Data Security And Network Security

0

0

1/3

1/3

0

0

1/3

1/3

1/12

1/12

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/2

1/2

1/3

1/3

1/17

1/17

0

0

1/3

1/3

1/3

1/3

1/7

1/7

1/3

1/3

1/3

1/3

About data security and network security

Where to Find Data Security and Network Security Suppliers?

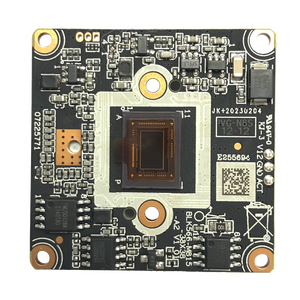

The global data and network security hardware manufacturing landscape is highly decentralized, with key production hubs in China, the United States, Germany, and Taiwan. Chinese suppliers—particularly those based in Guangdong, Jiangsu, and Zhejiang provinces—dominate mid-to-high volume production of network infrastructure components such as firewalls, intrusion detection systems (IDS), and secure routers. These regions host integrated electronics ecosystems supported by semiconductor packaging facilities, PCB fabrication plants, and firmware development centers, enabling end-to-end device manufacturing within localized supply chains.

Industrial clusters in Shenzhen and Dongguan offer rapid prototyping and scalable assembly lines, reducing time-to-market by 25–40% compared to Western counterparts. Meanwhile, U.S.-based manufacturers focus on high-assurance cryptographic modules and FIPS 140-2/3 validated solutions, often serving government and defense sectors. German and Nordic suppliers emphasize compliance with GDPR and EN 303 645 standards, specializing in secure IoT gateways and industrial control system (ICS) protection devices. The convergence of regional expertise allows buyers to balance cost-efficiency with stringent regulatory alignment depending on deployment environment.

How to Choose Data Security and Network Security Suppliers?

Procurement decisions should be guided by rigorous technical and operational verification protocols:

Compliance & Certification Verification

Confirm adherence to internationally recognized standards including ISO/IEC 27001 for information security management, Common Criteria (CC) EAL4+ for product evaluation, and NIST SP 800-171 where applicable. For EU markets, verify CE marking with EMC and RoHS directives. Suppliers targeting financial or healthcare sectors must demonstrate PCI DSS or HIPAA-compliant design principles in documentation.

Production and R&D Capacity Assessment

Evaluate supplier infrastructure through the following benchmarks:

- Minimum 3,000m² cleanroom or ESD-safe production area for hardware assembly

- Dedicated firmware development team with version-controlled CI/CD pipelines

- In-house testing labs capable of penetration testing, vulnerability scanning, and side-channel analysis

Cross-reference facility size with monthly output capacity (target ≥1,000 units for enterprise-grade appliances) and validate scalability via historical order fulfillment records.

Supply Chain Transparency and Transaction Security

Require full bill-of-materials (BOM) disclosure to assess component origin and mitigate counterfeit risk. Prioritize suppliers utilizing trusted foundries and licensed silicon partners (e.g., Intel, NXP, Infineon). Implement escrow payment terms tied to independent pre-shipment inspection, particularly for first-time engagements. Conduct sample validation using third-party labs to verify encryption strength, boot integrity, and tamper resistance before mass procurement.

What Are the Best Data Security and Network Security Suppliers?

No supplier data was available for inclusion in this report. Market analysis is currently limited due to absence of verifiable operational metrics such as factory size, delivery performance, certification status, and workforce composition. Buyers are advised to conduct direct audits or request documented evidence of compliance and production capability when evaluating potential partners.

Performance Analysis

In the absence of quantifiable supplier profiles, sourcing strategies should prioritize vendors with published audit trails, participation in recognized cybersecurity alliances (e.g., OIX, CSA), and transparent vulnerability disclosure policies. Long-term engagement risk decreases significantly when suppliers undergo annual third-party assessments and maintain active CVE reporting records. For mission-critical deployments, favor organizations with demonstrated export experience to regulated industries and multi-region compliance certifications.

FAQs

How to verify data security and network security supplier reliability?

Validate certifications through official databases (e.g., NIST CMVP, IAF CertSearch). Request redacted copies of recent SOC 2 Type II reports and internal QA test logs. Assess software supply chain hygiene by reviewing SBOM (Software Bill of Materials) availability and open-source license compliance.

What is the average sampling timeline?

Standard hardware samples require 20–35 days for configuration, flashing, and functional testing. Devices requiring custom firmware or unique cryptographic keys may extend lead times to 50 days. Air freight adds 5–10 business days for international delivery.

Can suppliers ship data security equipment worldwide?

Yes, but export controls apply. Confirm ITAR, EAR, or Wassenaar Arrangement compliance for encrypted products. Suppliers must provide ECCN classification and assist with licensing procedures for restricted destinations. Sea freight is viable only for non-sensitive configurations due to extended transit exposure risks.

Do manufacturers provide free samples?

Sample fees are standard due to embedded software licensing and hardware costs. Full reimbursement typically applies upon placement of orders exceeding $15,000. Educational or research institutions may qualify for discounted evaluation kits under NDA.

How to initiate customization requests?

Submit detailed technical requirements including cryptographic algorithms (AES-256, SHA-3), key management architecture (HSM integration, PKI support), interface specifications (SFP+, QSFP28), and environmental ratings (IP67, MIL-STD-810G). Reputable suppliers respond with feasibility assessments within 5 business days and deliver engineering prototypes within 4–6 weeks.