Additive Rapid Prototyping

About additive rapid prototyping

Where to Find Additive Rapid Prototyping Suppliers?

China leads global production in additive rapid prototyping services, with key supplier clusters concentrated in Guangdong and surrounding industrial zones. These regions host vertically integrated manufacturing ecosystems that combine advanced 3D printing technologies—such as SLA, SLS, FDM, and metal-based additive systems—with complementary CNC machining, vacuum casting, and injection molding capabilities. The proximity of material suppliers, post-processing units, and logistics networks enables streamlined workflows for low-volume production and functional prototyping.

Suppliers in Shenzhen and Guangzhou dominate the sector, offering scalable solutions from single-part prototypes to small-batch manufacturing runs. Their operational efficiency is enhanced by localized supply chains, reducing lead times by up to 40% compared to Western counterparts. Buyers benefit from flexible MOQs (often starting at 1 unit), competitive pricing models, and rapid iteration cycles—critical for product development timelines. Average unit prices range from $0.65 to $12.98 depending on complexity, material selection, and surface finish requirements.

How to Choose Additive Rapid Prototyping Suppliers?

Selecting a reliable partner requires structured evaluation across technical, operational, and transactional dimensions:

Technical Capabilities Verification

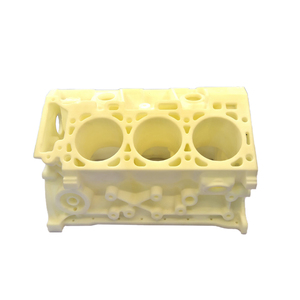

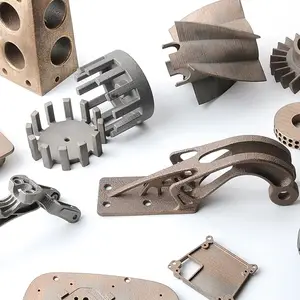

Confirm access to a diversified portfolio of additive technologies including stereolithography (SLA), selective laser sintering (SLS), fused deposition modeling (FDM), and multi-jet fusion (MJF). For high-performance applications, assess availability of engineering-grade materials such as PPSU, PEI 9085, nylon, and high-toughness resins. Suppliers should provide detailed process documentation, including layer resolution (typically 25–100μm), build volume specifications, and support for both plastic and metal components.

Production Infrastructure Assessment

Evaluate core operational metrics:

- Facility size and equipment density indicative of scalability

- In-house post-processing capabilities: sanding, painting, anodizing, laser engraving, and assembly

- Dedicated quality control stations with coordinate measuring machines (CMM) or optical scanning

- Customization depth: color matching, texture finishes, logo integration, packaging design

Cross-reference response time data (e.g., ≤1h to ≤5h benchmarks) and on-time delivery performance (target ≥96%) as proxies for operational discipline. High-performing suppliers maintain online revenue exceeding US $30,000 annually, reflecting consistent order volume and market trust.

Quality & Transaction Assurance

While formal certifications (ISO 9001, CE, RoHS) are not universally listed, prioritize suppliers who disclose compliance upon request. Demand digital inspection reports, first-article testing results, and sample validation before scaling orders. Utilize secure payment mechanisms that align financial release with milestone deliveries. Pre-shipment inspections and third-party audits mitigate risks associated with offshore procurement.

What Are the Best Additive Rapid Prototyping Suppliers?

| Company Name | Location | Main Products (Listings) | On-Time Delivery | Response Time | Reorder Rate | Online Revenue | Min. Order | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Guangzhou Gaojie Model Design & Manufacturing Co., Ltd. | Guangdong, CN | Machining Services (543) | 100% | ≤5h | 80% | US $30,000+ | 1 unit | $0.65–9.90 |

| Shenzhen Tuowei Model Technology Co., Limited | Shenzhen, CN | Customization-focused services | 96% | ≤3h | 29% | US $330,000+ | 1 piece | $1.11–9.99 |

| Shenzhen Yanmi Model Co., Ltd. | Shenzhen, CN | Machining Services (168) | 100% | ≤3h | <15% | US $1,000+ | 1 piece | $0.99–12.98 |

| Shenzhen Heruiyun Technology Co., Ltd. | Shenzhen, CN | Machining Services (531) | 100% | ≤1h | 27% | US $7,000+ | 10 pieces | $6.80–30 |

| HUITONG RAPID PROTOTYPE & SUPPLY COMPANY LIMITED | Guangdong, CN | Machining Services (184) | 100% | ≤4h | 25% | US $30,000+ | 1 piece | $0.90–19.90 |

Performance Analysis

Guangzhou Gaojie stands out with an exceptional 80% reorder rate, indicating strong customer satisfaction despite a slower average response time. Shenzhen Tuowei leads in digital responsiveness and customization breadth, supported by extensive offerings in anodizing, silicone molding, and five-axis machining. Its high annual revenue reflects robust demand and export capability. HUITONG and Yanmi demonstrate reliability with perfect on-time delivery records, suitable for time-sensitive development cycles. Heruiyun excels in rapid communication (≤1h response) and specializes in high-toughness resin and nylon-based printed parts, though its MOQ starts at 10 units. Buyers seeking one-off prototypes should prioritize suppliers with 1-piece minimums and broad material flexibility.

FAQs

How to verify additive rapid prototyping supplier reliability?

Assess on-time delivery history, response speed, and reorder rates as indicators of service consistency. Request evidence of in-house production facilities through video tours or photo documentation. Validate material traceability and post-processing workflows. Use platform-backed transaction systems to ensure accountability during fulfillment.

What is the typical lead time for prototypes?

Standard lead times range from 3–7 days for basic 3D-printed parts. Complex geometries requiring support removal, curing, or secondary operations may extend to 10–14 days. Rush services are often available for expedited delivery within 48–72 hours, subject to additional fees.

Do suppliers support full customization?

Yes, most offer end-to-end customization including geometry adjustments, color prototyping, surface finishes (glossy, matte, textured), and branding elements like laser engraving or label application. Technical drawings or 3D models (STL, STEP) are required for accurate quoting and production planning.

Are samples available before bulk ordering?

Sample production is standard practice. Many suppliers include prototype validation in project quotes, especially for complex designs. Unit costs for initial samples reflect actual production expenses, but may be partially credited toward larger orders.

What materials are commonly used in additive rapid prototyping?

Common polymers include ABS, PLA, PETG, TPU, nylon (PA12), PPSU, and PEI 9085 for high-temperature resistance. Photopolymers (resins) are used in SLA for fine-detail prototypes. Metal alloys such as aluminum, stainless steel, and titanium are processed via selective laser melting (SLM) for industrial applications.