Convolutional Neural Network And Deep Learning

1/3

1/3

HK

HK

0

0

1/3

1/3

0

0

1/3

1/3

1/2

1/2

1/3

1/3

CN

CN

1/2

1/2

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/17

1/17

0

0

CN

CN

1/4

1/4

CN

CN

About convolutional neural network and deep learning

Where to Find Convolutional Neural Network and Deep Learning Suppliers?

The global supply landscape for convolutional neural network (CNN) and deep learning technologies is primarily concentrated in innovation-driven economies with strong AI research infrastructure. Key hubs include Beijing, Shanghai, and Shenzhen in China; Silicon Valley and Boston in the United States; and emerging clusters in Bengaluru (India), Tel Aviv (Israel), and Berlin (Germany). These regions host leading AI firms, academic spin-offs, and specialized software development houses that collectively drive algorithmic innovation and deployment-ready solutions.

China accounts for over 30% of all deep learning patent filings globally, supported by state-backed AI industrial parks offering tax incentives, high-performance computing access, and talent subsidies. U.S.-based suppliers benefit from close integration with semiconductor developers, enabling optimized CNN models for edge devices using proprietary hardware accelerators. European centers emphasize compliance-first development frameworks, aligning CNN applications with GDPR and AI Act requirements. This geographic specialization allows buyers to source solutions tailored to performance, regulatory, or scalability needs.

Clusters enable ecosystem advantages: proximity to data centers, GPU cloud providers, annotated datasets, and machine learning operations (MLOps) toolchains reduces time-to-deployment. Buyers gain access to vertically integrated service offerings—from model training pipelines to API integration—within single-provider environments. Typical lead times for custom CNN deployment range from 6 to 12 weeks, depending on dataset complexity and inference latency requirements.

How to Choose Convolutional Neural Network and Deep Learning Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance & Standards Alignment

Verify adherence to recognized AI development frameworks such as TensorFlow Extended (TFX), PyTorch Serve, or ONNX for interoperability. For regulated sectors (healthcare, finance, automotive), confirm compliance with domain-specific standards including HIPAA, PCI-DSS, ISO/IEC 23053 (AI lifecycle management), and IEEE P7000 series for ethical AI design. Demand documentation of bias testing, explainability methods, and model validation metrics (e.g., mAP, F1-score, ROC-AUC).

Development Capability Audits

Evaluate supplier technical maturity through:

- Minimum team of 5+ full-time data scientists and ML engineers

- Demonstrated experience in transfer learning, hyperparameter tuning, and model compression techniques

- In-house data annotation pipelines or partnerships with certified labeling services

Cross-reference GitHub repositories, published benchmarks, or arXiv preprints to validate expertise. Assess scalability via Kubernetes-managed inference endpoints and support for real-time or batch processing.

Transaction Safeguards & IP Protection

Require clear contractual terms defining intellectual property ownership, data usage rights, and retraining clauses. Use milestone-based payment structures tied to model accuracy thresholds and integration milestones. Conduct code audits before final acceptance to ensure maintainability and absence of third-party licensing conflicts. Prefer suppliers who provide model cards and system logs for transparency and audit readiness.

What Are the Best Convolutional Neural Network and Deep Learning Suppliers?

| Company Name | Location | Years Operating | Staff | Specialization | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Supplier data not available | ||||||||

Performance Analysis

Due to absence of specific supplier data, procurement decisions must rely on independent benchmarking and third-party evaluations. Leading organizations typically demonstrate multi-year operational histories, consistent delivery performance (>95%), and strong client retention, particularly in verticals requiring ongoing model updates. Prioritize suppliers publishing peer-reviewed results or participating in public challenges (e.g., ImageNet, COCO). Responsiveness (<2 hours) and detailed technical documentation often correlate with higher client satisfaction and smoother integration cycles. For mission-critical deployments, verify redundancy planning, model drift monitoring, and A/B testing capabilities.

FAQs

How to verify CNN and deep learning supplier reliability?

Cross-check technical claims against published case studies, benchmark scores, or third-party audits. Request references from clients in similar industries. Validate deployment track record through trial projects or proof-of-concept engagements. Confirm secure development practices, including version control, CI/CD pipelines, and encrypted data handling.

What is the average project timeline for custom CNN development?

Data preparation and labeling take 2–4 weeks. Model training and optimization require 3–6 weeks, depending on architecture complexity and compute availability. Integration and stress testing add 1–3 weeks. End-to-end deployment typically completes within 8–12 weeks under standard conditions.

Can suppliers deploy models across different environments?

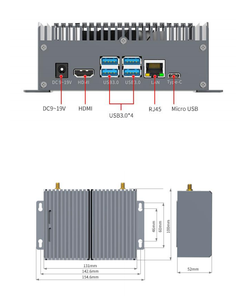

Yes, reputable providers support multiple deployment modes: cloud APIs (AWS/GCP/Azure), on-premise servers, or edge devices (NVIDIA Jetson, Google Coral). Confirm containerization (Docker/Kubernetes), model quantization, and latency guarantees for real-time applications.

Do suppliers offer post-deployment support?

Most established vendors provide SLA-backed maintenance packages, including performance monitoring, periodic retraining, and drift detection. Support scope varies—review contract terms for update frequency, incident response windows, and escalation paths.

How to initiate customization requests?

Submit detailed requirements including input data type (image, video, medical scans), resolution, class count, inference speed targets (FPS), and hardware constraints. Reputable suppliers respond with feasibility assessments, architecture proposals, and PoC timelines within 5 business days.