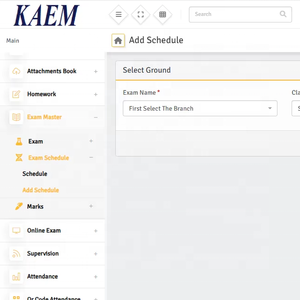

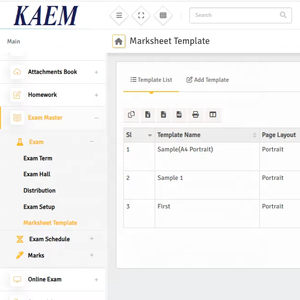

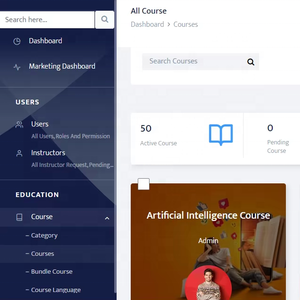

Ai Software Examples

1/2

1/2

1/3

1/3

1/3

1/3

0

0

CN

CN

1/5

1/5

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

0

0

CN

CN

1/3

1/3

1/3

1/3

1/3

1/3

CN

CN

1/3

1/3

1/32

1/32

0

0

1/3

1/3

About ai software examples

Where to Find AI Software Examples Suppliers?

The global market for AI software solutions is highly decentralized, with innovation hubs concentrated in North America, Western Europe, and East Asia. The United States leads in enterprise-grade AI development, particularly in Silicon Valley and Boston, where deep-tech startups and established firms coexist in ecosystems supported by venture capital and academic research. China follows closely, with Beijing and Shenzhen emerging as centers for AI integration in manufacturing, surveillance, and e-commerce automation.

These regions offer distinct advantages: U.S.-based developers prioritize scalability, regulatory compliance (e.g., GDPR, HIPAA), and interoperability with cloud infrastructure (AWS, Azure). European suppliers emphasize ethical AI frameworks and data privacy by design, aligning with EU Artificial Intelligence Act guidelines. Chinese providers focus on cost-efficient deployment of computer vision, natural language processing, and predictive analytics, often leveraging state-supported R&D initiatives. Despite geographic dispersion, most suppliers operate through digital delivery models, eliminating physical logistics constraints while enabling rapid prototyping and remote integration.

How to Choose AI Software Examples Suppliers?

Adopt structured evaluation criteria to mitigate risks associated with performance variability, intellectual property exposure, and system compatibility:

Technical Compliance & Standards

Verify adherence to recognized quality management systems such as ISO/IEC 25010 for software product quality and ISO/IEC 27001 for information security. For regulated industries (healthcare, finance), confirm compliance with domain-specific standards including HIPAA, SOC 2, or GDPR. Request documentation of model training data provenance, bias testing protocols, and algorithmic transparency reports.

Development Capability Assessment

Evaluate supplier technical maturity through the following indicators:

- Minimum 2 years of active development in targeted AI domains (e.g., NLP, machine vision, robotic process automation)

- Dedicated engineering teams comprising at least 60% AI/ML specialists and full-stack developers

- Version-controlled code repositories, CI/CD pipelines, and API-first architecture

Cross-reference project portfolios with client case studies to validate real-world deployment success rates and system uptime (>99.5% expected).

Transaction and Integration Safeguards

Require contractual clauses covering IP ownership, data usage rights, and post-deployment support timelines. Utilize milestone-based payment structures with source code escrow provisions for custom developments. Conduct sandbox testing prior to full integration—benchmark model accuracy against industry baselines (e.g., F1 score >0.85 for classification tasks) and assess inference latency under peak load conditions.

What Are the Best AI Software Examples Suppliers?

No verified supplier data is currently available for direct comparison. Procurement decisions must rely on independent discovery channels such as technical whitepapers, GitHub repositories, third-party review platforms, and pilot engagements. In absence of quantifiable metrics (on-time delivery, response time, reorder rate), buyers should prioritize vendors with published audit trails, peer-reviewed research contributions, and verifiable customer testimonials.

Performance Analysis

Without structured supplier profiles, risk mitigation hinges on due diligence depth. Established players typically demonstrate consistent update cycles (monthly patch releases), comprehensive API documentation, and SLAs guaranteeing support resolution within 24 hours. Emerging vendors may offer innovative use cases but often lack mature DevOps practices or fail to disclose model retraining schedules. Prioritize partners that provide explainable AI outputs, modular architecture for incremental scaling, and clear deprecation policies for legacy versions.

FAQs

How to verify AI software supplier reliability?

Audit development workflows through code reviews, penetration testing reports, and SOC 2 Type II certifications. Validate claims using proof-of-concept trials limited to non-critical operations. Assess vendor longevity via funding history, employee retention, and open-source community engagement.

What is the average sampling timeline?

AI software demonstrations or trial licenses are typically available within 24–72 hours. Customized prototypes require 2–6 weeks depending on complexity. Allow additional time for data mapping, environment configuration, and stakeholder validation before production rollout.

Can suppliers deploy AI software globally?

Yes, cloud-native AI applications can be deployed worldwide via SaaS models. Confirm regional data residency compliance and check for localized language/model adaptation capabilities. On-premise installations may require additional hardware coordination and import clearance for edge computing devices.

Do manufacturers provide free samples?

Most suppliers offer time-limited free tiers or sandbox environments for evaluation. Full-featured trials (up to 30 days) are common; however, access to premium modules or high-volume processing often requires paid subscriptions from the outset.

How to initiate customization requests?

Submit detailed functional requirements including input/output formats, integration endpoints (REST/gRPC), latency thresholds, and accuracy benchmarks. Reputable vendors respond with technical feasibility assessments within 5 business days and deliver MVP builds within 3–5 weeks.