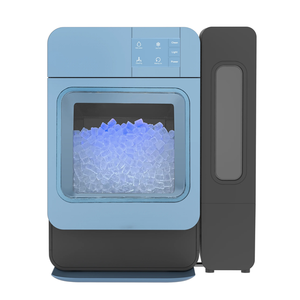

Compact Crushed Ice Maker

1/21

1/21

1/10

1/10

1/18

1/18

1/8

1/8

1/19

1/19

1/17

1/17

1/41

1/41

About compact crushed ice maker

Where to Find Compact Crushed Ice Maker Suppliers?

China remains the central hub for compact crushed ice maker manufacturing, with key production clusters in Fujian, Shandong, and Qingdao regions. Xiamen-based suppliers dominate in OEM/ODM export capacity, leveraging established logistics networks for efficient global distribution. The concentration of component manufacturers—compressors, evaporators, and food-grade plastic molds—within these zones enables vertically integrated production, reducing unit costs by 15–25% compared to non-specialized regions.

Suppliers in these industrial hubs operate within mature ecosystems that include refrigeration engineers, mold fabrication workshops, and packaging specialists within a 50km radius. This proximity supports rapid prototyping and shortens lead times, typically 25–35 days for standard orders. Buyers benefit from scalable output, with leading facilities capable of monthly production volumes exceeding 10,000 units. Localized supply chains also enhance flexibility for both bulk procurement and customized configurations, including color, logo, and capacity modifications.

How to Choose Compact Crushed Ice Maker Suppliers?

Effective supplier selection requires structured evaluation across technical, operational, and transactional dimensions:

Quality Assurance & Compliance

Prioritize suppliers with verifiable adherence to international standards such as CE, RoHS, and ISO 9001. These certifications confirm compliance with electrical safety, material toxicity limits, and quality management systems essential for market entry in Europe and North America. Request test reports for compressor efficiency, noise levels (typically 40–50 dB), and ice production cycles to validate performance claims.

Production & Customization Capacity

Assess operational infrastructure through the following benchmarks:

- Minimum facility size supporting batch production (≥3,000m² preferred)

- In-house design or engineering teams enabling OEM/ODM development

- Capability for material, color, labeling, and packaging customization

Cross-reference stated production capacity with online revenue metrics and reorder rates. Suppliers with sustained online revenue above US $290,000 demonstrate consistent order fulfillment and market demand.

Procurement Terms & Risk Mitigation

Evaluate minimum order quantities (MOQ) relative to your distribution scale. MOQs vary significantly—from 1 piece for sample testing to 585 pieces for volume pricing. Use third-party inspection services pre-shipment to verify build quality and functionality. Favor suppliers offering Trade Assurance or escrow-compatible transactions to mitigate financial risk. Sample validation is critical; expect 7–14 days for prototype delivery and 3–5 days for air freight shipping.

What Are the Best Compact Crushed Ice Maker Suppliers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | MOQ Range | Price Range (USD) | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Xiamen Sunford Industry Trade Co., Ltd. | Fujian, CN | Compact ice makers, self-cleaning models | US $290,000+ | 100% | ≤5h | 50–585 pcs | $75–$135 | <15% |

| Neaptech (Qingdao) Co., Ltd. | Qingdao, CN | Portable, bullet, and clear cube ice makers | US $10,000+ | 100% | ≤2h | 1–3 pcs | $39–$115 | <15% |

| Xiamen Beiruikang Technology Co., Ltd. | Fujian, CN | Electric countertop, mini, and household ice makers | US $290,000+ | 100% | ≤2h | 1 pc | $38–$180 | <15% |

| Cixi Jirui Electric Appliance Co., Ltd. | Zhejiang, CN | Ice crushers, shaved ice machines, blenders | US $1,000+ | 50% | ≤6h | 2–10 pcs | $18.50–$200 | <15% |

| Shandong Chenxiang Machinery Equipment Co., Ltd. | Shandong, CN | Nugget ice makers, commercial snack machines | US $40,000+ | 87% | ≤2h | 1–2 pcs | $19–$1,535 | <15% |

Performance Analysis

Xiamen-based suppliers like Sunford and Beiruikang lead in export volume and production consistency, backed by high online revenues and 100% on-time delivery records. Neaptech stands out for low MOQs (as low as 1 piece) and rapid response times (≤2h), ideal for small businesses or sampling. While Cixi Jirui offers competitive pricing, its 50% on-time delivery rate presents fulfillment risks. Shandong Chenxiang caters to niche markets with premium nugget ice models but at significantly higher price points. Buyers seeking reliability should prioritize suppliers with verified 100% on-time delivery and response times under 5 hours.

FAQs

How to verify compact crushed ice maker supplier reliability?

Validate certifications (CE, RoHS) through issuing bodies and request product test reports for electrical safety and ice yield. Analyze supplier transaction history, focusing on on-time delivery rates, reorder frequency, and customer dispute resolution. Conduct video audits to confirm factory operations and quality control processes.

What is the typical lead time for production and shipping?

Standard production lead time ranges from 25 to 35 days after order confirmation. Air freight delivery takes 5–10 days for samples or small batches; sea freight requires 25–35 days for full container loads. Expedited production may reduce timelines by 7–10 days at additional cost.

Can suppliers provide custom branding and design?

Yes, multiple suppliers offer OEM services including custom colors, logos, packaging, and user interface labeling. Minimum order thresholds apply, typically starting at 500 units for full branding customization. Prototypes are usually available within 10–14 days upon design submission.

What are common MOQ and pricing structures?

MOQs range from 1 piece for trial orders to 585 pieces for lowest unit pricing. Unit prices vary from $18.50 for basic ice crushers to $1,535 for multi-nozzle commercial models. Economies of scale are significant—ordering 500+ units can reduce per-unit costs by 20–30%.

How to assess ice maker performance before bulk ordering?

Request functional samples to evaluate ice production speed (typically 6–20 kg/24h), noise level, ease of cleaning, and bin capacity. Test under real-world conditions to verify durability and energy consumption. Confirm warranty terms and availability of spare parts prior to full-scale procurement.