2 Way Amplifier Module Supplier

TW

TW

1/39

1/39

1/30

1/30

1/31

1/31

1/31

1/31

1/40

1/40

1/27

1/27

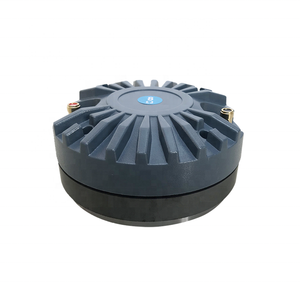

About 2 way amplifier module supplier

Where to Find 2 Way Amplifier Module Suppliers?

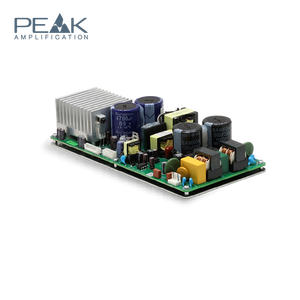

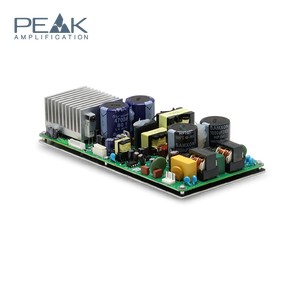

China remains the central hub for 2 way amplifier module manufacturing, with key production clusters in Guangdong and Zhejiang provinces. These regions host specialized electronics manufacturers that integrate design, component sourcing, and surface-mount technology (SMT) assembly under one roof. Guangzhou and Foshan in Guangdong province are particularly notable for their concentration of audio equipment producers, offering scalable solutions from low-power modules to high-efficiency Class D amplifiers exceeding 4000W output.

The industrial ecosystem supports rapid prototyping and volume production through vertically integrated supply chains. Many suppliers operate in facilities equipped with automated PCB mounting lines and anechoic testing chambers, enabling consistent performance validation. Buyers benefit from localized access to magnetic components, heat sinks, and power transistors, reducing material lead times by up to 40%. Typical production cycles range from 15–30 days for standard orders, with MOQs as low as 1–2 units for sample evaluation and scaling to thousands for OEM contracts.

How to Choose 2 Way Amplifier Module Suppliers?

Selecting reliable partners requires structured due diligence across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm expertise in Class D, DSP-controlled, or analog amplifier topologies based on application needs. Review product specifications for signal-to-noise ratio (>85dB), total harmonic distortion (<0.1%), and thermal management design. Suppliers should provide test reports for output stability under varying impedance loads (4Ω–8Ω). For commercial installations, verify support for 70V/100V line configurations.

Production Infrastructure Assessment

Evaluate supplier capacity using these benchmarks:

- Minimum 3,000m² factory area with dedicated SMT and aging test lines

- In-house R&D teams capable of custom firmware development for DSP modules

- Automated optical inspection (AOI) and burn-in testing procedures

Cross-reference online revenue data and on-time delivery rates (target ≥90%) to assess operational reliability.

Quality & Transaction Assurance

Prioritize suppliers adhering to ISO 9001 standards and component-level compliance with RoHS and CE directives. Use secure payment mechanisms where funds are held until post-delivery verification. Conduct sample testing for long-term durability, especially under continuous full-load operation. Request BOM traceability for critical ICs such as TI, Infineon, or Analog Devices to avoid counterfeit components.

What Are the Best 2 Way Amplifier Module Suppliers?

| Company Name | Location | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order | Price Range (USD) | Key Product Features |

|---|---|---|---|---|---|---|---|---|

| Guangzhou Wepal Technology Co., Ltd. | Guangzhou, CN | US $50,000+ | 66% | ≤8h | 25% | 1–2 pcs | $55–555 | 70V/100V mixer amps, wall-mounted, compact zone control |

| Guangzhou Suiyu Technology Co., Ltd. | Guangzhou, CN | US $130,000+ | 93% | ≤10h | <15% | 1–2 units | $220–419 | High-power (up to 3000W), DSP-enabled, multi-channel modules |

| Guangdong Chuanqi Technology Co., Ltd. | Guangdong, CN | US $70,000+ | 90% | ≤1h | 15% | 2–100 pcs | $44–96 | Cost-effective UDA600/PAL750 series, Bluetooth integration |

| Foshan Yinchi Electronics Co., Ltd. | Foshan, CN | US $40,000+ | 82% | ≤12h | 23% | 1–2 pcs | $20–320 | DSP control plates, wide power range (100W–2000W) |

| Ningbo Shengchuang Electronic Co., Ltd. | Ningbo, CN | US $30,000+ | 69% | ≤16h | <15% | 1 pc | $47–120 | DSP-class modules, monoblock mixers, high-wattage designs |

Performance Analysis

Guangzhou Suiyu leads in delivery consistency (93%) and high-power module offerings, making it suitable for professional audio integrators requiring robust DSP amplification. Guangdong Chuanqi stands out for responsiveness (≤1h) and competitive pricing on mid-tier 2-way modules, ideal for cost-sensitive bulk procurement. Foshan Yinchi offers broad product flexibility with pricing starting at $20, though response times lag behind top-tier performers. Ningbo Shengchuang provides advanced DSP and monoblock solutions but has lower reorder rates, suggesting potential gaps in after-sales service. Buyers seeking high-volume reliability should prioritize suppliers with on-time delivery above 90% and proven experience in export logistics for sensitive electronic goods.

FAQs

How to verify 2 way amplifier module supplier quality?

Request detailed technical documentation including schematic overviews, thermal derating curves, and protection circuit descriptions (over-voltage, short-circuit, thermal shutdown). Validate compliance with CE, RoHS, and FCC standards through official test reports. Conduct independent lab testing on received samples for frequency response accuracy and power output consistency.

What is the typical lead time for amplifier module samples?

Standard sample production takes 7–14 days. Customized modules with DSP programming or unique form factors may require 20–25 days. Add 5–10 days for international express shipping. High-volume production timelines range from 25–35 days depending on order size and component availability.

Can suppliers accommodate OEM/ODM requests?

Yes, most listed suppliers support OEM branding (custom labels, packaging) and ODM modifications (PCB layout changes, firmware tuning). Minimum thresholds typically start at 500 units for full customization. Confirm tooling costs and NRE fees before prototype development.

Do suppliers offer free samples?

Sample policies vary: some suppliers offer paid samples refundable against future orders, while others charge full cost for initial evaluation units. Free samples are generally reserved for buyers with established purchasing intent or projected annual volumes exceeding 1,000 units.

What are common MOQ and pricing structures?

MOQ ranges from 1 piece for evaluation to 20+ pieces for discounted bulk pricing. Unit costs decrease significantly at higher volumes—e.g., UDA600 modules drop from $54.45 (20 pcs) to $44.55 (100 pcs). Negotiate tiered pricing based on forecasted annual demand to optimize per-unit costs.