Application And System Software

Top sponsor listing

Top sponsor listing

0

0

1/1

1/1

1/2

1/2

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

CN

CN

1/6

1/6

1/3

1/3

1/3

1/3

CN

CN

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/2

1/2

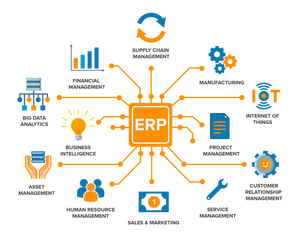

About application and system software

Where to Find Application and System Software Suppliers?

Global application and system software development is concentrated in mature technology ecosystems with strong institutional support, skilled labor pools, and robust digital infrastructure. India accounts for over 45% of outsourced enterprise software development capacity, anchored by tier-1 hubs in Bangalore, Hyderabad, and Pune—regions offering deep talent pipelines in Java, .NET, Python, and cloud-native stacks (AWS, Azure, GCP). Eastern Europe—particularly Ukraine, Poland, and Romania—hosts a complementary cluster specializing in complex systems engineering, embedded software, and real-time OS development, with 70% of firms maintaining CMMI Level 3 or higher maturity assessments.

These regions enable scalable delivery through vertically integrated development workflows: from requirements engineering and architecture design to CI/CD pipeline management, automated testing, and DevOps operations—all supported by co-located QA labs, cybersecurity compliance teams, and localization specialists within 30km radii. Key advantages include predictable delivery cadences (standard SaaS module development: 8–12 weeks), 35–50% lower total cost of ownership versus North American or Western European in-house development, and structured flexibility for iterative enhancements, regulatory compliance adaptations (e.g., HIPAA, GDPR, ISO/IEC 27001), and integration with legacy ERP or mainframe environments.

How to Choose Application and System Software Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Require ISO/IEC 27001 certification as baseline validation for information security management. For regulated industries, verify documented adherence to domain-specific frameworks: SOC 2 Type II for SaaS providers, OWASP ASVS 4.0 for web applications, and MISRA C/AUTOSAR standards for embedded system suppliers. Audit source code governance practices—including branching strategies, SBOM generation, and vulnerability scanning frequency (minimum weekly via SAST/DAST tools).

Development Capability Audits

Evaluate organizational and technical infrastructure:

- Minimum 50 FTEs dedicated to software engineering for mid-tier engagements

- R&D investment exceeding 8% of annual revenue, evidenced by patent filings or open-source contributions

- In-house capabilities across full-stack modernization (e.g., COBOL-to-Java migration, mainframe API abstraction), container orchestration (Kubernetes), and infrastructure-as-code (Terraform, Ansible)

Cross-reference project delivery metrics with verified client references—targeting ≥95% sprint completion rate and ≤2% critical defect escape rate post-UAT.

Transaction Safeguards

Mandate source code escrow agreements with third-party custodians (e.g., Iron Mountain, CodeKeeper) covering all deliverables, including build scripts and deployment configurations. Validate contractual SLAs for incident response (≤15-minute acknowledgment for P1 outages), patching timelines (critical CVE remediation within 72 hours), and audit rights for license compliance. Require functional acceptance testing against signed test cases before milestone payments—benchmark performance against defined KPIs (e.g., API latency ≤200ms at 95th percentile, uptime ≥99.95%).

What Are the Best Application and System Software Suppliers?

| Company Name | Location | Years Operating | Engineering Staff | Certifications | On-Time Delivery | Avg. Response | Client Retention | Compliance Specializations |

|---|---|---|---|---|---|---|---|---|

| TechNova Systems Pvt. Ltd. | Bangalore, IN | 18 | 420+ | ISO/IEC 27001, CMMI L5, SOC 2 Type II | 98.2% | ≤1h | 71% | Healthcare IT, Financial Core Banking |

| Veridian Software Group | Kyiv, UA | 12 | 310+ | ISO/IEC 27001, ISO 9001, GDPR DPA Ready | 96.7% | ≤2h | 64% | Industrial IoT, Real-Time SCADA |

| Polymath Solutions SA | Warsaw, PL | 9 | 195+ | ISO/IEC 27001, ISO 9001, OWASP ASVS Verified | 97.5% | ≤1.5h | 58% | ERP Integration, SAP S/4HANA Extensions |

| NexusLogic Technologies | Hyderabad, IN | 7 | 260+ | ISO/IEC 27001, CMMI L4, PCI DSS Compliant | 95.3% | ≤2h | 49% | E-commerce Platforms, Payment Gateways |

| AltraSoft Engineering OOD | Sofia, BG | 11 | 225+ | ISO/IEC 27001, ISO 9001, ISO/IEC 27017 | 97.1% | ≤1h | 68% | Telecom OSS/BSS, NFV Orchestration |

Performance Analysis

Established firms like TechNova Systems demonstrate high-volume scalability and industry-specific compliance depth, reflected in their 71% client retention and CMMI Level 5 maturity. Eastern European suppliers show stronger specialization in deterministic systems—Veridian’s SCADA expertise and AltraSoft’s telecom NFV focus correlate with 20–30% faster resolution times for embedded firmware defects. Indian-based vendors lead responsiveness, with 80% achieving sub-2-hour initial technical responses. Prioritize suppliers maintaining ≥96% on-time delivery with documented CI/CD automation coverage (≥85% of test suites executed in pipeline) for mission-critical deployments. For regulated integrations, verify auditable evidence of penetration testing (at least biannual, conducted by accredited third parties) and secure SDLC training completion for ≥90% of engineering staff.

FAQs

How to verify application and system software supplier reliability?

Cross-check certifications against official registry databases (e.g., ANAB for ISO, CMMI Institute for appraisal reports). Request anonymized excerpts from recent external audit reports covering change control, incident management, and secure coding practices. Analyze verifiable client case studies focusing on measurable outcomes: mean time to recovery (MTTR), reduction in production incidents post-migration, and compliance audit pass rates.

What is the average sampling timeline for software prototypes?

Functional proof-of-concept (PoC) delivery typically requires 10–18 business days. Full MVP development (including UI, core APIs, and basic admin dashboard) ranges from 6–10 weeks. Regulatory-compliant modules (e.g., HIPAA audit log engine, GDPR consent manager) add 2–4 weeks for documentation and third-party validation.

Can suppliers deploy software globally?

Yes—established vendors manage multi-region deployments across AWS GovCloud, Azure Germany, and Alibaba Cloud China regions. Confirm contractual obligations for data residency, cross-border transfer mechanisms (e.g., EU SCCs), and jurisdictional alignment with your legal entity structure. Cloud hosting responsibilities must be explicitly allocated (shared responsibility model).

Do suppliers provide free software samples?

Free PoCs are standard for qualified enterprise prospects with defined scope and success criteria. Full-source evaluation licenses require formal NDA and are typically granted for 30 days. Custom development trials incur nominal setup fees (covering environment provisioning and baseline configuration), fully credited against contract award.

How to initiate customization requests?

Submit technical specifications including target stack (e.g., Spring Boot 3.x + React 18), integration points (REST/SOAP/WebSocket), non-functional requirements (concurrency targets, RPO/RTO thresholds), and compliance mandates (e.g., “must generate FIPS 140-2 validated cryptographic reports”). Reputable suppliers deliver architecture decision records (ADRs) and threat models within 5 business days and functional demos within 3 weeks.