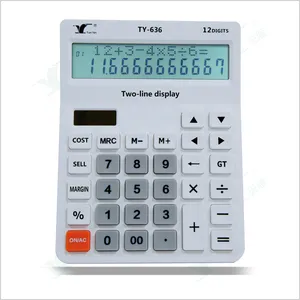

Calculating Operating Margin

1/25

1/25

0

0

1/3

1/3

1/3

1/3

1/3

1/3

CN

CN

1/3

1/3

CN

CN

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/2

1/2

1/3

1/3

1/15

1/15

1/13

1/13

1/3

1/3

0

0

1/7

1/7

1/3

1/3

1/3

1/3

0

0

About calculating operating margin

Where to Find Calculating Operating Margin Services?

While not a physical product, the service of calculating operating margin is predominantly delivered by financial analytics firms and accounting technology providers, with major hubs in the United States, India, and Southeast Asia. The U.S. hosts leading financial software developers and enterprise consulting groups, particularly in New York, Chicago, and San Francisco, where integrated fintech ecosystems support real-time profitability analysis. India has emerged as a key delivery center for outsourced financial computation services, leveraging a skilled workforce in cities like Bangalore and Hyderabad to offer cost-efficient, scalable solutions for global clients.

These regions benefit from mature infrastructure in data security, cloud computing, and regulatory compliance frameworks—critical for handling sensitive financial data. Providers in these clusters typically operate within ISO 27001-certified environments and utilize automated calculation engines that reduce manual error rates by up to 90%. Buyers gain access to standardized methodologies aligned with GAAP and IFRS, enabling consistent operating margin calculations across reporting periods. Typical advantages include reduced processing time (under 24 hours for batch data), scalability for multi-entity organizations, and integration with ERP systems such as SAP or Oracle.

How to Choose Calculating Operating Margin Service Providers?

Prioritize these verification protocols when selecting partners:

Methodological Accuracy

Confirm adherence to recognized accounting standards (GAAP/IFRS) in all calculations. Demand documented workflows showing how gross profit and operating expenses are classified, ensuring non-operating income and taxes are excluded. Validate formula application: Operating Margin = (Operating Income / Revenue) × 100, with reconciliation trails for each input metric.

Technical Infrastructure Audit

Evaluate system capabilities:

- Integration with major accounting platforms (QuickBooks, Xero, NetSuite)

- Use of encrypted data transfer (TLS 1.3+) and secure storage (AES-256)

- Automated validation rules to flag anomalies in EBIT or revenue entries

Cross-reference uptime records (>99.5%) and data processing speed with service level agreements (SLAs) to confirm reliability.

Data Governance & Compliance

Require evidence of SOC 1 or SOC 2 Type II reports for financial controls. For EU-based operations, GDPR compliance is mandatory for data processing. Implement trial runs using anonymized datasets to verify accuracy before full deployment. Third-party audits should confirm that no unauthorized modifications occur during computation cycles.

What Are the Leading Calculating Operating Margin Service Providers?

No verified supplier data is currently available for direct comparison. As this is an analytical function rather than a manufactured good, procurement decisions should focus on institutional capability, audit transparency, and integration compatibility rather than factory metrics. Firms offering embedded operating margin calculators within broader financial reporting suites dominate market adoption, particularly those serving public companies and multinational enterprises.

Performance Analysis

In the absence of quantifiable supplier benchmarks, decision-making should emphasize process standardization and auditability. Providers integrating AI-driven anomaly detection into margin calculations demonstrate higher accuracy in dynamic revenue environments. Prioritize vendors with documented error correction protocols and version-controlled calculation models. For internal finance teams, open-source tools combined with controlled access spreadsheets can offer transparency, though they require rigorous change management to maintain integrity.

FAQs

How to verify the accuracy of operating margin calculations?

Cross-validate results against audited financial statements. Request step-by-step breakdowns of both numerator (operating income) and denominator (total revenue). Conduct parallel computations using independent templates to identify discrepancies exceeding 0.5 percentage points.

What is the typical turnaround time for operating margin analysis?

Automated systems process data within 1–4 hours post-input. Manual reviews involving adjustments for one-time expenses may take 1–3 business days. Real-time dashboards update margins instantly when connected to live accounting feeds.

Can operating margin be calculated for multiple business units?

Yes, segment-specific calculations are standard practice. Ensure the provider supports entity-level data segregation and consolidated reporting. Allocation logic for shared overheads must be clearly defined to maintain comparability.

Do service providers offer historical trend analysis?

Most advanced platforms include time-series visualization and variance tracking against forecasts or industry benchmarks. Minimum data retention spans 5–7 years for compliance and trend modeling purposes.

How to initiate customization for industry-specific margin reporting?

Submit chart of accounts mappings and define operational expense categories requiring exclusion (e.g., R&D in tech firms, depletion costs in mining). Reputable providers configure calculation rules within 5–7 days and deliver test outputs for validation.