Tariffs—taxes imposed on imported goods—are among the most debated tools in economic policy. While often criticized for increasing consumer prices and provoking trade conflicts, tariffs can also serve strategic national interests. When applied thoughtfully, they protect emerging industries, correct trade imbalances, and generate government revenue. However, their long-term effects depend heavily on design, context, and global response. Understanding both the advantages and drawbacks is essential for evaluating whether a tariff does more harm than good.

The Economic Rationale Behind Tariffs

At their core, tariffs alter the price dynamics of international trade. By making foreign goods more expensive, they aim to level the playing field for domestic producers competing against lower-cost imports. This mechanism can be especially useful in economies where certain industries are still developing or face unfair competition due to subsidies abroad.

One foundational argument for tariffs comes from economist Alexander Hamilton, who advocated for \"infant industry protection\" in the 18th century. His idea was simple: new industries need temporary shelter from dominant foreign competitors to grow, innovate, and eventually compete globally. Countries like South Korea and Japan used this strategy effectively during their industrialization phases.

“Protection in the early stages of development allows innovation and investment to take root without being crushed by established foreign firms.” — Dr. Linda Chen, Trade Economist at Georgetown University

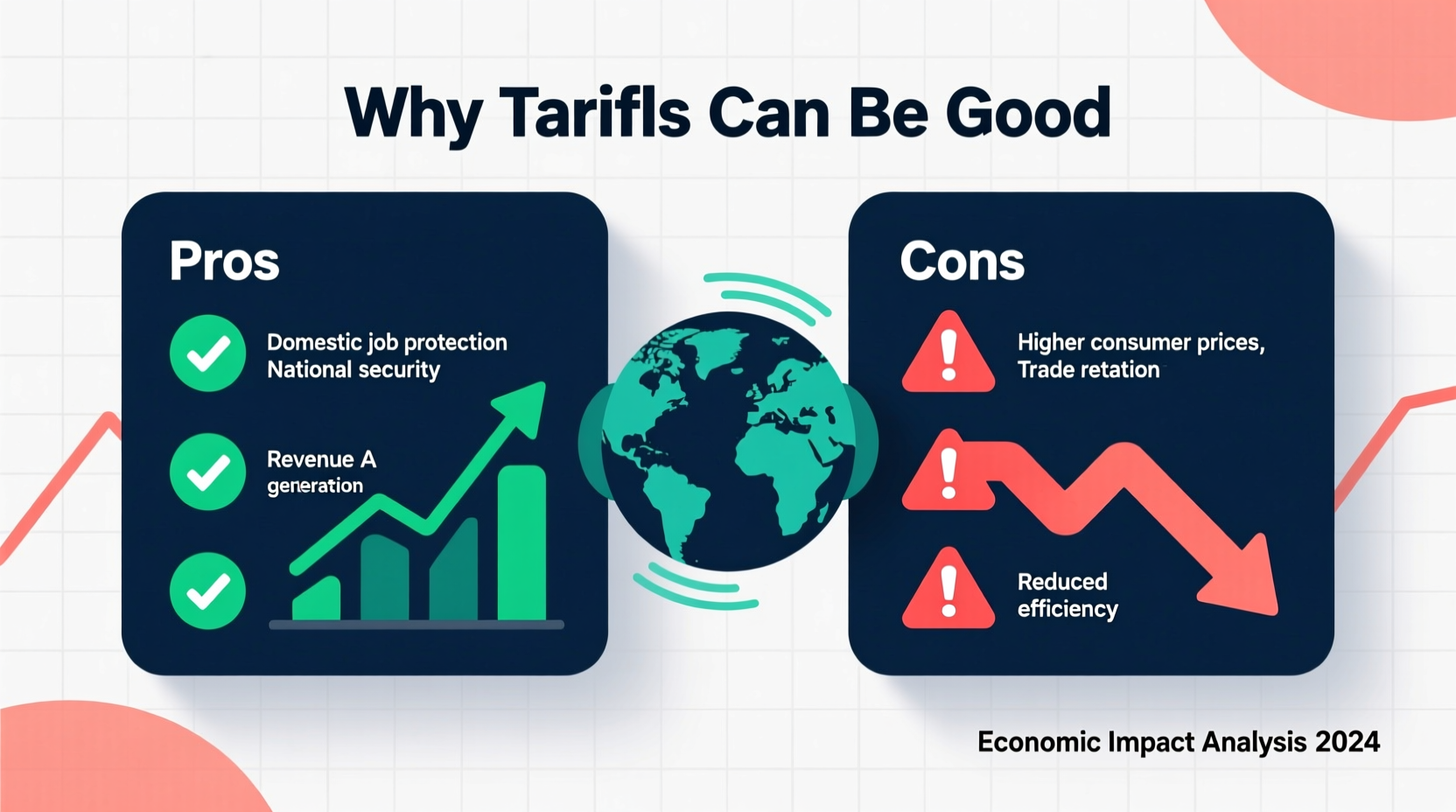

Pros of Tariffs: When They Can Be Beneficial

- Protect Domestic Jobs: Tariffs can shield labor-intensive sectors such as manufacturing, steel, and agriculture from cheap foreign labor, helping preserve employment in key regions.

- Encourage Local Production: Higher import costs incentivize companies to produce locally, strengthening supply chains and reducing dependency on foreign nations.

- Generate Government Revenue: In developing countries with limited tax bases, tariffs remain a significant source of public income.

- Address Unfair Trade Practices: Tariffs can counteract dumping (selling below cost) or state-subsidized exports that distort markets.

- National Security Considerations: Strategic industries like semiconductors, defense, and energy may warrant protection to ensure self-reliance during crises.

Cons of Tariffs: The Hidden Costs

While the intent behind tariffs may be sound, their consequences are rarely isolated. Economists widely agree that tariffs function as a form of taxation—ultimately paid not by foreign exporters, but by domestic consumers and businesses that rely on imported inputs.

For example, a tariff on steel raises costs for automakers, construction firms, and appliance manufacturers. These increased expenses are often passed down through higher prices, contributing to inflation. Additionally, trading partners frequently retaliate, imposing their own tariffs on exported goods, which harms farmers, tech firms, and service providers abroad.

Historical evidence underscores these risks. The Smoot-Hawley Tariff Act of 1930 raised U.S. tariffs on over 20,000 goods, triggering global retaliation and worsening the Great Depression. Modern analyses estimate it reduced world trade by a third between 1929 and 1732.

Common Negative Effects Include:

- Rising consumer prices for everyday goods

- Reduced efficiency and innovation due to lack of competition

- Supply chain disruptions

- Retaliatory measures affecting export sectors

- Increased risk of trade wars that destabilize markets

Case Study: Solar Panel Tariffs in the United States

In 2018, the U.S. imposed a 30% tariff on imported solar panels, aiming to revive domestic manufacturing. At the time, American producers argued they couldn't compete with low-cost Chinese and Southeast Asian manufacturers benefiting from state support.

The policy did lead to some new factory investments. However, the broader solar industry—particularly installers and developers—faced rising equipment costs. According to the Solar Energy Industries Association, thousands of installation jobs were lost or delayed as project costs climbed and demand softened.

The result was mixed: while a few domestic producers benefited, the downstream sector suffered. Ultimately, the overall growth of renewable energy slowed temporarily, demonstrating how targeted protection can have unintended ripple effects across an ecosystem.

Comparative Impact: Pros vs. Cons at a Glance

| Aspect | Positive Impact (Pros) | Negative Impact (Cons) |

|---|---|---|

| Domestic Industry | Shields emerging or struggling sectors | May foster inefficiency and reduce innovation |

| Employment | Preserves jobs in protected industries | Costs jobs in import-dependent sectors |

| Consumer Prices | Limited direct benefit | Increases prices on goods and services |

| Government Revenue | Generates income, especially in developing nations | Can decrease if trade volume drops significantly |

| Trade Relations | Can enforce fair trade rules | Risks retaliation and diplomatic tension |

When Are Tariffs Most Effective?

Tariffs tend to succeed under specific conditions:

- Temporary and Targeted: Applied for a defined period to support strategic industries with measurable milestones.

- Paired with Investment: Accompanied by funding for R&D, workforce training, and infrastructure to build real competitiveness.

- Used Against Proven Unfair Practices: Justified by WTO-recognized issues like dumping or illegal subsidies.

- Part of Broader Strategy: Integrated into comprehensive industrial or trade policy rather than used unilaterally.

Prolonged or broad-based tariffs, especially those driven by political motives rather than economic analysis, tend to do more harm than good. The key lies in balance—protection without isolation, strength without provocation.

Frequently Asked Questions

Do tariffs really protect jobs?

They can protect jobs in specific industries, such as steel or textiles, but often at the expense of job losses elsewhere in the economy. For instance, higher material costs may force manufacturers to cut production or lay off workers. Studies show the net effect on employment is often neutral or negative.

Who actually pays for tariffs?

Despite political rhetoric, foreign exporters typically do not absorb the cost. Instead, U.S. importers and consumers bear the burden through higher prices. Research from the Federal Reserve and NBER confirms that nearly all tariff costs are passed on domestically.

Can tariffs improve a country’s trade balance?

Not necessarily. While tariffs reduce imports initially, they often trigger retaliatory measures that hurt exports. Moreover, a stronger currency or high domestic demand can offset any gains. The U.S. trade deficit, for example, widened after the 2018–2019 tariff hikes despite the aggressive trade stance.

Conclusion: A Tool, Not a Solution

Tariffs are not inherently good or bad—they are tools whose value depends on how and why they’re used. In rare cases, they can defend national interests, nurture innovation, and correct market distortions. But when deployed broadly or indefinitely, they risk inflating prices, damaging alliances, and weakening economic resilience.

The most effective trade policies combine selective protection with openness, enforcement with diplomacy, and short-term safeguards with long-term competitiveness strategies. Rather than viewing tariffs as a cure-all, policymakers—and citizens—should assess them critically: Do they solve a real problem? Are there less costly alternatives? What are the second-order effects?

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?