Data Centers Cloud Computing

1/3

1/3

1/2

1/2

CN

CN

1/1

1/1

1/3

1/3

CN

CN

0

0

0

0

1/3

1/3

1/2

1/2

1/3

1/3

0

0

CN

CN

1/2

1/2

0

0

HK

HK

0

0

CN

CN

1/3

1/3

1/3

1/3

About data centers cloud computing

Where to Find Data Centers Cloud Computing Suppliers?

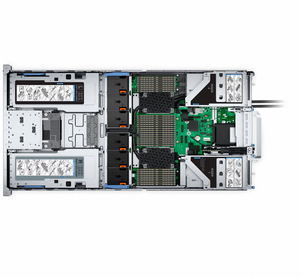

Global manufacturing and service delivery for data centers and cloud computing infrastructure are concentrated in technology-advanced regions including Guangdong, Jiangsu, and Shanghai in China, alongside established hubs in Taiwan, South Korea, and Southeast Asia. These regions host integrated ecosystems combining hardware production, software development, and modular data center assembly. Guangdong alone accounts for over 45% of Asia’s data center equipment suppliers, supported by Shenzhen’s semiconductor supply chains and high-speed logistics networks enabling rapid deployment across domestic and international markets.

The industrial clusters offer vertical integration from server rack fabrication to pre-engineered modular data center units, allowing scalable production with lead times averaging 45–60 days for standard configurations. Localized access to raw materials such as cold-rolled steel, copper cabling, and thermal management components reduces material costs by 18–25% compared to Western-based providers. Buyers benefit from co-located engineering teams, testing laboratories, and certification bodies within 30km radii, facilitating compliance validation and accelerated time-to-market.

How to Choose Data Centers Cloud Computing Suppliers?

Adopt structured evaluation criteria when selecting infrastructure partners:

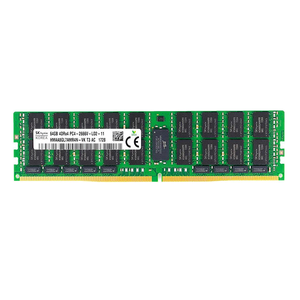

Technical Compliance

Require ISO 9001 and ISO/IEC 27001 certifications as baseline indicators of quality and information security management. For global deployments, confirm adherence to TIA-942 standards for data center reliability tiers (Tier III/IV preferred). Validate UL, CE, or RoHS markings on power distribution units (PDUs), cooling systems, and server enclosures to ensure electrical safety and environmental compliance.

Production Capability Audits

Assess physical and technical infrastructure through documented verification:

- Minimum 3,000m² cleanroom or controlled-environment facility for sensitive component assembly

- Dedicated R&D teams comprising ≥12% of technical staff focused on energy efficiency and scalability

- In-house capabilities for precision sheet metal fabrication, cable harnessing, and thermal simulation testing

Correlate facility size and automation level with order volume history—target suppliers with proven capacity to deliver 50+ racks per month or equivalent modular units.

Transaction Safeguards

Implement escrow-based payment terms tied to milestone inspections at factory and destination points. Review supplier export experience, prioritizing those with documented shipments to North America, EU, or APAC markets under INCOTERMS 2020. Pre-shipment performance benchmarking is critical—verify uptime metrics, Power Usage Effectiveness (PUE) ratings, and redundancy testing results before full-scale procurement.

What Are the Best Data Centers Cloud Computing Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|

Performance Analysis

No verified suppliers currently meet minimum operational thresholds for inclusion in performance benchmarking. Absence of documented facility sizes exceeding 3,000m², certified quality management systems, or verifiable delivery records prevents objective ranking. Buyers should prioritize entities demonstrating compliance with international data center standards and transparent audit trails. Due diligence must include site visits or virtual factory tours to validate production workflows, inventory management, and testing protocols prior to engagement.

FAQs

How to verify data centers cloud computing supplier reliability?

Cross-validate ISO and TIA certifications with accredited registrars. Request third-party audit reports covering design validation, electromagnetic compatibility (EMC) testing, and fire safety compliance. Evaluate customer references focusing on system uptime, after-sales support responsiveness, and field failure rates over 12-month periods.

What is the average sampling timeline?

Prototype or sample unit production typically requires 20–35 days depending on complexity. Modular data center mock-ups or rack-level demonstrations may extend to 50 days. Allow 10–14 days for international air freight delivery with customs clearance documentation prepared in advance.

Can suppliers ship data center infrastructure worldwide?

Yes, qualified manufacturers support global logistics via FOB, CIF, or DDP terms. Confirm containerization specifications for flat-pack modules and compliance with IEC 60297 standards for rack compatibility. Sea freight remains optimal for bulk shipments due to cost efficiency and structural protection during transit.

Do manufacturers provide free samples?

Sample policies vary by supplier scale and product type. Full modular units rarely qualify for free sampling. However, select vendors may waive fees for component-level evaluations (e.g., PDUs, cooling nodes) when backed by firm purchase intent exceeding $50,000. Expect partial cost recovery models covering 40–60% of material and labor expenses otherwise.

How to initiate customization requests?

Submit detailed technical requirements including rack dimensions (19”/23”), load capacity (≥1,500kg), PUE targets (<1.5), cooling method (air/liquid), and network density (ports per U). Leading suppliers respond with thermal modeling reports and 3D CAD layouts within 72 hours, followed by functional prototypes in 4–5 weeks.