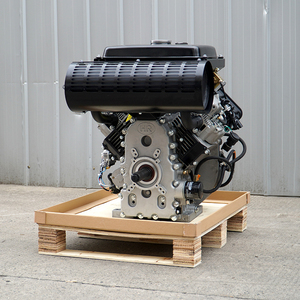

2 Types Of Engines

About 2 types of engines

Where to Find Suppliers for 2 Types of Engines?

China remains the central hub for engine manufacturing, with key production clusters in Chongqing, Changzhou, and Jinhua enabling specialized output across gasoline and diesel platforms. These regions host vertically integrated facilities capable of producing both single-cylinder and twin-cylinder internal combustion engines, serving applications in agricultural machinery, power generation, construction equipment, and industrial pumps. The concentration of component suppliers—ranging from piston manufacturers to fuel injection system providers—within 50km radii supports rapid prototyping and scalable production.

Suppliers in this sector benefit from localized supply chains that reduce material costs by 18–25% compared to non-Asian counterparts. Average lead times for standard orders range from 25 to 40 days, with established exporters offering just-in-time delivery models supported by containerized logistics networks. Buyers gain access to modular engine designs adaptable to OEM integration, particularly in off-road machinery and portable generator sets.

How to Choose Suppliers for 2 Types of Engines?

Effective supplier selection requires a structured evaluation based on technical capability, compliance, and transactional reliability:

Technical & Quality Compliance

Verify adherence to international performance benchmarks such as ISO 9001 for quality management systems. For diesel-powered units, confirm emissions compliance with Tier II or equivalent standards where applicable. Request test reports covering thermal efficiency, vibration tolerance, and durability under continuous load (e.g., 500-hour endurance tests). CE marking is recommended for European market entry.

Production Capacity Assessment

Evaluate core operational metrics:

- Minimum factory area exceeding 3,000m² for sustained volume output

- In-house machining capabilities including CNC cylinder boring, crankshaft grinding, and head milling

- Assembly lines equipped for both air-cooled and OHV (overhead valve) configurations

Cross-reference declared monthly capacity with on-time delivery rates; prioritize suppliers maintaining ≥95% fulfillment consistency.

Procurement Safeguards

Utilize secure payment mechanisms such as trade assurance or escrow services until product inspection is completed. Analyze reorder rates as an indicator of post-sale satisfaction—values above 30% suggest strong reliability and service support. Conduct sample testing to validate claimed horsepower, fuel consumption, and shaft alignment before scaling orders.

What Are the Leading Suppliers for 2 Types of Engines?

| Company Name | Location | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options | Min. Order Quantity | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Shanghai Client Diesel Engine Co., Ltd. | Shanghai, CN | US $1,800,000+ | 96% | ≤9h | 33% | Diesel/petrol variants, turbocharged, gearbox coupling, color, dimensions | 1 set | $200–5,000 |

| Changzhou Hi-Earns Mechanical And Electrical Co., Ltd. | Changzhou, CN | US $620,000+ | 100% | ≤1h | 17% | Shaft type, starter motor, keyway, power output, logo | 1–5 pieces | $338–1,070 |

| Chongqing Telijing Technology Co., Ltd. | Chongqing, CN | US $180,000+ | 95% | ≤2h | 19% | Fuel type, shaft size, emission parameters, generator coupling, color | 1–5 sets | $33.99–795 |

| Jinhua Damyo Machinery Co., Ltd. | Jinhua, CN | US $200,000+ | 100% | ≤3h | <15% | Color, material, packaging, labeling, graphic design | 5–20 sets | $791–907 |

| Chongqing Fullas Industry Co., Ltd. | Chongqing, CN | US $70,000+ | 100% | ≤3h | 40% | Limited customization per listed models | 10–12 pieces | $430–900 |

Performance Analysis

Shanghai Client Diesel Engine stands out with the highest online revenue and broadest price flexibility, accommodating both budget and high-power demands ($200–5,000), though response times lag behind peers. Changzhou Hi-Earns excels in responsiveness (≤1h) and perfect on-time delivery, ideal for time-sensitive procurement. Chongqing Fullas demonstrates the strongest customer retention (40% reorder rate), indicating reliable post-sale performance despite mid-tier output volume. Jinhua Damyo and Chongqing Telijing offer robust customization for integration into pumps, generators, and industrial drives, albeit with higher MOQ thresholds (5–20 sets). Buyers seeking low-volume trials should prioritize suppliers with 1-set minimums and sub-$100 starting points for single-cylinder units.

FAQs

What are the common engine types available from these suppliers?

The primary configurations include single-cylinder and twin-cylinder (V-twin or inline) four-stroke engines, available in both gasoline and diesel variants. Air-cooled OHV designs dominate for portability and simplicity, while select models feature electric starters, fuel injection (EFI), and vertical/horizontal shaft outputs.

What is the typical minimum order quantity?

MOQs vary from 1 set for entry-level single-cylinder engines to 20 sets for industrial-grade diesel units. High-volume orders often unlock pricing tiers and enhanced customization options.

Can suppliers customize engines for OEM integration?

Yes, leading suppliers offer configuration adjustments including shaft dimensions, mounting brackets, fuel systems, color coding, branding, and emissions tuning. Technical drawings and 3D models are typically provided within 72 hours of inquiry.

How long does production and shipping take?

Manufacturing lead time averages 30 days for standard orders. Air freight delivers samples in 7–10 days; sea freight for bulk shipments requires 25–35 days depending on destination port and customs processing.

Do suppliers provide warranties and after-sales support?

Most offer 12-month warranties covering defects in materials and workmanship. Reputable vendors provide technical documentation, spare parts availability, and remote troubleshooting. On-site service may be arranged for large contracts or regional distributors.