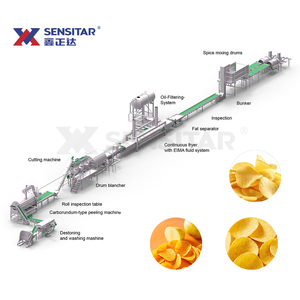

Chip Maker Machine

Top sponsor listing

Top sponsor listing

1/3

1/3

1/3

1/3

1/3

1/3

CN

CN

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/1

1/1

1/23

1/23

0

0

0

0

0

0

1/12

1/12

About chip maker machine

Where to Find Chip Maker Machine Suppliers?

China remains the global epicenter for chip maker machine manufacturing, with key industrial clusters in Shandong, Henan, and Zhecheng provinces driving innovation and cost efficiency. Shandong’s equipment manufacturers benefit from proximity to major port infrastructure and integrated food processing supply chains, enabling faster export cycles. Henan province hosts a dense network of machinery producers specializing in automated food processing lines, leveraging economies of scale that reduce unit production costs by 18–25% compared to non-specialized regions.

These hubs feature vertically integrated production ecosystems—encompassing CNC machining, electrical control systems assembly, and stainless steel fabrication—allowing suppliers to deliver turnkey solutions within 30–60 days for standard configurations. Buyers gain access to mature vendor networks where raw material sourcing, component manufacturing, and final assembly occur within tightly coordinated regional zones, minimizing logistics delays and ensuring consistent quality control across batches.

How to Choose Chip Maker Machine Suppliers?

Effective supplier selection requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical Compliance & Certifications

Verify adherence to international safety and quality standards such as ISO 9001 for quality management and CE marking for electrical and mechanical compliance. For exports to regulated markets (EU, North America), confirm inclusion of protective systems (e.g., overload protection, emergency stop circuits) and compatibility with local voltage requirements (110V/220V).

Production Capability Assessment

Evaluate core manufacturing indicators:

- Minimum factory area exceeding 3,000m² for sustained volume output

- In-house engineering teams capable of customizing cutting blades, feed mechanisms, and drying integration

- Proven track record in delivering full processing lines—not just standalone units

Cross-reference on-time delivery performance (target ≥99%) with response time metrics (≤2 hours preferred) to assess operational responsiveness.

Transaction Security & Quality Verification

Utilize secure payment frameworks that release funds upon inspection confirmation at destination. Prioritize suppliers offering sample testing under real operating conditions. Benchmark machine durability—particularly blade hardness (HRC 58–62) and motor lifespan (≥10,000 hours)—before scaling procurement. Request video audits of production lines to validate customization capabilities and quality assurance protocols.

What Are the Best Chip Maker Machine Suppliers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options | Min. Order Value |

|---|---|---|---|---|---|---|---|---|

| Shandong Sensitar Industrial Equipment Co., Ltd. | Shandong, CN | Potato chips making machine, Fryers, Food processing lines | US $110,000+ | 100% | ≤3h | 25% | Color, material, size, logo, packaging, label, graphic | $125/set |

| Zhecheng Hong Xin Machinery Factory | Zhecheng, CN | Plantain/Banana chips machines, Coconut cutters | US $620,000+ | 99% | ≤2h | <15% | Color, material, size, logo, packaging, label, graphic | $125/piece |

| Henan Restar Machinery Co.,Ltd | Henan, CN | Potato/French fries machines, Chin-chin formers | US $20,000+ | 100% | ≤4h | 33% | N/A | $139/set |

| XIWANG TECHNOLOGY INC | N/A | Semi/Automatic potato chips machines, Puffed snack lines | Data Unavailable | No Data | ≤1h | No Data | N/A | $162/set |

| Zhucheng Chixin Machinery Co., Ltd. | Shandong, CN | Fully automatic potato/cassava/banana chip lines | US $3,000+ | 100% | ≤1h | <15% | N/A | $2,000/set |

Performance Analysis

Shandong Sensitar and Zhucheng Chixin demonstrate perfect on-time delivery records, indicating robust production planning and logistics execution. Zhecheng Hong Xin leads in online transaction volume (US $620,000+), reflecting strong market penetration and buyer trust. Henan Restar stands out with a 33% reorder rate—the highest among peers—suggesting high customer satisfaction despite slower response times. XIWANG TECHNOLOGY INC excels in responsiveness (≤1h), critical for urgent procurement cycles, though transparency gaps in delivery and revenue metrics warrant further due diligence. Suppliers in Shandong and Henan dominate automation capability, offering semi- to fully automatic lines scalable from 300kg/hour to over 1,000kg/hour throughput.

FAQs

How to verify chip maker machine supplier reliability?

Cross-check ISO and CE certifications through official registries. Request documented quality control procedures, including weld integrity tests, motor load testing, and stainless steel grade verification (typically SUS304). Analyze transaction history for dispute resolution patterns and prioritize suppliers with verified post-sale service support.

What is the typical lead time for chip making machines?

Standard models require 20–35 days for production and pre-shipment inspection. Customized or fully automatic lines may take 45–70 days depending on complexity. Air freight adds 5–10 days globally; sea freight ranges from 25–40 days based on destination port congestion.

Can suppliers accommodate OEM/ODM requests?

Yes, leading suppliers offer comprehensive customization including branding (logo, color scheme), structural modifications (feed hopper design, conveyor length), and integration with auxiliary systems (dryers, fryers, packaging units). Minimum order thresholds typically apply for OEM tooling adjustments.

Do manufacturers provide free samples or trial runs?

Most suppliers do not offer free physical samples due to equipment size and operational costs. However, many provide remote video demonstrations of machine operation using client-specified materials. Sample processing fees are common and often creditable toward bulk orders.

What are standard payment and MOQ terms?

Common payment structures include 30% advance T/T with balance prior to shipment. MOQs range from 1 set for small-scale cutters to full production lines for industrial clients. Negotiation leverage increases significantly at order volumes exceeding five units or integrated line purchases.