Api Formulation

CN

CN

About api formulation

Where to Find API Formulation Suppliers?

The global API formulation supply base is concentrated in industrial hubs across China and the UAE, with distinct specialization in lubricant chemistry and metal-based industrial formulations. Chinese suppliers dominate production of API-certified engine oils and industrial lubricants, leveraging integrated refining and blending infrastructure in Shandong and Jiangsu provinces. These regions host vertically aligned facilities capable of processing base oils into finished formulations at scale, achieving 20–25% cost efficiency over Western counterparts due to proximity to petrochemical feedstock and streamlined logistics.

Meanwhile, UAE-based manufacturers such as AVANA LUBRICANT FZE focus on high-volume export-oriented production, emphasizing fast response times and compliance with international performance standards. The region benefits from strategic port access, enabling efficient distribution to African, Asian, and Middle Eastern markets. Key advantages include low MOQ flexibility (starting at 2,000 liters), rapid customization cycles for viscosity grades and additive packages, and adherence to API SN, SM, and CF specifications. This dual-regional structure allows buyers to balance cost, volume, and technical precision based on application requirements.

How to Choose API Formulation Suppliers?

Effective supplier selection requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical Compliance

Confirm API certification for all listed products, particularly for engine oils and industrial lubricants. Verify ISO 9001 or equivalent quality management systems as a baseline. For critical applications, request test reports on viscosity index, flash point, total base number (TBN), and oxidation stability per ASTM/ISO standards.

Production & Customization Capability

Assess supplier capacity through key indicators:

- Minimum monthly output exceeding 100,000 liters for sustained bulk supply

- In-house blending lines with additive dosing control for custom formulations

- Ability to adjust viscosity grades (e.g., 5W30, 15W40) and base oil types (mineral, semi-synthetic, synthetic)

Cross-reference product listings with response time metrics—suppliers averaging ≤5 hours demonstrate higher operational responsiveness.

Transaction Safeguards

Prioritize suppliers with documented on-time delivery performance (ideally ≥97%) and transparent order tracking. Utilize secure payment mechanisms such as escrow services for initial transactions. Conduct sample testing to validate performance claims before scaling procurement. Evaluate packaging options (drums, IBCs, bulk tankers) and labeling compliance with destination market regulations.

What Are the Best API Formulation Suppliers?

| Company Name | Location | Main Products | Min. Order Quantity | Price Range (USD) | On-Time Delivery | Avg. Response | Customization | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| AVANA LUBRICANT FZE | UAE | Gear Oil, Petrol Engine Oil | 2,000 liters | $0.92–1.15 | Data not available | ≤10h | Limited | Data not available |

| ARMOR LUBRICANTS PER PERSON COMPANY LLC | UAE | Synthetic Motor Oil, Gear Oil | 12 drams / 1,7000 liters | $0.85–2.45 | Data not available | ≤5h | Moderate | Data not available |

| AVOS AUTO EXPORTS LIMITED | India | Engine Lubricants (Mutul, Shell, Castrol) | 500–7,000 liters | $1–3 | Data not available | ≤5h | Brand replication | Data not available |

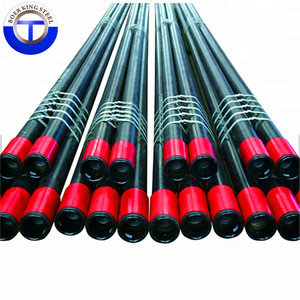

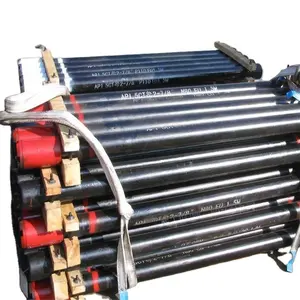

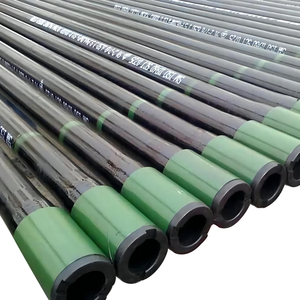

| JIN ZHEFENG METAL CO., LTD | China | Steel Pipes (API 5L, 5CT) | 5 tonnes | $575–635 | Data not available | ≤8h | Dimensional | Data not available |

| Shandong Hongzhi Metal Product Co., Ltd. | Shandong, CN | API 5L, 5CT Casing/Tubing | 5 tons | $380–550 | 100% | ≤2h | Full (color, size, packaging, logo) | <15% |

Performance Analysis

While most suppliers list API-formulated lubricants, only Shandong Hongzhi demonstrates verifiable performance metrics with 100% on-time delivery and sub-2-hour response times, indicating robust internal coordination. AVANA and ARMOR offer competitive pricing and low MOQs ideal for trial orders, but lack disclosed reorder rates or revenue verification. AVOS AUTO EXPORTS handles branded lubricant formulations, suggesting OEM partnership capabilities. Notably, JIN ZHEFENG and Shandong Hongzhi specialize in API-monogrammed steel products (e.g., API 5L pipes), reflecting a divergence in interpretation of "API formulation"—a critical consideration for buyers to clarify whether the requirement pertains to chemical formulations or mechanical product specifications. Prioritize suppliers with explicit documentation of API licensing and third-party quality validation for mission-critical applications.

FAQs

How to verify API formulation supplier reliability?

Cross-check API monogram approval status through the American Petroleum Institute’s Licensing Directory. Request copies of ISO 9001 certificates and batch-specific material test reports. Analyze supplier communication patterns—consistent responsiveness correlates with operational discipline.

What is the typical lead time for API formulation orders?

Standard lubricant batches require 15–25 days for production and packaging. Bulk metal components (e.g., API 5L pipe) take 30–45 days. Add 10–14 days for international shipping via sea freight.

Can suppliers customize API formulations?

Yes, many suppliers offer tailored viscosity grades, additive concentrations, and packaging configurations. Full customization—including private labeling and safety data sheets—is available from manufacturers with dedicated R&D teams and blending flexibility.

Do suppliers provide samples before bulk orders?

Most suppliers offer samples for $50–$200, refundable against first orders. Sample volumes range from 1 to 20 liters, with delivery in 5–10 business days via express courier.

What are common payment terms for API formulation sourcing?

Typical terms include 30% advance payment with 70% prior to shipment. Established buyers may negotiate LC at sight or extended terms after order history is built. Escrow services are recommended for first-time transactions.