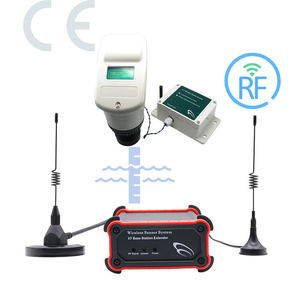

A Large Factory Is Monitoring Machine With Digital Sensor

1/17

1/17

1/11

1/11

1/11

1/11

CN

CN

1/5

1/5

1/9

1/9

About a large factory is monitoring machine with digital sensor

Where to Find Large Factory Monitoring Machines with Digital Sensors?

China remains the central hub for industrial monitoring systems, with specialized manufacturing clusters in Beijing, Shandong, and Anhui provinces driving innovation and production efficiency. Beijing-based suppliers leverage proximity to research institutions and advanced electronics R&D centers, enabling integration of high-precision digital sensors into scalable monitoring platforms. Coastal regions like Weihai in Shandong benefit from established supply chains for environmental testing equipment and IoT components, reducing component lead times by 20–30% compared to inland counterparts.

These regional ecosystems support vertically integrated production—from sensor calibration labs to final system assembly—allowing suppliers to maintain tight quality control and rapid prototyping cycles. Buyers gain access to facilities equipped with automated testing benches and cloud-connected diagnostics, ensuring product reliability under industrial conditions. Key advantages include MOQ flexibility (as low as 1 piece), customization at scale, and average delivery timelines of 15–30 days for standard configurations. Localization of sensor fabrication and firmware development further enables cost reductions of 18–25% versus Western manufacturers.

How to Choose Suppliers for Large-Scale Digital Monitoring Systems?

Selecting reliable partners requires a structured evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm that suppliers integrate certified digital sensors compliant with IEC 61000-4 (EMC) and ISO/IEC 17025 testing standards. For deployment in regulated environments (e.g., environmental monitoring or industrial safety), verify CE marking and RoHS compliance. Request validation reports for sensor accuracy—such as ±0.5% FS for pressure or DO measurements—and data transmission protocols (Modbus RTU, 4G LTE-M, LoRaWAN).

Production Infrastructure Assessment

Evaluate core manufacturing attributes:

- Own production lines with in-house PCB assembly and firmware programming

- Dedicated quality testing stations for long-duration burn-in and environmental stress screening

- Customization capacity for enclosure materials (IP65/IP67-rated ABS or stainless steel), labeling, and UI localization

Cross-reference on-time delivery performance (target ≥96%) and response time (≤2 hours) as proxies for operational maturity.

Procurement Risk Mitigation

Prioritize suppliers offering third-party inspection options prior to shipment. Analyze reorder rates as an indicator of post-sale satisfaction—rates above 30% suggest strong product reliability and service support. Conduct sample testing to validate real-world sensor responsiveness and system uptime under continuous operation. Use incremental order scaling (sample → pilot batch → bulk) to assess consistency before full deployment.

What Are the Leading Suppliers of Large Factory Monitoring Machines with Digital Sensors?

| Company Name | Location | Main Products | Customization Options | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate | Verified Status |

|---|---|---|---|---|---|---|---|---|

| Beijing Zetron Technology Co., Ltd. | Beijing, CN | Digital analyzers, environmental monitoring systems | Color, material, size, logo, packaging, label, graphic | 96% | ≤3h | US $250,000+ | 30% | Multispecialty Supplier |

| Weihai Gemho Digital Mine Technology Co., Ltd. | Weihai, CN | Environmental sensors, gas analyzers, soil testers, weather stations | Not specified | 98% | ≤2h | US $20,000+ | <15% | - |

| Anhui Ya Tun Iot Technology Co., Ltd. | Anhui, CN | IoT agricultural monitors, wireless greenhouse systems, all-in-one environmental sensors | Not specified | 92% | ≤2h | US $40,000+ | <15% | - |

| Shijiazhuang Glit Electronic Technology Co., Ltd. | Hebei, CN | Inclinometers, slope monitoring systems, large-screen visualization systems | Color, material, size, logo, packaging, label, graphic | 100% | ≤1h | US $40,000+ | <15% | Multispecialty Supplier |

| Huan Dian Intelligent Control Technology (Guangdong) Co., Ltd. | Guangdong, CN | Industrial voltage monitors, resistance monitoring devices, welding process analyzers | Not specified | 100% | ≤1h | US $1,000+ | - | - |

Performance Analysis

Beijing Zetron stands out with the highest reorder rate (30%) and substantial online revenue, indicating strong market acceptance and repeat business—key indicators of product durability and customer service. Shijiazhuang Glit and Huan Dian achieve perfect on-time delivery records (100%) and sub-1-hour response times, reflecting robust internal coordination and order prioritization. While Anhui Ya Tun and Weihai Gemho focus on environmental and agricultural IoT applications, their lower reorder rates suggest room for improvement in post-sale engagement or long-term reliability. Suppliers with verified status and customization capabilities offer greater flexibility for enterprise deployments requiring branded interfaces or site-specific enclosures.

FAQs

How to verify the accuracy of digital sensors in monitoring machines?

Request calibration certificates traceable to NIST or CNAS standards. Conduct side-by-side benchmarking against reference instruments for parameters like dissolved oxygen, temperature drift, or electrical load stability. Verify factory test logs showing 72-hour continuous operation without signal degradation.

What is the typical lead time for customized monitoring systems?

Standard units ship within 15–20 days. Custom configurations involving unique sensor arrays or communication protocols require 25–35 days, including design validation and pre-production sampling.

Can these monitoring machines be integrated into existing SCADA or IIoT platforms?

Yes, most suppliers support Modbus, MQTT, or OPC UA protocols for seamless integration. Confirm API availability and data polling frequency (e.g., 1-second intervals) during technical due diligence.

Do suppliers offer OEM/ODM services for industrial monitoring equipment?

Multiple suppliers—including Beijing Zetron and Shijiazhuang Glit—explicitly list logo, packaging, and graphic customization, confirming established OEM workflows. Minimum order volumes for branding typically start at 10 units.

What are common power and connectivity options for large-scale monitoring installations?

Units commonly support 12–24V DC or 110–220V AC inputs, with solar-compatible variants available. Connectivity ranges from RS485 and Ethernet to 4G/GPRS and LoRa, enabling deployment in remote or outdoor environments.