lead to policy errors with long-term consequences.

Business Planning and Investment Decisions

For businesses, inflation impacts costs, pricing strategies, and long-term planning. Rising input costs—from raw materials to wages—can squeeze profit margins unless companies pass those increases to consumers. However, frequent price hikes risk losing customers, especially in competitive markets.

In investment, inflation alters asset valuations. Fixed-income investments like bonds lose appeal when inflation rises, since future payments are worth less in real terms. Equities may perform better over time, as companies can raise prices and potentially grow earnings, but volatile inflation complicates forecasting.

| Asset Type | Impact of High Inflation | Strategic Response |

|---|---|---|

| Savings Accounts | Negative – Interest often below inflation | Shift to higher-yield or inflation-linked options |

| Bonds | Negative – Real returns decline | Favor short-term or TIPS (Treasury Inflation-Protected Securities) |

| Stocks | Mixed – Some sectors benefit, others suffer | Focus on pricing power and strong cash flow |

| Real Estate | Generally positive – Property values rise | Consider rental income potential and leverage |

Real-World Example: The 1970s Inflation Crisis

A striking illustration of inflation’s destructive potential occurred in the 1970s, particularly in the United States. Triggered by oil price shocks, wage-price spirals, and loose monetary policy, inflation surged above 13% by 1980. Consumers faced rapidly rising prices for fuel, food, and housing. The Federal Reserve, under Chairman Paul Volcker, responded aggressively by raising interest rates to nearly 20%, plunging the economy into recession but ultimately restoring price stability.

This period taught critical lessons: delayed responses to inflation can deepen crises, and public confidence in currency depends on credible policy. It also highlighted how inflation disproportionately affects lower-income households, who spend a larger share of income on essentials.

Protecting Your Finances Against Inflation

While individuals can’t control national inflation rates, they can take steps to mitigate personal impact. Awareness and proactive planning are essential.

- Invest in assets that outpace inflation: Historically, stocks, real estate, and commodities have provided returns above inflation over the long term.

- Diversify your portfolio: Avoid overreliance on cash or fixed-income instruments vulnerable to erosion.

- Negotiate wages strategically: During high-inflation periods, seek cost-of-living adjustments in employment contracts.

- Reduce high-interest debt: Inflation may benefit borrowers with fixed-rate loans, but variable-rate debt can become more costly if rates rise.

- Monitor spending habits: Track where your money goes and adjust budgets as prices shift.

Frequently Asked Questions

Is inflation always bad?

No. Moderate inflation (around 2%) is generally healthy for an economy. It encourages spending and investment rather than hoarding cash. Problems arise when inflation is too high, too low, or unpredictable.

Who benefits from inflation?

Borrowers with fixed-rate loans benefit because they repay debts with money that’s worth less over time. Governments with large debts may also gain, as inflation reduces the real value of obligations. However, savers and lenders typically lose purchasing power.

How does inflation affect interest rates?

Central banks often raise interest rates to combat high inflation. Higher rates discourage borrowing and spending, slowing demand and reducing upward pressure on prices. Conversely, low inflation may prompt rate cuts to stimulate growth.

Conclusion: Take Control of Your Financial Future

Understanding why the inflation rate is important empowers you to make informed choices—whether you're saving for retirement, investing, or managing household expenses. Inflation isn’t just an abstract economic concept; it directly shapes your financial well-being. By staying informed, adjusting your strategies, and prioritizing inflation-resistant assets, you can protect your wealth and maintain purchasing power over time.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?