Delta Emulator

0

0

1/5

1/5

1/1

1/1

1/3

1/3

1/3

1/3

0

0

0

0

1/7

1/7

0

0

1/1

1/1

1/15

1/15

1/3

1/3

0

0

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

About delta emulator

Where to Find Delta Emulator Suppliers?

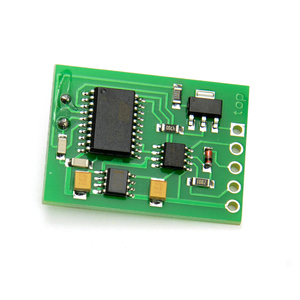

China serves as the central hub for delta emulator manufacturing, with key production clusters concentrated in Shenzhen and Chengdu. These regions host specialized electronics firms leveraging vertically integrated supply chains and proximity to semiconductor distributors, PCB fabricators, and logistics networks. Shenzhen-based suppliers benefit from access to one of Asia’s most advanced electronics ecosystems, enabling rapid prototyping and scalable assembly. Chengdu contributes niche technical expertise in automotive immobilizer and ECU simulation technologies, particularly for multi-brand compatibility applications.

The industrial concentration supports cost efficiency and fast turnaround. Localized component sourcing reduces material lead times by 20–35% compared to offshore alternatives. Most facilities operate SMT lines with automated testing stations, supporting batch production from prototype to volume runs. Buyers gain access to flexible MOQs (as low as 1 piece) and short development cycles—typically 7–14 days for standard emulator models. The ecosystem also facilitates integration with diagnostic software platforms and firmware customization for specific vehicle ECUs or industrial controllers.

How to Choose Delta Emulator Suppliers?

Effective supplier selection requires structured evaluation across three core areas:

Technical Capability Verification

Confirm supplier experience with target emulator types: automotive IMMO off devices, JTAG debuggers, or universal ECU simulators. Review product specifications for protocol support (e.g., CAN bus, K-Line), voltage tolerance, and microcontroller compatibility (PIC, Renesas, TI DSP). Prioritize suppliers offering test reports or demonstration videos showing successful key programming or ECU emulation sequences.

Production & Quality Assurance Assessment

Evaluate operational metrics derived from verifiable performance data:

- On-time delivery rate exceeding 97%

- Average response time under 2 hours for inquiry resolution

- In-house R&D capacity indicated by firmware updates or new model releases

- Compliance with RoHS and ISO 9001 standards where applicable

Cross-reference order fulfillment history with online revenue indicators to assess scalability and financial stability.

Transaction Risk Mitigation

Utilize secure payment methods such as escrow services to align payment milestones with delivery and functionality verification. Request sample units before bulk ordering to validate build quality and operational accuracy. For customized emulators, require source code access or update rights if long-term maintenance is needed. Ensure packaging includes anti-static protection and clear labeling for traceability.

What Are the Best Delta Emulator Suppliers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

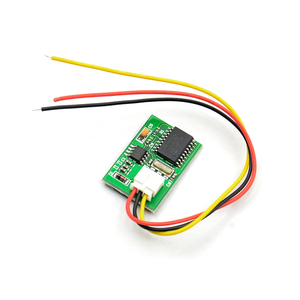

| Shenzhen Tompzon Electronics Co., Ltd. | Shenzhen, CN | Diagnostic Tools, GPS Tracker, Car Radio | US $200,000+ | 98% | ≤2h | 17% | 1 piece | $2.70–$44.99 |

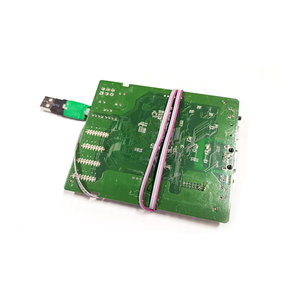

| Chengdu Chexinwang Electronic Technology Co., Ltd. | Chengdu, CN | IMMO Off Emulators, Key Programmers, VCI Dongles | US $180,000+ | 99% | ≤2h | 17% | 1–5 pieces | $4.56–$19.99 |

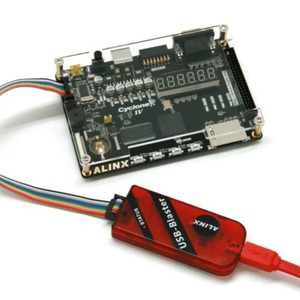

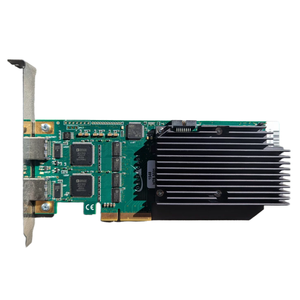

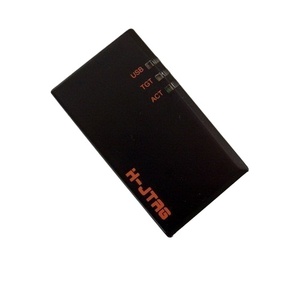

| Shenzhen Kaisheng Century Electronics Co., Ltd. | Shenzhen, CN | USB-JTAG Emulators, Altera Downloaders | US $180,000+ | 100% | ≤2h | 17% | 1 piece | $8–$360.10 |

| Shenzhen Zhuoyue Oude Electronic Technology Co., Ltd. | Shenzhen, CN | Diagnostic Tools, Auto Electronics, Car Alarms | US $100,000+ | 97% | ≤2h | <15% | 1–10 pieces | $2.95–$10.68 |

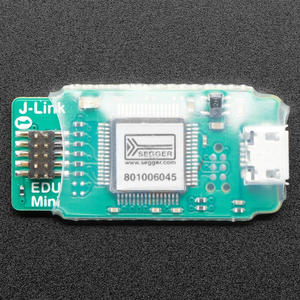

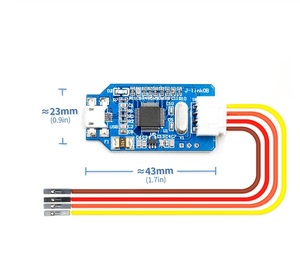

| Shenzhen LRF Technology Ltd. | Shenzhen, CN | Programmers, Emulators, Debuggers, Testing Equipment | US $120,000+ | 98% | ≤6h | 20% | 1 piece | $12.90–$45.00 |

Performance Analysis

Shenzhen Kaisheng Century leads in reliability with a perfect 100% on-time delivery record and broad portfolio of industrial-grade JTAG emulators. Chengdu Chexinwang excels in automotive-specific solutions, offering multi-brand support and advanced features like offline VIN editing and fuel injector testing integration. Shenzhen Tompzon provides the lowest entry pricing ($2.70/unit) for universal IMMO off emulators, making it suitable for high-volume procurement. While Shenzhen LRF has a slightly longer response window (≤6h), its 20% reorder rate suggests strong post-sale satisfaction, likely due to competitive pricing and consistent debugger performance. Buyers seeking firmware flexibility should prioritize suppliers with documented customization capabilities and technical documentation availability.

FAQs

How to verify delta emulator supplier reliability?

Validate supplier credentials through shipment records, customer feedback with verifiable transaction dates, and consistency in product listing details. Request references or third-party inspection reports if placing orders above 500 units. Confirm whether the company holds brand ownership or acts as a distributor to assess authenticity risk.

What is the typical sampling timeline for emulators?

Standard emulator samples are typically dispatched within 3–7 days after payment. Custom firmware versions may require 10–15 days for development and testing. Air shipping adds 5–10 days depending on destination region.

Can suppliers provide custom firmware or branding?

Yes, multiple suppliers offer OEM/ODM services including logo printing, custom packaging, and tailored firmware builds. Minimum thresholds vary—typically 100–500 units—depending on modification complexity. Confirm intellectual property rights and update protocols prior to contract signing.

Do suppliers support global shipping and compliance?

All listed suppliers export internationally via express carriers or freight services. Compliance with local electronic import regulations (e.g., FCC, CE, RoHS) must be confirmed per unit type. Automotive emulators may face regulatory scrutiny in certain markets; buyers are responsible for end-use legality verification.

What are common MOQs and pricing structures?

MOQs range from 1 piece (for high-value debuggers) to 10 pieces (for basic IMMO emulators). Unit prices decrease incrementally at 50, 100, and 500-piece tiers. Bulk discounts average 10–25% depending on volume and negotiation terms.