Algorithmic Trading Software

1/2

1/2

1/3

1/3

1/3

1/3

0

0

0

0

1/2

1/2

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

0

0

CN

CN

1/2

1/2

1/3

1/3

1/1

1/1

About algorithmic trading software

Where to Find Algorithmic Trading Software Suppliers?

The global algorithmic trading software market is highly decentralized, with development hubs concentrated in technologically advanced regions including North America, Western Europe, and East Asia. The United States leads in quantitative finance innovation, hosting major financial technology clusters in New York, Chicago, and San Francisco that serve institutional investors and hedge funds. These centers offer deep integration with exchange APIs, low-latency execution frameworks, and compliance-ready architectures tailored for regulated markets.

Eastern European countries such as Ukraine, Poland, and Romania have emerged as key outsourcing destinations due to strong mathematical education systems and cost-efficient engineering talent. Firms in these regions typically deliver custom algorithm development at 40–60% lower annual costs compared to U.S.-based teams, while maintaining compatibility with FIX/FAST protocols, SMART order routing, and high-frequency trading (HFT) infrastructure. Indian tech hubs like Hyderabad and Pune also provide scalable software solutions, particularly for mid-tier asset managers seeking rule-based strategy automation and backtesting environments.

These ecosystems support modular development through standardized frameworks—such as .NET for Windows-based platforms or Python/C++ for Linux-driven systems—enabling interoperability with brokerages, clearinghouses, and market data providers. Buyers benefit from access to specialized developers experienced in time-series analysis, statistical arbitrage modeling, and risk engine integration. Lead times for fully deployed systems range from 8 to 20 weeks depending on complexity, with cloud-hosted versions reducing deployment cycles by up to 50%.

How to Choose Algorithmic Trading Software Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Verify adherence to financial industry standards including SEC/FINRA regulations (for U.S. operations), MiFID II (Europe), and ISO 27001 for information security management. Demand documented proof of encryption protocols (AES-256), secure API authentication (OAuth 2.0), and audit trails for trade activity. For firms operating in multiple jurisdictions, confirm multi-market data normalization capabilities and regulatory reporting modules.

Development Capability Audits

Evaluate technical infrastructure and team qualifications:

- Minimum team size of 15 engineers with demonstrated expertise in quantitative finance or electronic trading

- Proven experience integrating with major brokers (Interactive Brokers, Goldman Sachs Marquee) and exchanges (NASDAQ, CME, Eurex)

- In-house capabilities in machine learning model training, strategy optimization, and latency benchmarking

Cross-reference code repository activity (e.g., GitHub/GitLab commit frequency) and request performance benchmarks under simulated load conditions (e.g., 10,000+ orders per second).

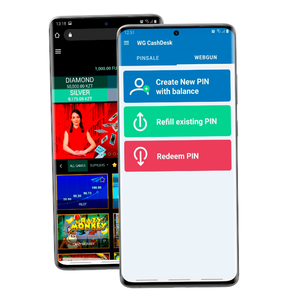

Transaction Safeguards

Implement phased payment structures tied to milestone deliveries—initial prototype, beta testing, final deployment. Require source code escrow agreements to ensure continuity in case of vendor discontinuation. Conduct third-party penetration testing before live rollout. Validate historical claims through client references specializing in similar trading strategies (e.g., mean reversion, momentum chasing, pairs trading).

What Are the Best Algorithmic Trading Software Suppliers?

| Company Name | Location | Years Operating | Staff | Core Technologies | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Data not available | — | — | — | — | — | — | — | — |

Performance Analysis

Due to the absence of verified supplier data in this category, procurement decisions must rely on independent technical assessments and direct engagement. Established firms typically demonstrate consistent delivery records (>95% on-time completion), structured SDLC (Software Development Life Cycle) practices, and documented post-deployment support SLAs. Prioritize vendors offering transparent pricing models, modular licensing (per strategy, per exchange), and sandbox environments for pre-live validation. For customization projects, require demonstration of prior work involving similar asset classes (equities, futures, forex) and execution requirements.

FAQs

How to verify algorithmic trading software supplier reliability?

Request case studies with anonymized performance metrics, including backtest-to-live variance rates and drawdown analysis. Confirm participation in recognized fintech accelerators or partnerships with tier-1 financial institutions. Validate company registration, software copyrights, and past litigation history through public business registries.

What is the average development timeline?

Standard algorithm modules take 6–10 weeks for development and testing. Full-suite platforms incorporating portfolio management, risk controls, and UI dashboards require 14–20 weeks. Cloud-native deployments can reduce setup time to under 5 days for predefined strategies.

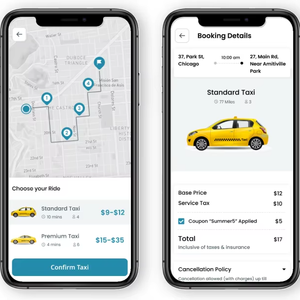

Can suppliers integrate with existing brokerage accounts?

Yes, reputable providers support integration with major retail and institutional brokers via REST/WebSocket APIs or proprietary SDKs. Confirm support for order type coverage (limit, stop, IOC, FOK), position synchronization, and margin calculation accuracy during testing phases.

Do manufacturers provide free trials or demos?

Most suppliers offer time-limited demo versions or paper trading modes. Fully functional trial periods typically last 14–30 days. Source code access is rarely provided without NDA and escrow agreements. Some vendors waive setup fees for contracts exceeding $50,000 in annual license value.

How to initiate customization requests?

Submit detailed specifications including supported instruments (stocks, options, crypto), preferred programming language (Python, C#, Java), required execution speed (microsecond precision for HFT), and desired risk constraints. Reputable developers respond with system architecture diagrams within 5 business days and deliver MVP builds in 3–6 weeks.