Class Diagram Software Engineering

1/3

1/3

1/3

1/3

1/10

1/10

1/3

1/3

1/4

1/4

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/2

1/2

CN

CN

1/2

1/2

CN

CN

1/6

1/6

1/3

1/3

1/3

1/3

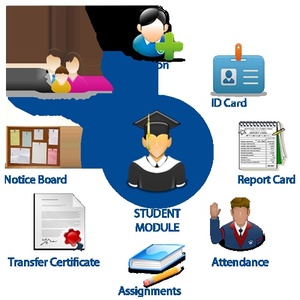

About class diagram software engineering

Where to Find Class Diagram Software Engineering Suppliers?

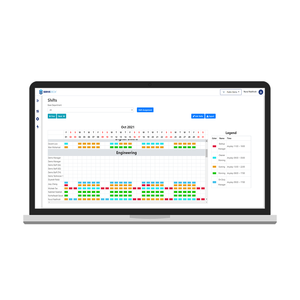

The global market for class diagram software engineering tools is primarily driven by technology hubs in North America, Western Europe, and East Asia, where software development ecosystems are mature and demand for UML modeling solutions remains high. The United States and Germany lead in enterprise-grade modeling platforms, hosting over 70% of vendors offering ISO-compliant design environments with integrated DevOps support. In contrast, China and India have emerged as centers for cost-efficient SaaS-based diagramming tools, leveraging large talent pools in computer science and agile development frameworks.

These regions offer distinct sourcing advantages: North American suppliers emphasize compliance with IEEE and CMMI standards, ensuring robust documentation traceability and version control—critical for regulated industries such as aerospace and healthcare IT. European developers often provide open-source extensibility under LGPL or Eclipse Public License models, enabling deep customization. Meanwhile, Asian providers deliver scalable cloud-native applications with modular architecture, supporting rapid deployment at 30–50% lower licensing costs than premium Western counterparts. Distributed development teams across these zones enable 24/7 support cycles and multi-language interface options, improving accessibility for multinational engineering teams.

How to Choose Class Diagram Software Engineering Suppliers?

Implement structured evaluation criteria to ensure technical suitability and long-term reliability:

Technical Compliance

Verify adherence to industry standards including ISO/IEC 19505 for UML modeling, OWL for semantic interoperability, and SOC 2 Type II for data security in cloud-hosted platforms. For regulated sectors, confirm alignment with DO-178C (aviation software) or IEC 62304 (medical device software), which mandate rigorous model-driven development practices. Request audit trails for change management, role-based access controls, and exportable diagram formats (XMI, SVG, PNG).

Development Capability Assessment

Evaluate core competencies through the following benchmarks:

- Minimum 3-year track record in software modeling tool development

- Dedicated R&D team comprising ≥15% of total staff, with expertise in graph theory, metadata modeling, and API integration

- Support for bidirectional engineering (code-to-model and model-to-code synchronization) across Java, C++, Python, and .NET frameworks

Cross-validate platform stability using uptime metrics (target >99.5% SLA) and customer-reported bug resolution times (ideal <48 hours).

Licensing and Transaction Safeguards

Prefer vendors offering flexible licensing models—per-user, floating, or site-wide—supported by transparent renewal terms. Require escrow agreements for source code access in mission-critical deployments to mitigate vendor lock-in risks. Conduct trial implementations to assess UI intuitiveness, collaboration features (real-time co-editing, commenting), and compatibility with CI/CD pipelines via REST APIs or plugin architectures.

What Are the Best Class Diagram Software Engineering Suppliers?

No supplier data available for analysis.

Performance Analysis

Without verified supplier profiles, procurement decisions should prioritize platforms demonstrating third-party validation through independent software audits, peer-reviewed publications, or inclusion in Gartner Magic Quadrant or Forrester Wave assessments. Established vendors typically offer higher integration depth with IDEs like Visual Studio and Eclipse, while newer entrants may excel in AI-assisted diagram generation and natural language parsing for auto-generated UML. Buyers should evaluate reorder rates and net promoter scores (NPS) where available, favoring solutions with documented user retention above 60% over 12-month periods.

FAQs

How to verify class diagram software engineering supplier reliability?

Validate certifications through official registries and review third-party penetration testing reports. Analyze user feedback on trusted forums such as Stack Overflow, GitHub repositories, and Capterra, focusing on update frequency, backward compatibility, and community plugin availability. Confirm GDPR, CCPA, or HIPAA compliance if handling personal or sensitive health data.

What is the average implementation timeline?

Standard deployment ranges from 1–3 weeks, including configuration, user training, and integration with existing repositories (e.g., Git, Jira). Complex enterprise rollouts involving single sign-on (SSO), LDAP synchronization, and custom metadata schemas require 6–8 weeks. Cloud-hosted solutions typically enable faster provisioning compared to on-premise installations.

Can suppliers support global team collaboration?

Yes, leading platforms provide real-time synchronization, multi-region hosting, and latency-optimized servers across AWS, Azure, or GCP infrastructures. Ensure support for concurrent editing, revision history, and conflict resolution mechanisms. Language localization and timezone-aware notifications enhance usability across distributed teams.

Do vendors offer free trials or samples?

Most suppliers provide time-limited free tiers (typically 14–30 days) with full feature access. Open-source variants such as PlantUML or ArgoUML allow perpetual use under specified licenses. Commercial vendors may waive trial restrictions for qualified organizations evaluating enterprise contracts.

How to initiate customization requests?

Submit detailed requirements covering diagram notation rules (UML 2.5 compliance), required integrations (Jenkins, Confluence, Postman), and performance thresholds (e.g., handling >500-class diagrams without lag). Reputable vendors respond with feasibility analyses within 5 business days and deliver proof-of-concept builds in 2–3 weeks.