Access Control Oem

Top sponsor listing

Top sponsor listing

About access control oem

Where to Find Access Control OEM Suppliers?

China remains the central hub for access control OEM manufacturing, with key production clusters concentrated in Shenzhen and Guangzhou. These regions host vertically integrated supply chains spanning electronic components, embedded firmware development, and mechanical fabrication—enabling rapid prototyping and scalable production. Shenzhen’s ecosystem excels in smart access technologies, including biometric readers, cloud-connected controllers, and IoT-integrated systems, supported by proximity to semiconductor suppliers and contract electronics manufacturers.

The Pearl River Delta industrial zone offers logistical efficiency, with established export infrastructure handling high-volume shipments to North America, Europe, and Southeast Asia. Suppliers benefit from localized sourcing of RFID modules, metal housings, PCBs, and hydraulic components, reducing material lead times by 20–35% compared to offshore alternatives. Average monthly output across verified manufacturers ranges from 10,000 to 50,000 units, depending on product complexity. This density enables buyers to secure competitive pricing, fast iteration cycles for custom designs, and flexible MOQs starting as low as one unit for sample validation.

How to Choose Access Control OEM Suppliers?

Procurement decisions should be guided by technical capability, quality assurance, and operational responsiveness:

Technical & Customization Capability

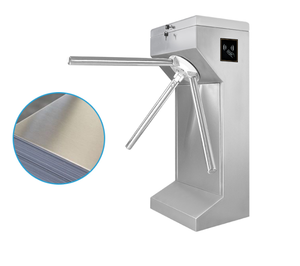

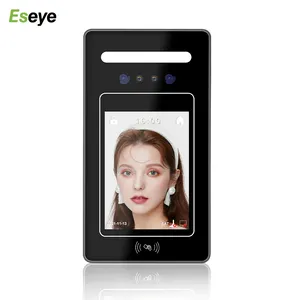

Verify suppliers offer comprehensive customization options, including enclosure material (aluminum, stainless steel, ABS), color finishes, branding (laser engraving, logo printing), and communication protocols (Wiegand, TCP/IP, RS485). Leading OEMs support integration with Tuya, TTLock, and proprietary cloud platforms. Confirm compatibility with RFID, NFC, BLE, Wi-Fi, and LPR systems based on deployment requirements. For turnkey solutions, assess firmware adaptability and SDK availability for third-party software integration.

Production and Quality Infrastructure

Prioritize suppliers with documented quality management systems. While formal ISO 9001 certification is not universally listed, consistent on-time delivery rates above 97% and reorder rates exceeding 20% indicate reliable internal processes. Evaluate response time (target ≤3 hours) and after-sales support structure. In-house R&D teams are critical for OEM/ODM projects requiring unique configurations such as bi-directional turnstiles, parking barrier synchronization, or multi-factor authentication logic.

- Minimum facility size: 2,000m² for full assembly and testing lines

- In-house capabilities: PCB assembly, die-casting, CNC machining, and environmental stress testing

- Compliance with IP65/IP68 waterproofing standards and CE/RoHS directives for international market access

Transaction and Risk Mitigation

Leverage transaction safeguards such as milestone-based payments and pre-shipment inspections. Analyze online revenue indicators and order history to gauge scalability. Request functional samples before bulk ordering—particularly for networked access panels or fingerprint modules where performance consistency is critical. Validate packaging integrity and labeling accuracy for branded deployments.

What Are the Best Access Control OEM Suppliers?

| Company Name | Main Products | On-Time Delivery | Response Time | Reorder Rate | Customization Options | Verified Status | Online Revenue |

|---|---|---|---|---|---|---|---|

| Shenzhen Zento Traffic Equipment Co., Ltd. | Turnstiles, Parking Barriers, Biometric Systems, Network Cameras | 94% | ≤3h | 22% | Size, color, logo, IC/ID cards, boom length, LPR, hydraulic bollards, HDMI output | Custom Manufacturer | US $760,000+ |

| Guangzhou Keysecu Electronic Co., Ltd. | Smart Door Locks, Fingerprint Controllers, IP67 Waterproof Systems | 99% | ≤5h | 16% | Color, material, logo, packaging, graphic design | Multispecialty Supplier | US $230,000+ |

| Secukey Technology Co., Ltd. | Tuya/WiFi/BLE Smart Locks, Biometric Controllers | 99% | ≤3h | 23% | Color, size, logo, packaging, material, firmware branding | Custom Manufacturer | US $460,000+ |

| CiVinTec Intelligence & Technology Co., Ltd. | Access Control Readers, Biometric Devices, Turnstiles, Door Phones | 100% | ≤2h | - | Limited public data; TCP/IP, QR code, Linux-based systems available | Unverified | - |

| Shenzhen Union Timmy Technology Co., Ltd. | Biometric Attendance, 4-Door Control Panels, Cloud-Based Systems | 91% | ≤4h | 40% | Software branding, Wiegand interface, panel configuration | Unverified | US $350,000+ |

Performance Analysis

Shenzhen Zento stands out for mechanical system integration, offering full customization across turnstiles, parking barriers, and LPR-enabled gates—ideal for large-scale site security deployments. Secukey and Keysecu specialize in smart electronic locks with strong IoT connectivity, catering to residential and commercial smart building applications. CiVinTec demonstrates perfect on-time delivery and ultra-fast response times, suggesting robust internal coordination despite limited reorder metrics. Shenzhen Union Timmy exhibits the highest reorder rate (40%), indicating strong customer satisfaction with its biometric and multi-door control solutions. Buyers seeking deep OEM collaboration should prioritize custom manufacturers with proven firmware development and hardware modification experience.

FAQs

What certifications should access control OEM suppliers have?

Look for compliance with CE, RoHS, and FCC standards for electromagnetic compatibility and environmental safety. For biometric devices deployed in regulated environments, ensure data processing aligns with GDPR or CCPA guidelines. Although ISO 9001 is not always declared, consistent delivery performance and repeat order volume serve as practical proxies for quality management maturity.

What is the typical lead time for OEM access control products?

Standard orders take 15–25 days post-sample approval. Custom tooling or firmware development may extend timelines to 35–45 days. Express production is available from select suppliers within 7–10 days for urgent prototypes, subject to MOQ adjustments.

Can suppliers provide private labeling and branding?

Yes, all listed manufacturers offer logo imprinting, custom packaging, and UI/UX rebranding for mobile apps and web interfaces. Some support full ODM services, including unique housing design and exclusive model numbering.

What are common MOQs for access control OEM orders?

MOQs vary by product type: electronic controllers and smart locks often require 100–500 units, while mechanical components like turnstiles or barriers may require container-based orders. Sample orders are typically accepted at 1–5 units for evaluation.

How to validate product durability and performance?

Request test reports for IP rating verification, cycle endurance (e.g., 500,000+ operations for electric locks), and temperature tolerance (-20°C to +70°C standard range). Conduct field trials on sample units under real-world conditions before scaling procurement.