Building Cladding Supplier

1/15

1/15

1/3

1/3

1/12

1/12

CN

CN

1/3

1/3

1/24

1/24

1/26

1/26

0

0

1/28

1/28

1/1

1/1

1/32

1/32

1/3

1/3

1/9

1/9

1/15

1/15

0

0

1/3

1/3

1/3

1/3

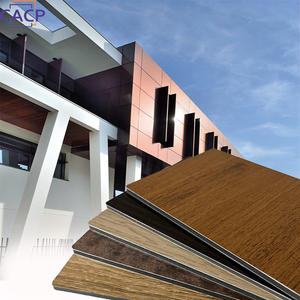

About building cladding supplier

Where to Find Building Cladding Supplier Hubs?

China remains the central node in global building cladding manufacturing, with specialized industrial clusters concentrated in Guangdong, Jiangsu, and Zhejiang provinces. These regions collectively host over 70% of China’s architectural envelope producers, supported by mature metalworking, polymer processing, and glass fabrication ecosystems. Guangdong excels in aluminum composite panel (ACP) production, leveraging proximity to raw material refineries that reduce input costs by 12–18%. Jiangsu’s Yixing and Changzhou zones specialize in fiber cement and terracotta cladding systems, benefiting from established ceramic supply chains and energy-efficient kiln networks.

The clustering enables vertical integration across extrusion, coating, and assembly stages, allowing for rapid prototyping and scalable output. Facilities within these zones typically operate within co-located supplier rings—component vendors, logistics operators, and technical service providers are situated within 40km radii, minimizing coordination delays. Buyers gain access to lead times averaging 25–40 days for standard orders, 20–25% lower unit costs due to localized inputs, and strong adaptability for both modular and bespoke facade solutions. Export infrastructure is robust, with direct rail and port access facilitating containerized shipments to Europe, Southeast Asia, and the Middle East.

How to Choose Building Cladding Suppliers?

Implement structured evaluation criteria to mitigate sourcing risks:

Quality & Compliance Verification

Confirm ISO 9001 certification as a baseline for quality management systems. For projects targeting EU or UK markets, CE marking under EN 14907 (for ACPs) or ETAG 018 (for rainscreen systems) is mandatory. Suppliers must provide fire performance test reports—compliance with ASTM E84 or EN 13501-1 (Class B-s1, d0 minimum recommended) is critical for high-rise applications. RoHS and REACH declarations are required for environmentally regulated installations.

Production Capacity Assessment

Evaluate core operational metrics:

- Minimum factory footprint of 3,000m² to ensure batch consistency

- In-house capabilities including coil coating lines, CNC profiling, and powder coating booths

- Dedicated R&D or technical design team (minimum 8% of total staff)

- Monthly production capacity exceeding 50,000m² for volume procurement readiness

Correlate facility size with on-time delivery performance (target ≥96%) and export order volume to validate scalability.

Procurement Risk Mitigation

Utilize secure transaction models: escrow-based payments tied to milestone inspections are advised for first-time engagements. Request sample panels for third-party testing—verify bond strength (≥7 N/mm for ACP), weathering resistance (QUV exposure ≥1,000 hours), and dimensional accuracy (±0.5mm tolerance). Prioritize suppliers with documented project references in climatically similar regions to assess long-term durability.

What Are the Key Building Cladding Supplier Metrics?

No supplier data is currently available for analysis. Buyers should proactively collect and verify key operational indicators during vendor qualification, including factory size, certification status, monthly output capacity, and historical delivery reliability. Direct engagement through site audits or virtual tours is recommended to confirm stated capabilities, particularly for custom profile development or large-scale facade contracts requiring color-matching and batch traceability.

FAQs

How to verify building cladding supplier credentials?

Cross-validate certifications with accredited bodies such as TÜV or SGS. Request audit trails covering raw material sourcing (e.g., aluminum alloy grade 3003/3105), coating thickness logs (typically 25–40μm PVDF), and QC inspection records per batch. Assess real-world performance via case studies or installed project visits where feasible.

What is the typical sampling timeline for cladding materials?

Standard sample production takes 10–18 days, depending on material type. Complex configurations—such as double-curved metal panels or digitally printed surfaces—may require 25–35 days. Air freight adds 5–9 days for international delivery. Sample fees are generally applied but may be credited toward bulk orders exceeding 5,000m².

Can suppliers support global shipping and customs clearance?

Yes, experienced manufacturers manage end-to-end logistics under FOB, CIF, or DAP terms. Confirm compliance with destination regulations—especially fire codes and structural anchoring standards. Sea freight is standard for full-container loads (20’ or 40’ HC), with proper crating and moisture protection essential for long-haul shipments.

Do cladding suppliers offer customization?

Most suppliers accommodate custom dimensions, finishes (wood grain, metallic, matte), and joint systems (cassette, snap-lock, cassette). Provide detailed CAD drawings or BIM models for accurate quoting. Lead time extension of 10–20% should be expected for non-standard designs.

What are common MOQs and payment terms?

MOQs vary: typically 500–1,000m² for stock colors and profiles; higher for custom runs. Payment structures often follow 30% deposit, 60% pre-shipment, 10% post-delivery for new clients. Established buyers may negotiate LC terms or net-30 arrangements after performance validation.