Cocoa Price Chart

About cocoa price chart

Where to Find Cocoa Price Chart Suppliers?

Global cocoa suppliers are increasingly concentrated in manufacturing and export hubs across Asia and West Africa, with notable clusters in China and Vietnam offering competitive pricing and scalable production. Chinese suppliers dominate in processed cocoa products such as cocoa powder, cocoa mass, and alkalized cocoa, leveraging vertically integrated supply chains from raw bean sourcing to final processing. These facilities benefit from proximity to port infrastructure and chemical processing zones, enabling cost-efficient bulk handling and export logistics.

Vietnamese exporters specialize in unprocessed or minimally refined cocoa liquor and beans, positioning themselves as primary sources for large-volume industrial buyers. The country’s favorable agricultural conditions support consistent yield cycles, allowing suppliers to maintain stable inventory levels year-round. Buyers gain access to streamlined procurement ecosystems where packaging, quality testing, and export documentation are managed in-house, reducing transaction complexity. Key advantages include low minimum order quantities (MOQs) for specialty grades, price transparency through real-time market indexing, and lead times averaging 15–25 days for containerized shipments.

How to Choose Cocoa Price Chart Suppliers?

Prioritize these verification protocols when selecting partners:

Quality Assurance & Compliance

Confirm adherence to international food safety standards such as ISO 22000, HACCP, or FSSC 22000. For EU and North American markets, verify compliance with FDA and EFSA regulations. Request certificates of analysis (COA) for microbial content, heavy metals, and fat percentage (cocoa butter content typically ranging 20–26%).

Production and Processing Capability

Evaluate supplier infrastructure based on:

- In-house roasting, grinding, and pressing facilities for full process control

- Dutch-processing (alkalization) capability for pH-modified cocoa powders

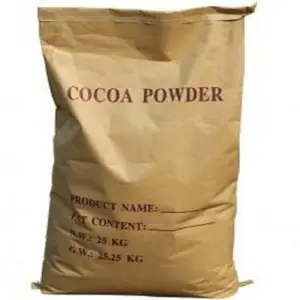

- Bulk packaging lines (25kg bags, 1-ton supersacks) compatible with automated filling systems

Cross-reference response time metrics (target ≤4 hours) and on-time delivery rates (>97%) to assess operational reliability.

Transaction and Sourcing Safeguards

Utilize secure payment mechanisms such as escrow services or letter of credit (L/C) terms for initial orders. Analyze historical transaction data, prioritizing suppliers with documented reorder rates above 15%. Conduct sample testing for flavor profile, solubility, and color consistency before scaling procurement. Free samples are available from select suppliers under conditional terms, often requiring proof of purchase intent.

What Are the Best Cocoa Price Chart Suppliers?

| Company Name | Main Products | Price Range | Min. Order | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|

| NV AGS Trading | Cocoa, Copy Paper, Animal Feed | $150–250 | 10–20 tons | Data not available | ≤8h | Data not available | Data not available |

| sentianherb LLC | Plant Extract, Food Additives, Cocoa Powder | $5–9.80 | 25 kg | Data not available | ≤4h | Data not available | Data not available |

| Kap (xiamen) Bio-Tech Co., Ltd. | Cocoa Powder, Organic Cocoa, Alkalized Cocoa | $4–8.50 | 1,000 kg | 97% | ≤2h | 17% | US $390,000+ |

| Shaanxi Saiyang Food Co., Ltd. | Low-Fat Cocoa Powder, Natural Cocoa | $4.20–9.50 | 5–25 kg | 99% | ≤2h | <15% | US $590,000+ |

| PHUC THINH VIETNAM IMPORT EXPORT CO., LTD | Cocoa Liquor, Cocoa Mass, Natural Cocoa | $5 | 4,000 tons | Data not available | ≤12h | Data not available | Data not available |

Performance Analysis

High-volume traders like PHUC THINH offer ultra-low pricing at massive scale (4,000-ton MOQ), ideal for industrial chocolate manufacturers seeking long-term contracts. In contrast, Chinese bio-tech and food processors such as Kap and Shaanxi Saiyang provide tighter quality control, faster response times (≤2h), and verified on-time delivery exceeding 97%, making them suitable for mid-sized buyers requiring reliability. Sentianherb LLC caters to niche markets with small MOQs and competitive pricing for raw cacao and extracts, though lacks verifiable performance metrics. NV AGS Trading serves bulk commodity buyers but offers limited transparency on delivery performance. Suppliers with US $390,000+ annual online revenue demonstrate consistent export activity and market presence.

FAQs

How to verify cocoa supplier reliability?

Cross-check food safety certifications with issuing bodies. Request batch-specific COAs for moisture, ash, and fat content. Analyze customer feedback focusing on product consistency, packaging integrity, and customs documentation accuracy.

What is the typical lead time for cocoa shipments?

Standard production and packing require 10–15 days. Add 15–30 days for sea freight depending on destination. Air shipping reduces transit to 5–7 days but increases costs significantly for bulk orders.

Can cocoa suppliers accommodate custom specifications?

Yes, many suppliers offer customization in fat content, particle size, pH level (for Dutch-processed cocoa), and organic certification. Packaging can be tailored with private labeling, multilingual printing, and moisture-resistant materials.

Do suppliers provide free cocoa samples?

Select suppliers offer free samples for qualified buyers, typically limited to 1–2 kg. Conditions may include providing company registration details or committing to a minimum future order volume.

What are common cocoa pricing benchmarks?

Prices vary by form: raw beans ($1,500–2,500/ton), cocoa mass ($1,700–2,200/ton), and cocoa powder ($4–10/kg). Fluctuations align with ICCO composite indicators and futures markets (ICE/NYBOT). Buyers should reference live cocoa price charts to time procurement during market dips.