Android Auto Screen Distributor

Top sponsor listing

Top sponsor listing

1/3

1/3

1/21

1/21

1/3

1/3

1/37

1/37

1/3

1/3

0

0

1/3

1/3

0

0

1/15

1/15

1/16

1/16

1/3

1/3

1/2

1/2

1/3

1/3

1/23

1/23

0

0

1/17

1/17

0

0

1/23

1/23

About android auto screen distributor

Where to Find Android Auto Screen Distributors?

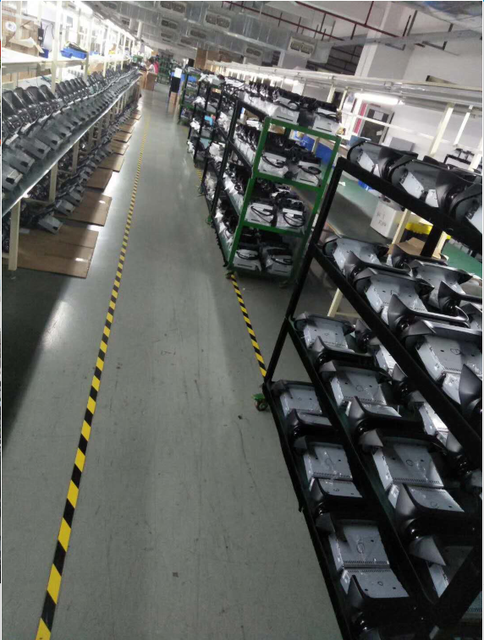

China remains the central hub for automotive infotainment manufacturing, with key supplier clusters concentrated in Shenzhen and Huizhou—cities renowned for their advanced electronics ecosystems. Shenzhen, a designated Special Economic Zone, hosts over 70% of China’s car multimedia system exporters, supported by mature supply chains for semiconductors, display panels, and wireless communication modules. Huizhou complements this with cost-efficient production zones specializing in OEM/ODM assembly, enabling rapid scaling for high-volume orders.

These regions offer integrated manufacturing networks where component sourcing, PCB fabrication, software integration, and final assembly occur within tightly coordinated industrial corridors. Suppliers benefit from localized access to critical materials such as IPS/LCD screens, DDR4 RAM, eMMC storage, and Bluetooth/Wi-Fi chipsets, reducing lead times by 25–40% compared to offshore alternatives. Buyers gain flexibility in order size, with standard lead times averaging 15–25 days for batch production and expedited fulfillment options available for urgent procurement needs.

How to Choose Android Auto Screen Distributors?

Effective supplier selection requires systematic evaluation across technical, operational, and transactional dimensions:

Technical & Functional Compliance

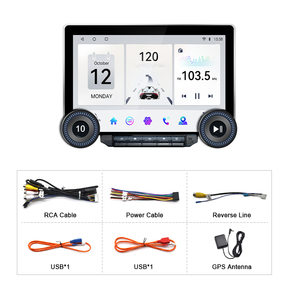

Verify compatibility with Google-certified Android Auto and Apple CarPlay protocols. Confirm hardware specifications including minimum 2GB RAM, 32GB internal storage, quad-core processors, and support for HD video decoding (1080P AHD). Essential features include GPS navigation, DSP audio processing, CanBus integration, and dual-camera inputs (front/rear). For export markets, ensure CE, FCC, and RoHS compliance to meet regulatory requirements in Europe, North America, and Southeast Asia.

Production and Customization Capability

Assess suppliers based on demonstrated capacity for both standard and customized solutions. Key indicators include:

- In-house R&D teams capable of UI/UX customization, firmware adaptation, and multi-language support

- Flexible configuration options: screen sizes (7–13 inch), aspect ratios (16:9, 8:5, vertical 9:16), and mounting formats (single-din, double-din)

- Custom branding services: logo imprinting, packaging design, color-matched bezels, and ambient lighting integration

Cross-reference product listings with customization tags to validate scalability and engineering responsiveness.

Operational Reliability Metrics

Prioritize suppliers with verifiable performance records:

- On-time delivery rate exceeding 96%

- Reorder rate above 20%, indicating customer retention and satisfaction

- Average response time under 5 hours, reflecting proactive communication

Use these metrics to shortlist partners capable of sustaining long-term supply agreements with minimal service disruption.

What Are the Leading Android Auto Screen Distributors?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Response Time | Customization Options | Verified Status |

|---|---|---|---|---|---|---|---|

| Huizhou Kris Technology Co., Ltd. | Car DVD Player, LED Headlights, Auto Interior Lighting | US $490,000+ | 98% | 20% | ≤3h | Screen size, color, packaging, logo, RAM, storage, DVR, SIM card support | Custom Manufacturer |

| Shenzhen Yuncar Technology Co., Ltd. | Car Multimedia System, DVR, Rearview Camera | US $260,000+ | 99% | 28% | ≤2h | UI themes, DSP, physical buttons, CanBus, split-screen, 360° camera, RAM, storage, frame design | Custom Manufacturer |

| Shenzhen Kianda Auto Electronic Co., Ltd. | Car DVD Player, Auto Meter, Car Monitor | US $80,000+ | 96% | <15% | ≤5h | Limited customization noted | - |

| Shenzhen Sunway Industry Co., Ltd. | Car Reversing Aid, Black Box, MP3 Player | US $490,000+ | 95% | <15% | ≤10h | Basic functional variants only | - |

Performance Analysis

Huizhou Kris and Shenzhen Yuncar stand out for high reorder rates (20–28%) and sub-3-hour response times, signaling strong post-sale support and engineering agility. Yuncar leads in technical versatility, offering extensive customization including rotatable displays, Hi-Fi audio integration, and optical fiber wiring harnesses. Both manufacturers demonstrate robust production control with on-time delivery rates at or above 98%. In contrast, Kianda and Sunway show lower reorder activity and slower response cycles, suggesting less emphasis on client retention or limited bandwidth for complex configurations. For buyers requiring deep customization or volume consistency, prioritizing verified custom manufacturers is recommended.

FAQs

What is the typical MOQ for Android Auto screen suppliers?

Minimum Order Quantities vary by model and price tier. Entry-level units start at 1 piece for sample testing, while bulk pricing applies from 2–5 pieces onward. High-end models with advanced features (e.g., Android 12, 128GB storage) may require 5+ units for optimal pricing.

How long does production and shipping take?

Standard production lead time ranges from 15 to 25 days after order confirmation. Air freight delivery to international destinations takes 5–10 days; sea freight requires 25–40 days depending on port of discharge. Expedited production (7–10 days) is available from select suppliers at a premium.

Can suppliers integrate region-specific features?

Yes, leading manufacturers support localization including language packs (Russian, Spanish, Arabic, etc.), regional radio frequencies (FM/AM/DAB+), GPS map providers (Here, TomTom), and network compatibility (4G LTE bands for North America, Europe, or Asia).

Do suppliers provide firmware updates and technical support?

Top-tier suppliers offer ongoing firmware maintenance, SDK access for app integration, and remote debugging support. Confirm whether OTA (over-the-air) update capability is included and if API documentation is available for enterprise integration.

What are common payment and transaction terms?

Standard terms include 30% deposit with balance prior to shipment. Accepted methods range from T/T and L/C to platform-backed escrow. Suppliers with trade assurance programs reduce financial risk through milestone-based release of funds.