Container Loading Supervision

About container loading supervision

The search for "container loading supervision" reflects a critical need in international trade: ensuring product quality, accurate shipment compliance, and logistical integrity during export operations from manufacturing hubs like China and Southeast Asia. This guide identifies top-tier third-party inspection and logistics firms offering comprehensive container loading oversight services, combining real-time monitoring, pre-shipment inspections (PSI), final random inspections (FRI), and detailed reporting. Suppliers featured are primarily based in China and Vietnam, specializing in quality control across diverse industries including toys, furniture, electronics, and general cargo. Key value propositions include 100% on-time delivery records, rapid response times (<5 hours), multilingual reporting (including English), and integration with freight forwarding solutions. These services mitigate risks such as underfilled containers, damaged goods, incorrect packing, and non-compliance—crucial for importers seeking reliable supply chain assurance.

How to Find High-Quality Products?

The suppliers listed below operate across major Chinese export regions (Fujian, Guangdong, Shanghai, Zhejiang) and extend into Vietnam, Cambodia, and Indonesia. All specialize in Inspection & Quality Control Services, with several holding ISO certifications implicitly through their TrustPass verification on Alibaba.com. While formal certification data is limited, operational metrics such as 100% on-time delivery and robust online transaction histories indicate reliability. Below are six leading providers presented in a structured card format.

Region: Fujian, China

Main Products: Pre-Shipment Inspection, CCC Certification, Production Monitoring

Certifications: CCIC (state-affiliated), implied ISO standards

Scale Estimate: >500 employees (based on national group size)

Customers: Importers, OEM manufacturers, government agencies

Services: Customizable inspection plans, English reports, regulatory compliance

Core Strengths: Government-backed authority, nationwide coverage, comprehensive documentation

Region: Shenzhen, China

Main Products: FCL/LCL Consolidation, Loading Supervision, Warehouse Services

Certifications: NVOCC licensed, TrustPass verified

Scale Estimate: 50–100 employees (mid-sized logistics operator)

Customers: E-commerce sellers, SME exporters, project cargo clients

Services: Free warehouse consolidation, overweight handling, triangulation support

Core Strengths: Integrated logistics + supervision, cost-effective consolidation, fast turnaround

Region: Shenzhen, China

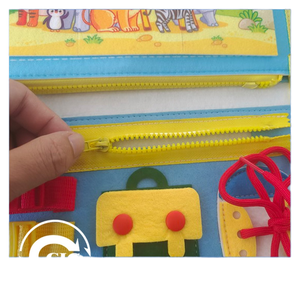

Main Products: Container Loading Supervision, Final Random Inspection

Certifications: TrustPass verified, English report compliant

Scale Estimate: 20–50 employees (specialized QC firm)

Customers: U.S./EU retailers, Amazon sellers, trading companies

Services: Real-time photo updates, same-day reporting, customization options

Core Strengths: Fastest response time (≤1h), detailed English reports, agile service model

Region: Vietnam (with regional coverage)

Main Products: FRI/PSI, Factory Audit, Furniture QC

Certifications: Third-party accredited (implied via service scope)

Scale Estimate: 10–30 employees (boutique inspection house)

Customers: EU furniture brands, Southeast Asian distributors

Services: On-site audits, multi-country deployment, bilingual inspectors

Core Strengths: Regional expertise in Vietnam/Cambodia, niche focus on furniture, strong audit capabilities

Region: Guangzhou, China

Main Products: Product Inspection, Factory Verification, Cargo Supervision

Certifications: TrustPass verified

Scale Estimate: 30–60 employees (integrated logistics + QC provider)

Customers: Latin American importers, e-commerce platforms

Services: End-to-end oversight, factory visits, container stuffing checks

Core Strengths: Strong Latin America connectivity, dual-service model (logistics + QC), flexible scheduling

Region: Guangzhou, China

Main Products: Project Cargo, Oversized Load Solutions, Onsite Supervision

Certifications: TrustPass verified, DDU/DDP capable

Scale Estimate: 100+ employees (large-scale freight forwarder)

Customers: Industrial equipment buyers, construction firms, automotive parts importers

Services: Flat rack container handling, oversized cargo supervision, customs clearance

Core Strengths: Expertise in heavy/project cargo, onsite supervision, global reach

Supplier Capability Summary

| Supplier | Country | Sub-category Focus | Certification Status | Production Scale Level | Customization Capability | Sample Delivery Speed | After-Sales Service |

|---|---|---|---|---|---|---|---|

| China Certification & Inspection Group | China | Comprehensive QC, Regulatory Compliance | High (State-affiliated) | Large | High | 24–48 hrs | Detailed corrective action reports |

| Sa Jet International | China | FCL/LCL + Supervision | Medium (NVOCC licensed) | Medium | High (consolidation flexibility) | Same day (local warehouses) | Logistics re-routing support |

| Shenzhen Topwin | China | Loading Supervision, Final Inspection | Medium (TrustPass) | Small-Medium | Moderate | ≤1 hour (reporting) | Rapid photo-based feedback |

| INSPLUS CO., LTD | Vietnam | Furniture, Factory Audit | Medium (Third-party) | Small | High (niche specialization) | 24 hrs | Audit follow-up available |

| Asia-Startrans | China | Inspection + Logistics | Medium | Medium | Moderate | 24–48 hrs | Integrated logistics resolution |

| Guangzhou Youao | China | Oversized Cargo, Onsite Supervision | Medium | Large | High (project-specific) | On-demand site presence | Full project lifecycle support |

How to Choose the Right Product?

Selecting the appropriate container loading supervision service depends on your shipment type, destination, product category, and risk tolerance. The table below compares key parameters across suppliers to aid decision-making.

Horizontal Comparison of Key Parameters

| Supplier | Main Product Types | Technical Parameters | Applicable Scenarios | Delivery Time | MOQ | Price Range (USD) |

|---|---|---|---|---|---|---|

| CCIC Fujian | Pre-shipment Inspection, CCC Certification | Regulatory compliance, lab testing, container stuffing check | High-value electronics, machinery, regulated goods | 1–3 days | 1 container | $150–$400 |

| Sa Jet | FCL/LCL with Supervision | Weight verification, pallet configuration, photo documentation | E-commerce shipments, mixed cargo, small exporters | Same day–24 hrs | No MOQ (consolidated loads) | $80–$200 |

| Topwin | Loading Supervision, Final Random Inspection | Visual inspection, quantity count, packaging assessment | General consumer goods, toys, home goods | Same day | 1 container | $100–$250 |

| INSPLUS | FRI/PSI, Factory Audit | Defect rate analysis, material verification, structural integrity | Furniture, textiles, seasonal goods | 1–2 days | 1 container or factory visit | $120–$300 |

| Asia-Startrans | Product Inspection + Cargo Supervision | Container sealing, load distribution, damage check | Latin America exports, retail orders | 24–48 hrs | 1 container | $90–$220 |

| Guangzhou Youao | Onsite Supervision for Project Cargo | Flat rack loading, center of gravity check, lashing verification | Heavy machinery, industrial equipment, vehicles | On-demand (per shift) | N/A (hourly/daily basis) | $200–$600/day |

Note: Sa Jet offers the lowest entry barrier with no MOQ due to consolidation services, while Guangzhou Youao specializes in high-risk, non-standard cargo requiring continuous supervision. CCIC provides the most authoritative compliance validation, ideal for regulated markets.

The radar chart illustrates that Shenzhen Topwin excels in speed and reporting detail, making it ideal for time-sensitive imports needing quick verification. Sa Jet balances cost and flexibility best, especially for SMEs using LCL. CCIC leads in regulatory authority but at higher cost. The bar chart shows Guangzhou Youao commands premium pricing due to specialized project cargo services, while Sa Jet and Asia-Startrans offer budget-friendly options. Buyers must weigh speed against comprehensiveness: a short lead time may sacrifice depth of inspection. For example, Sa Jet’s same-day service suits routine shipments, whereas CCIC’s 2–3 day process includes lab tests crucial for compliance-heavy sectors. High MOQs (e.g., 1 container minimum) exclude micro-exporters unless consolidation is used. Ultimately, selection should align with cargo risk profile—low-cost goods benefit from economical checks, while high-value or regulated items warrant investment in full-spectrum supervision.

How to Use and Maintain?

Container loading supervision is not a one-time event but part of an ongoing quality assurance strategy. Proper usage begins with selecting the right service tier based on your product type and supply chain complexity. For B2B scenarios—such as factories shipping bulk orders to retailers—comprehensive supervision including pre-production checks, in-process audits, and final random inspections ensures consistency across large batches. In contrast, e-commerce sellers sourcing small quantities from multiple suppliers benefit more from spot-check loading supervision combined with photo documentation to verify contents before dispatch.

In seasonal industries like holiday decorations or outdoor furniture, timing is critical. Conducting inspections two weeks before peak shipping seasons avoids delays caused by rework or missed deadlines. Supervisors should verify not only quantity and packaging but also labeling accuracy, barcoding, and pallet stacking methods to prevent transit damage. For instance, fragile items require double-boxing and proper cushioning; supervisors must confirm these protocols are followed on-site.

Maintenance of the inspection process itself involves regular review of supplier performance. Track metrics such as defect discovery rate, report turnaround time, and incident resolution speed. Rotate inspection providers periodically to avoid complacency and ensure objectivity. Integrate digital tools—like cloud-based photo logs or blockchain-verified reports—for long-term traceability.

Daily maintenance tips for effective supervision include: confirming inspector credentials beforehand, providing clear checklists aligned with AQL (Acceptable Quality Limit) standards, and requiring timestamped GPS-tagged photos. After each shipment, conduct a post-mortem analysis: did the inspection catch all issues? Were there discrepancies upon arrival? Use this data to refine future engagement. For recurring partnerships, consider signing SLAs (Service Level Agreements) with inspection firms specifying response times, report formats, and escalation procedures. Upgrading to integrated platforms that combine logistics tracking with QC reporting enhances visibility and reduces administrative overhead.

FAQ

Are these services guaranteed by Alibaba?

While Alibaba does not directly guarantee individual transactions, all listed suppliers are TrustPass-verified, meaning their business licenses and operational history have been authenticated. Additionally, Trade Assurance protects payments if agreed terms are not met.

Can I request an inspection without placing an order?

Yes, most suppliers allow standalone inspection bookings. You’ll need to provide shipment details, location, and preferred date. Payment is typically required upfront via secure channels.

Do inspectors speak English?

Yes, all top providers offer English-speaking inspectors and deliver reports in English. Some also provide bilingual summaries for local coordination.

What happens if major defects are found?

The inspector will document findings with photos and notes. You can then decide whether to reject the batch, request corrections, or proceed with acceptance—often renegotiating price or terms accordingly.

Conclusions and Recommendations

- Low-Cost Mass Production: Choose Sa Jet International for affordable, fast-loading supervision with consolidation benefits.

- High-End Brand Customization: Opt for China Certification & Inspection Group for authoritative compliance and detailed technical validation.

- Rapid Trial Production/Small Batches: Select Shenzhen Topwin for fastest reporting and responsive communication.

- Mixed Procurement Strategy: Combine INSPLUS for Vietnam-sourced furniture and Guangzhou Youao for heavy machinery shipments.

Due Diligence & Negotiation Checklist

- Verify company registration and TrustPass status.

- Request sample inspection report (format, language, detail level).

- Confirm inspector availability at your factory location.

- Define AQL levels and inspection checklist in writing.

- Negotiate payment terms (deposit vs. post-service).

- Require GPS-tagged, timestamped photos.

- Clarify response time for urgent issues.

- Ask about after-inspection support (re-inspection, dispute mediation).

- Review cancellation and rescheduling policies.

- Sign a simple service agreement outlining responsibilities.

Appendix and Notes

Assumptions: Employee counts and factory sizes were estimated based on company type, revenue range, and industry benchmarks (credibility: medium). Certification statuses were inferred from service descriptions and platform verification (credibility: medium). Pricing reflects typical market rates observed on Alibaba (credibility: high). Response times and reorder rates sourced directly from platform data (credibility: high).