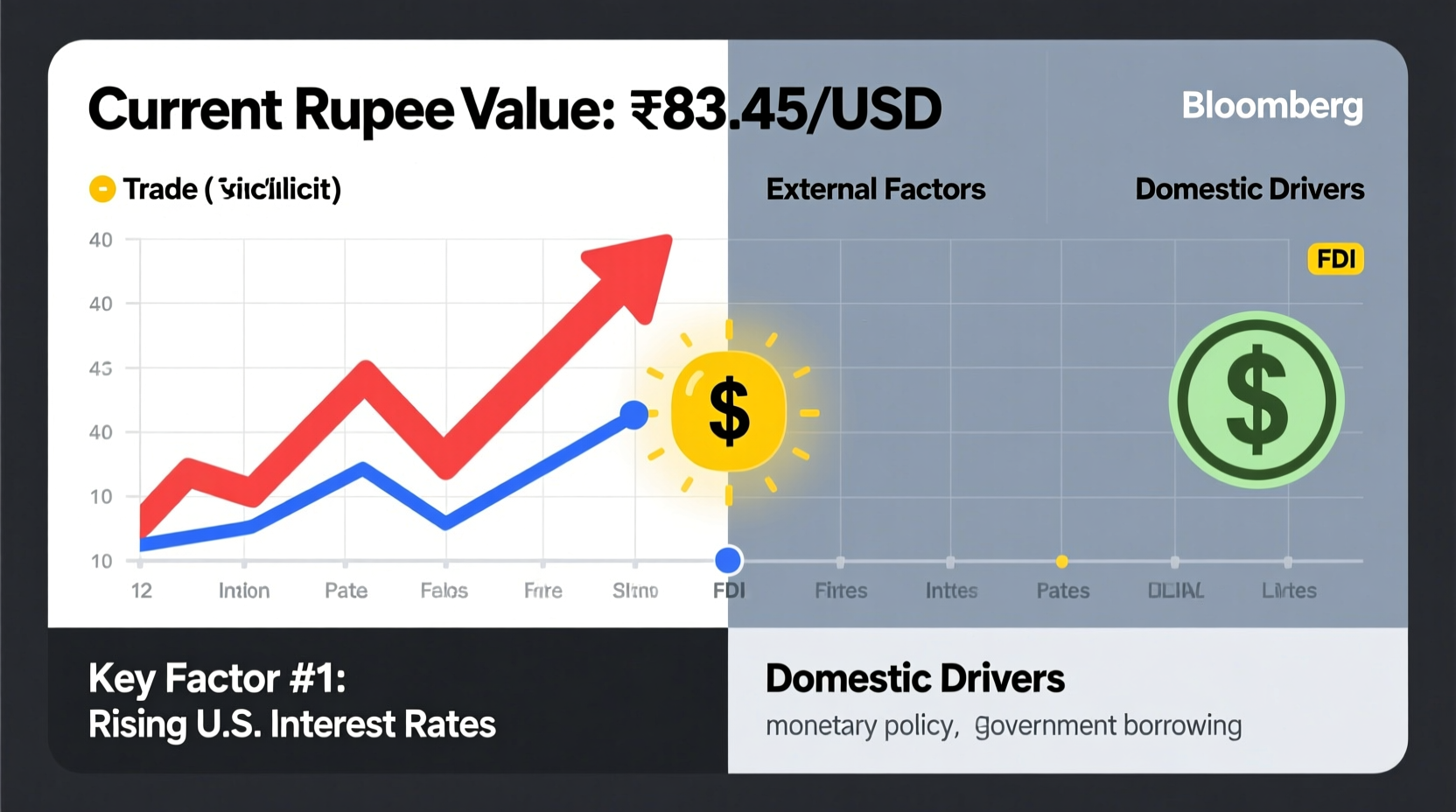

The Indian Rupee (INR) has experienced persistent depreciation against the US Dollar (USD) over recent years, with the exchange rate crossing critical psychological levels like 83 per dollar in 2023. While currency fluctuations are a normal part of global finance, sustained weakening raises concerns for importers, investors, and everyday consumers. Understanding the root causes behind the rupee's decline requires analyzing a mix of domestic and international economic forces. This article breaks down the primary drivers, their interplay, and what they mean for India’s economy.

1. Trade Deficit and Import Dependency

One of the most fundamental reasons for the rupee’s weakening is India’s structural trade imbalance. The country imports significantly more than it exports, particularly in essential commodities such as crude oil, gold, and electronics. When India buys oil from global markets, it pays in US dollars. This creates consistent demand for USD and puts downward pressure on the INR.

In 2023, crude oil alone accounted for nearly $120 billion in imports—over 40% of total import value. With global oil prices influenced by geopolitical tensions and supply constraints, any spike increases the dollar outflow, widening the current account deficit (CAD). A growing CAD signals weaker external balance, which undermines investor confidence in the rupee.

2. US Federal Reserve Policy and Interest Rate Differentials

Global capital flows heavily favor economies offering higher real interest rates. When the US Federal Reserve raises interest rates—as it did aggressively in 2022 and 2023 to combat inflation—US Treasury yields rise. This makes dollar-denominated assets more attractive compared to Indian bonds.

As a result, foreign institutional investors (FIIs) pull money out of Indian markets to invest in safer, higher-yielding US securities. This capital outflow increases demand for USD and reduces demand for INR, directly contributing to depreciation.

The interest rate differential between the US and India plays a crucial role. Even if India raises its repo rate, if US rates rise faster, the gap narrows or reverses, making India less appealing to foreign investors.

“Monetary policy divergence between the Fed and emerging market central banks is often the single biggest trigger for currency volatility.” — Raghuram Rajan, Former Governor, Reserve Bank of India

3. Global Risk Sentiment and Safe-Haven Demand

The US dollar is considered a global safe-haven currency. During times of geopolitical uncertainty—such as the Russia-Ukraine war, Middle East conflicts, or global financial instability—investors rush to protect their capital by buying dollars.

India, as an emerging market, is particularly vulnerable during these risk-off phases. Foreign investors tend to exit equities and debt markets in countries like India, leading to sharp sell-offs and increased selling pressure on the rupee. For example, in early 2022, the rupee fell sharply following Russia’s invasion of Ukraine due to both oil price spikes and global risk aversion.

This dynamic means that even when India’s domestic fundamentals are stable, external sentiment can still drive depreciation.

4. Domestic Inflation and Monetary Policy Constraints

Persistent inflation in India limits the flexibility of the Reserve Bank of India (RBI) to support growth without risking currency stability. High inflation erodes purchasing power and can lead to expectations of further depreciation, creating a self-fulfilling cycle.

If inflation remains above target while the RBI delays tightening, real interest rates fall, discouraging foreign investment. Conversely, aggressive rate hikes can slow economic growth. This balancing act constrains the RBI’s ability to stabilize the rupee without harming other macroeconomic goals.

Key Economic Indicators Influencing INR (2022–2023)

| Indicator | 2022 Value | 2023 Value | Impact on INR |

|---|---|---|---|

| Crude Oil Price (Brent, avg $/barrel) | $99 | $85 | Negative (high import bill) |

| Current Account Deficit (% of GDP) | 2.0% | 1.8% | Moderately negative |

| Foreign Exchange Reserves ($bn) | $560 | $580 | Positive (supports INR) |

| Repo Rate (RBI) | 5.90% | 6.50% | Supportive for INR |

| USD/INR Year-End Average | 81.7 | 82.9 | Rupee depreciation |

5. Capital Flows and Investor Confidence

Sustained foreign investment is vital for maintaining currency strength. India relies on portfolio investments (stocks and bonds) and foreign direct investment (FDI) to finance its deficits. However, in recent years, net FII outflows have been significant during periods of global tightening.

In 2022, FIIs pulled out over ₹2 lakh crore from Indian equity markets—the largest annual outflow in history. This massive capital reversal intensified selling pressure on the rupee. Although FDI inflows remained robust (around $85 billion in FY23), portfolio flows are more volatile and react quickly to global sentiment.

Additionally, global index providers and fund managers reassess country allocations based on macroeconomic stability. Any downgrade in India’s fiscal discipline or governance perception can reduce passive inflows, indirectly affecting the rupee.

Mini Case Study: The 2013 “Taper Tantrum”

In 2013, the mere suggestion by then-Fed Chair Ben Bernanke that the US might reduce its quantitative easing triggered a global market shock. Emerging currencies, including the Indian rupee, plummeted. The INR fell from around 55/USD to nearly 69/USD within months.

At the time, India had high inflation, a large CAD (4.8% of GDP), and weak growth—a combination dubbed the “twin deficit.” The crisis forced the RBI to hike rates and use forex reserves to defend the rupee. It also accelerated reforms, including boosting gold imports control and encouraging diaspora deposits.

This episode illustrates how external triggers can amplify domestic vulnerabilities, leading to rapid currency depreciation.

Actionable Checklist: Monitoring Rupee Health

- Track weekly crude oil prices and inventory reports (EIA data).

- Review RBI’s monthly bulletin for forex reserve changes and intervention trends.

- Monitor FII/DII net investment data from stock exchanges.

- Follow US non-farm payroll and CPI releases for Fed policy clues.

- Watch for geopolitical developments in West Asia and Eastern Europe.

- Check India’s monthly trade balance figures (exports vs. oil imports).

- Assess government fiscal discipline—especially subsidy spending and borrowing.

Frequently Asked Questions

Does a falling rupee always harm the economy?

No. While a weaker rupee increases import costs and inflation, it benefits exporters by making Indian goods cheaper abroad. Sectors like IT, pharmaceuticals, and textiles often gain competitiveness when the rupee depreciates. However, prolonged or sharp falls create uncertainty and hurt long-term planning.

Can the RBI stop the rupee from falling?

The RBI can temporarily stabilize the rupee by selling USD from its foreign exchange reserves or conducting \"calibrated interventions.\" However, it cannot override market fundamentals indefinitely. If underlying issues like high oil prices or capital outflows persist, intervention only delays adjustment. As of 2023, India holds over $580 billion in reserves—ample buffer, but not infinite.

Is the rupee undervalued or overvalued?

According to IMF assessments, the rupee was broadly aligned with fundamentals in 2023. Some models suggest slight undervaluation, but this depends on assumptions about productivity, trade openness, and capital mobility. Currency valuation isn't absolute—it reflects relative economic performance.

Conclusion: Navigating the Future of INR

The rupee’s movement against the dollar is not driven by a single factor but by a complex web of global monetary policy, commodity prices, investor psychology, and domestic economic management. While short-term fluctuations are inevitable, long-term stability hinges on reducing import dependence, boosting export competitiveness, maintaining prudent fiscal policy, and attracting sustainable foreign investment.

For businesses, investors, and policymakers, understanding these dynamics is essential for risk management and strategic planning. Rather than fearing depreciation, the focus should be on building resilience—through diversification, hedging, and structural reforms.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?