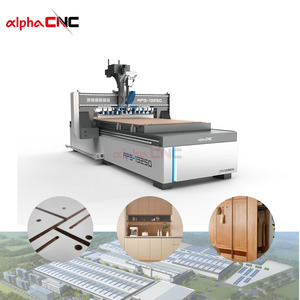

Cnc Router Machining Center

Top sponsor listing

Top sponsor listing

CN

CN

About cnc router machining center

Where to Find CNC Router Machining Center Suppliers?

China remains the dominant hub for CNC router machining center manufacturing, with Shandong province emerging as a key industrial cluster. Companies based in Jinan leverage concentrated supply chains for motion components—linear guides, ball screws, servo motors—and structural fabrication, enabling integrated production from casting to final assembly. This regional specialization supports cost efficiency, with localized sourcing reducing material procurement cycles by 20–30% compared to decentralized manufacturing regions.

The ecosystem around Jinan hosts vertically integrated facilities capable of producing high-precision gantry systems, vacuum worktables, and multi-axis spindles in-house. These suppliers benefit from proximity to steel processors and CNC component manufacturers, allowing rapid prototyping and scalable batch production. Buyers gain access to mature infrastructure where lead times for standard models average 30–45 days, while customized configurations are fulfilled within 60 days. The region’s logistics connectivity further enables efficient global shipping via Qingdao Port, a major export gateway for heavy machinery.

How to Choose CNC Router Machining Center Suppliers?

Procurement decisions should be guided by systematic evaluation of technical, operational, and transactional indicators:

Technical Capabilities Verification

Confirm supplier expertise in core technologies: helical rack drives, automatic tool changers (ATC), DSP or PC-based control systems, and six-sided drilling/milling integration. Machines designed for cabinet making, panel processing, or aerospace-grade composites require validated precision—look for repeatability within ±0.02mm. For woodworking applications, verify compatibility with vacuum clamping, air-cooled or water-cooled spindles (ranging 3–15kW), and nesting optimization software.

Production Infrastructure Assessment

Evaluate the following benchmarks:

- Minimum factory area of 3,000m² to support machining, assembly, and testing lines

- In-house capabilities for beam fabrication, gantry alignment, and electrical integration

- Dedicated R&D teams focused on automation features such as auto-loading/unloading, robotic welding integration, or IoT-enabled monitoring

- On-time delivery rate exceeding 95%, indicating reliable production planning and supply chain management

Cross-reference supplier claims with response time metrics (target ≤2 hours) and reorder rates as proxies for customer satisfaction and post-sale support quality.

Transaction Risk Mitigation

Utilize secure payment mechanisms such as escrow services that release funds only after machine verification at destination. Prioritize suppliers with documented quality management systems and third-party trade assurance participation. Conduct pre-shipment inspections to validate functionality, safety interlocks, and calibration accuracy. Request sample runs or video demonstrations of live cutting operations to assess real-world performance.

What Are the Best CNC Router Machining Center Suppliers?

| Company Name | Type | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Product Range | Key Features |

|---|---|---|---|---|---|---|---|---|

| Jinan Pinmai Cnc Equipment Co., Ltd. | Custom Manufacturer | Wood Routers, Boring Machines, Saw Machines | US $80,000+ | 80% | ≤4h | 57% | 15 models | Automatic tool changer, vacuum clamping, DSP control, six-sides drilling, gantry milling |

| Jinan Suntec Cnc Machinery Co., Ltd. | Manufacturer | Wood Routers, CNC Milling Machines, Laser Cutters | US $80,000+ | 100% | ≤3h | 50% | 5 models | 5-axis high-speed machining, ATC, horizontal drilling, heavy-duty bed |

| Jinan Rongchi Cnc Machinery Co., Ltd. | Manufacturer | Wood Routers, Foam & Cloth Cutting Machines | US $80,000+ | 100% | ≤2h | 50% | 5 models | Large-scale GRP boat machining, 5-axis milling, high-speed spindles |

| Jinan TechPro CNC Equipment Co., Ltd. | Multispecialty Supplier | Wood Routers, Cabinet Making Machines, 5-Axis Centers | US $590,000+ | 100% | ≤1h | 28% | 5 models | PTP drilling, dust aspiration, CAD/CAM compatibility, auto-lubrication |

| Jinan Extra Cnc Equipment Co., Ltd. | Manufacturer | Wood Routers, Plasma & Laser Engraving Machines | US $5,000+ | 100% | ≤1h | <15% | 5 models | 5-axis ATC routers, vertical milling centers, large-format cutting |

Performance Analysis

Jinan TechPro CNC stands out with the highest online revenue (US $590,000+), sub-one-hour response time, and full on-time delivery record, indicating strong operational efficiency despite a lower reorder rate. Its product line emphasizes automation and integration for furniture manufacturing, including PTP (point-to-point) drilling and nesting optimization. Jinan Suntec and Jinan Rongchi offer premium 5-axis solutions targeting specialized sectors like marine composite fabrication and high-speed mold making, with pricing reaching up to $205,000 for large-scale systems.

Jinan Pinmai offers broad customization across wood processing functions but reports an 80% on-time delivery rate, suggesting potential bottlenecks in fulfillment. Its 57% reorder rate indicates solid customer retention, likely driven by niche engineering capabilities. In contrast, Jinan Extra CNC, while fast-reacting and fully punctual, has minimal reorder activity and low reported revenue, which may reflect limited scalability or market penetration.

Buyers seeking high-volume, automated production lines should prioritize suppliers with proven experience in integrated systems—such as automatic loading, tool changers, and centralized lubrication. For prototyping or small-batch workshops, entry-level 3–4 axis models starting at $12,000 provide viable options with modular upgrade paths.

FAQs

How to verify CNC router machining center supplier reliability?

Validate ISO 9001 certification for quality management systems. Request evidence of CE marking for compliance with EU machinery directives. Review test reports for spindle runout, positional accuracy, and thermal stability. Analyze customer references focusing on after-sales service, spare parts availability, and software updates.

What is the typical MOQ and lead time?

Most suppliers set MOQ at 1 set, accommodating pilot purchases. Standard lead times range from 30–45 days for off-the-shelf models. Customized machines with extended beds, dual worktables, or robot integration may require 50–70 days for completion and factory acceptance testing.

Can suppliers provide customization?

Yes, leading manufacturers offer configurable options including working dimensions (e.g., 1300x2500mm), spindle power (6–15kW), drive systems (servo + ball screw or helical rack), control interfaces (DSP or Syntec/Fagor), and auxiliary systems like dust extraction, tool libraries, and vision alignment. Technical drawings and CAD models are typically required for non-standard requests.

Do suppliers support global shipping?

All listed suppliers export internationally. Confirm Incoterms (FOB, CIF, DDP) and packaging standards—machines are usually crated with anti-vibration mounts and moisture protection. Sea freight is standard for full-container loads; air shipment is available for urgent spare parts or compact units.

How to assess machine precision and durability?

Request cutting samples or video demonstrations showing edge finish, corner squareness, and through-hole consistency. Verify use of hardened linear rails (e.g., HIWIN, PMI), precision ball screws, and stress-relieved welded frames. Long-term durability is enhanced by automatic lubrication systems, sealed bearings, and robust cable carriers.