Android Tpms Oem

1/39

1/39

1/7

1/7

1/3

1/3

1/3

1/3

1/3

1/3

1/22

1/22

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/35

1/35

1/3

1/3

1/3

1/3

1/35

1/35

1/21

1/21

1/31

1/31

About android tpms oem

Where to Find Android TPMS OEM Suppliers?

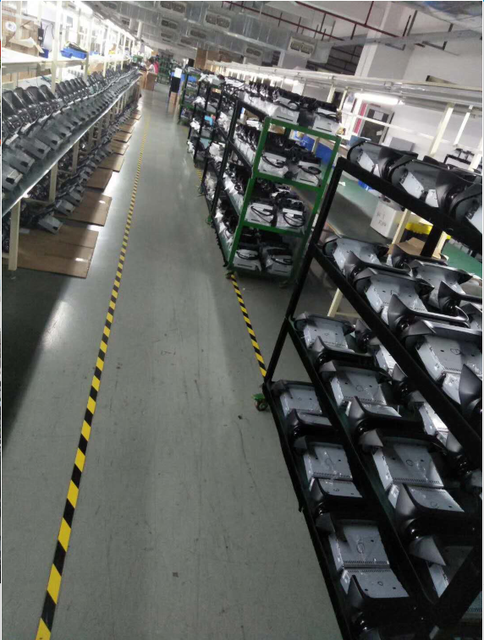

China remains the central hub for Android TPMS (Tire Pressure Monitoring System) OEM manufacturing, with key production clusters in Guangdong and Zhejiang provinces. Guangdong, particularly the Shenzhen-Dongguan corridor, hosts over 70% of China’s automotive electronics suppliers, supported by a mature ecosystem of PCB fabricators, sensor module producers, and software development firms. This region benefits from proximity to semiconductor suppliers and high-speed SMT (Surface Mount Technology) assembly lines, enabling rapid prototyping and scalable production.

Zhejiang’s Ningbo and Hangzhou zones specialize in integrated automotive IoT solutions, offering firmware customization and cloud connectivity support for Android-based TPMS platforms. These industrial clusters provide vertical integration from component sourcing to final system calibration, reducing material lead times by 25–40% compared to non-specialized regions. Buyers gain access to streamlined supply chains where microcontrollers, RF transmitters, and pressure sensors are sourced within 30km, supporting MOQs as low as 100 units and bulk orders exceeding 50,000 units monthly. Average production lead times range from 20–35 days, depending on software integration complexity and wireless protocol requirements (e.g., BLE 5.0 or LoRa).

How to Choose Android TPMS OEM Suppliers?

Implement structured evaluation criteria to ensure technical and operational reliability:

Quality & Compliance Verification

Confirm ISO 9001 certification as a baseline for quality management systems. For export to EU and North American markets, validate CE, FCC, and RoHS compliance documentation—particularly for radio frequency emissions and restricted materials. Review test reports for environmental durability, including IP67 ingress protection, operating temperature ranges (-40°C to +85°C), and EMI/EMC performance under automotive standards such as ISO 11452-2.

Technical & Production Capacity Assessment

Evaluate supplier infrastructure based on the following benchmarks:

- Minimum 2,000m² cleanroom facility for SMT and final assembly

- In-house firmware development team (minimum 5 engineers) for Android OS customization

- Automated testing rigs for real-time sensor calibration and wireless signal stability

Cross-reference factory audit reports with delivery performance data—target suppliers with on-time shipment rates above 97% and defect rates below 0.3%.

Procurement & Transaction Safeguards

Utilize secure payment mechanisms such as third-party escrow or irrevocable LC terms for initial large-volume orders. Prioritize suppliers with documented export experience to your target market, including customs classification (HS Code 8526.91) and pre-certified compatibility with vehicle ECUs. Conduct sample validation against functional KPIs: boot time (<3s), update latency (<500ms), and battery life (>3 years under standard duty cycles).

What Are the Best Android TPMS OEM Suppliers?

No verified suppliers are currently available in the provided dataset. When evaluating potential partners, focus on companies demonstrating proven track records in automotive electronics OEM manufacturing, particularly those with published technical portfolios covering CAN bus integration, mobile app interfaces, and multi-language Android UI support. Supplier credibility is further validated through participation in major trade shows such as Automechanika Frankfurt or Shanghai Auto Expo, and presence in industry registries with audited production metrics.

Performance Analysis

In the absence of specific supplier data, procurement strategy should emphasize due diligence in verifying claimed capabilities. Historical trends indicate that leading Android TPMS OEMs differentiate through software flexibility—offering white-label apps with configurable alert logic, GPS tagging, and OTA (over-the-air) update functionality. Hardware robustness is equally critical; top-tier suppliers implement dual-stage encapsulation for outdoor-rated external sensors and use AEC-Q100 qualified ICs. Until comprehensive supplier data is accessible, buyers should initiate engagement with shortlisted manufacturers via technical questionnaires and remote factory audits to assess readiness for volume production.

FAQs

How to verify Android TPMS OEM supplier reliability?

Request certified copies of quality management system audits (ISO 9001, IATF 16949 if applicable), product compliance test reports, and customer references from similar-scale deployments. Validate firmware ownership and update protocols to avoid intellectual property conflicts.

What is the average sampling timeline for Android TPMS units?

Standard sample development takes 15–25 days, including PCB assembly, casing integration, and basic Android interface configuration. Custom UI/UX designs or advanced diagnostics extend timelines to 35–45 days. Air shipping adds 7–10 days for international delivery.

Can Android TPMS OEMs support global shipping and localization?

Yes, experienced manufacturers manage end-to-end logistics under FOB, CIF, or DDP terms. Ensure suppliers support multilingual firmware (e.g., English, Spanish, German) and regional regulatory labeling. Confirm compatibility with local cellular bands if using LTE-enabled gateway modules.

Do suppliers offer free samples?

Sample policies vary. Typically, suppliers charge 50–70% of unit cost for first samples, fully refundable upon order placement above agreed thresholds (e.g., 1,000 units). Free samples may be offered selectively for long-term partnership discussions.

How to initiate customization requests for Android TPMS systems?

Submit detailed specifications including display resolution, supported vehicle protocols (OBD-II, CAN 2.0A/B), wireless standards, mobile OS versions (Android 8.0+ recommended), and branding requirements. Reputable OEMs provide UI mockups within 72 hours and deliver functional prototypes within 4 weeks.