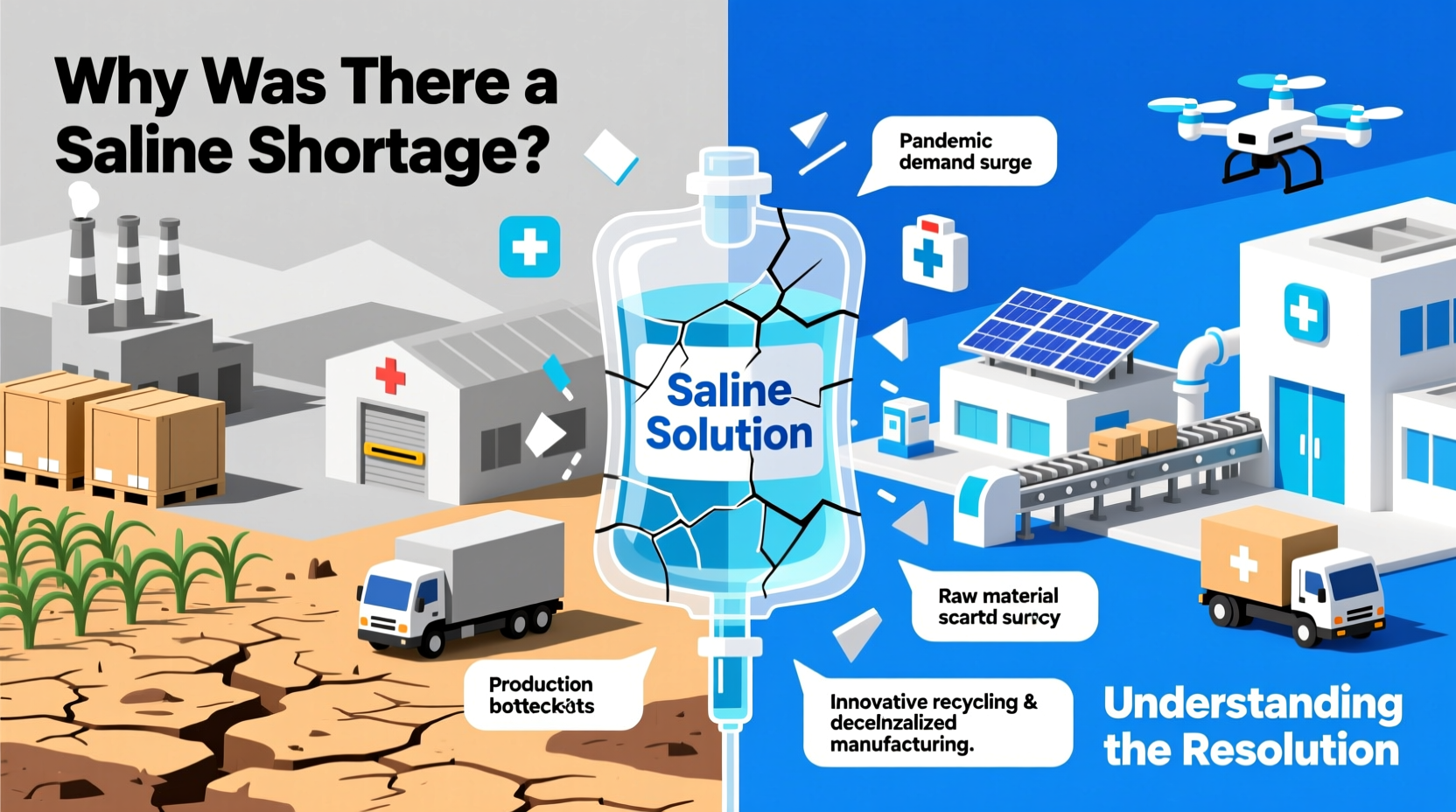

In late 2018 and into 2019, hospitals across the United States faced an unexpected disruption in one of the most fundamental tools of modern medicine: intravenous (IV) saline solution. What many assumed would be a minor blip turned into a months-long national crisis affecting emergency rooms, operating rooms, and outpatient clinics alike. The shortage forced clinicians to ration care, modify treatment protocols, and search for alternatives—raising urgent questions about the fragility of the medical supply chain. This article explores the root causes of the saline shortage, how healthcare systems adapted, and the long-term changes implemented to prevent recurrence.

The Role of Saline in Modern Medicine

Sodium chloride 0.9% solution, commonly known as normal saline, is far more than just saltwater. It is a cornerstone of clinical care used for hydration, medication delivery, blood transfusions, dialysis, and wound irrigation. Its widespread use—administered to millions of patients daily—makes it one of the most essential fluids in hospitals. Because it’s inexpensive and has a short shelf life, saline bags are typically ordered in high volume with minimal surplus. This lean inventory model works under normal conditions but leaves little room for disruption when supply falters.

Before the shortage, few outside the pharmaceutical industry considered saline a product vulnerable to scarcity. Yet its production relies on a complex network involving raw materials, specialized manufacturing facilities, sterilization processes, and precise distribution logistics—all of which proved susceptible to breakdowns.

Root Causes of the Shortage

The saline shortage wasn’t caused by a single event but by a cascade of interrelated factors that converged in 2018:

- Hurricane Maria’s impact on Puerto Rico: In September 2017, the Category 5 hurricane devastated Puerto Rico’s infrastructure, including power and transportation networks. Baxter International, which produces nearly half of the U.S. supply of IV fluids at plants on the island, suspended operations for weeks. Even after power was restored, requalifying sterile manufacturing lines took months due to strict FDA regulations.

- Concentrated market dependence: The U.S. relies heavily on a small number of manufacturers for generic IV solutions. At the time, three companies—Baxter, B. Braun, and Hospira (a Pfizer subsidiary)—supplied over 90% of saline. When one major player faced delays, the others couldn’t scale up quickly enough to compensate.

- Manufacturing quality issues: Even before the hurricane, several facilities had been cited by the FDA for sterility violations or packaging defects. These ongoing compliance challenges limited production capacity and reduced confidence in alternative suppliers.

- Limited domestic production redundancy: Most saline production was centralized in Puerto Rico and parts of the mainland with aging facilities. There were no immediate surge-capable plants ready to ramp up output during emergencies.

How Hospitals Responded: Crisis Management in Real Time

Faced with dwindling supplies, hospitals had to act swiftly. The American Society of Health-System Pharmacists (ASHP) classified the saline shortage as “critical,” prompting emergency measures nationwide. Healthcare providers adopted conservation strategies such as:

- Switching from IV hydration to oral rehydration when clinically appropriate.

- Using smaller bag sizes (e.g., 250 mL instead of 1,000 mL) to stretch available stock.

- Substituting lactated Ringer’s solution where compatible with medications.

- Repackaging large bags into multiple doses under sterile conditions—a practice allowed only under emergency compounding guidelines.

- Prioritizing saline for critical procedures like surgery and trauma care.

Pharmacy teams worked around the clock to track inventory, coordinate with distributors, and communicate with clinicians. Some hospitals reported using saline substitutes in over 30% of cases during peak shortage periods.

Mini Case Study: Regional Hospital Network Adapts

A midwestern hospital system serving over 20 facilities began experiencing saline delays in November 2018. Within two weeks, their central pharmacy initiated a tiered allocation protocol. Non-urgent infusions were rescheduled, and nurses were trained to minimize waste during line flushes. They also partnered with a nearby academic medical center to share best practices and alternate fluid formulations. By January 2019, they had reduced saline usage by 40% without compromising patient outcomes. Their experience became a model shared through the ASHP’s national advisory network.

Resolution and Regulatory Response

The shortage began easing in mid-2019 as Baxter resumed full production and the FDA expedited approvals for temporary importation and expanded manufacturing shifts. However, the resolution involved more than just restoring output—it required systemic changes.

The FDA launched the Drug Shortages Task Force in 2019 to identify vulnerabilities in the pharmaceutical supply chain. One key finding was that economic incentives often discourage investment in generic sterile injectables, which have low profit margins despite high clinical value.

“We need a supply chain that’s resilient, not just efficient. Redundancy may cost more upfront, but it prevents chaos during crises.” — Dr. Janet Woodcock, Former Director, FDA Center for Drug Evaluation and Research

Key Actions Taken to Restore Supply

| Action | Description | Impact |

|---|---|---|

| Expedited Inspections | FDA fast-tracked plant inspections and process validations | Reduced downtime at affected facilities by 30–50% |

| Temporary Imports | Approved saline from international Baxter sites | Bridged gap during recovery phase |

| Production Expansion | B. Braun increased output at Pennsylvania facility | Added 20 million bags annually to U.S. supply |

| Strategic Reserve Planning | HHS explored stockpiling critical generics | Still under development; pilot programs underway |

Preventing Future Shortages: A Checklist for Resilience

To avoid repeating this crisis, stakeholders across healthcare must adopt proactive measures. The following checklist outlines essential steps for institutions, regulators, and manufacturers:

- ✅ Diversify suppliers: Avoid reliance on single-source vendors for critical items.

- ✅ Invest in domestic manufacturing: Support policies that incentivize U.S.-based production of essential generics.

- ✅ Improve transparency: Require early reporting of potential disruptions from manufacturers.

- ✅ Build buffer stocks: Maintain modest emergency reserves of high-use, low-cost items like saline.

- ✅ Enhance monitoring systems: Use real-time data analytics to predict shortages before they escalate.

- ✅ Train staff in contingency protocols: Ensure clinicians know alternative treatments and conservation techniques.

FAQ

Is the saline shortage completely over?

Yes, the widespread shortage ended by late 2019. However, sporadic, localized shortages can still occur due to seasonal demand spikes or isolated production issues. The system is more resilient now, but vigilance remains necessary.

Why don’t we just make more saline in the U.S.?

We can—but building new sterile manufacturing facilities is expensive and highly regulated. Without guaranteed returns, companies hesitate to invest. Policy reforms are needed to support domestic production of essential medicines.

Can other fluids replace saline completely?

No. While alternatives like lactated Ringer’s exist, they aren’t suitable for all patients or medications. Saline remains the safest option for certain conditions, including hyperkalemia and during rapid fluid resuscitation.

Conclusion: Building a More Secure Medical Supply Chain

The saline shortage was a wake-up call. It revealed how deeply dependent modern healthcare is on a fragile, just-in-time supply model that prioritizes efficiency over resilience. While the immediate crisis has passed, the lessons remain urgent. From hospitals adjusting clinical workflows to federal agencies rethinking drug security, the response has sparked meaningful change. But sustained progress requires ongoing commitment—investment in infrastructure, smarter inventory planning, and stronger collaboration between public and private sectors.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?