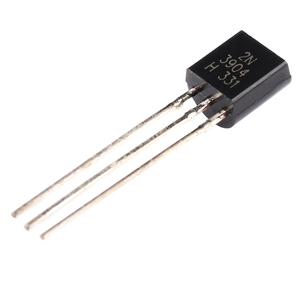

Digikey Npn Transistor

About digikey npn transistor

Where to Find NPN Transistor Suppliers?

Global sourcing of NPN transistors is heavily concentrated in Shenzhen, China—a hub for semiconductor distribution and electronics manufacturing. The region hosts a dense network of specialized suppliers with access to both original component inventories and qualified alternatives, enabling rapid fulfillment for prototyping and production-scale orders. These suppliers operate within integrated supply ecosystems supported by nearby PCB fabricators, testing labs, and logistics providers, ensuring streamlined operations.

Shenzhen-based suppliers leverage proximity to major IC packaging plants and regional warehouses formerly affiliated with global distributors, allowing competitive pricing and flexible order volumes. Buyers benefit from low minimum order quantities (MOQs), often as small as 1–5 pieces, making the market ideal for R&D teams and small-batch manufacturers. Lead times typically range from 3–15 days depending on stock availability, with express shipping options reducing delivery to under 7 days internationally. Cost efficiencies stem from localized testing and repackaging capabilities, which reduce overhead by up to 25% compared to direct OEM procurement.

How to Choose NPN Transistor Suppliers?

Evaluating suppliers requires a structured assessment of technical reliability, transactional performance, and quality control protocols:

Technical Verification

Confirm component authenticity through batch traceability and datasheet alignment. Cross-reference part numbers (e.g., 2N5885, TIP120, MMBT5401) with manufacturer specifications for voltage ratings, current capacity, and package type (TO-92, SMD, TO-220). Demand test reports for hFE gain, leakage current, and switching characteristics where applicable, especially for power transistors.

Production & Testing Capabilities

Assess supplier infrastructure based on the following indicators:

- In-house sorting and burn-in testing facilities

- Environmental controls for ESD-safe handling

- Ability to provide original or reformatted packaging per request

Prioritize suppliers advertising "original new" stock and those offering sample testing prior to bulk orders.

Transaction Reliability Metrics

Analyze verified performance data including on-time delivery rates (target ≥95%), response times (ideally ≤3 hours), and reorder rates (lower than 20% suggests niche focus or limited demand). Use platform-backed transaction guarantees where available. High online revenue (>$100,000/year) correlates with inventory depth and operational stability.

What Are the Best NPN Transistor Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Response Time | Reorder Rate | MOQ Range | Price Range (USD) | Verified |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Jeking Electronic Corp. | Power Transistors, General Purpose, Custom Packages | US $320,000+ | 100% | ≤3h | 40% | 10–100 pcs | $0.21–13.50 | Yes |

| Rtx Technology Co., Limited | SMD Transistors, Power Modules, ICs | US $220,000+ | 91% | ≤4h | 26% | 10–50 pcs | $0.10–9.00 | No |

| Shenzhen Cxcw Electronic Co., Ltd. | NPN Power, Small Signal, Refurbished Options | US $90,000+ | 95% | ≤3h | 19% | 10–1,000 pcs | $0.005–1.00 | Yes |

| Shenzhen Huake Shengye Technology Co., Ltd. | Original NPN, High-Voltage Types (TIP35C, 2N5551) | US $40,000+ | 100% | ≤3h | <15% | 1–100 pcs | $0.02–1.22 | Yes |

| Shenzhen Lingcheng E-Business Department | Discrete Transistors, Microcontrollers, PMICs | US $3,000+ | 100% | ≤2h | <15% | 5 pcs | $0.70–3.00 | No |

Performance Analysis

Shenzhen Jeking Electronic leads in scale and customization breadth, supporting requests for color coding, labeling, and module integration. With a 100% on-time delivery rate and high reorder volume, it demonstrates strong customer retention despite premium pricing on select power transistors. Rtx Technology offers aggressive pricing on SMD variants like MMBT5401 but shows a lower delivery reliability at 91%, suggesting potential fulfillment variability.

Shenzhen Cxcw stands out for ultra-low-cost small-signal transistors (e.g., SS8050 at $0.005/unit MOQ 1,000), ideal for high-volume consumer electronics assembly. Its certification as a multispecialty supplier and robust customization options enhance flexibility. Huake Shengye provides the lowest MOQs (down to 1 piece) and competitive pricing on legacy types like 2N5551, catering effectively to engineers and repair services. Lingcheng, while smaller in revenue, delivers rapid responses and consistent punctuality—advantageous for time-sensitive prototype sourcing.

FAQs

How to verify NPN transistor authenticity?

Request lot codes, original reels, or tape-and-reel markings matching known manufacturer standards. Conduct visual inspection for mold consistency, lead finish, and laser etching clarity. For critical applications, perform electrical testing using curve tracers or multimeters to validate gain and breakdown voltages against published specs.

What are typical MOQs for NPN transistors?

MOQs vary widely: from 1 piece for sample evaluation to 1,000+ units for cost-optimized production runs. Most suppliers offer tiered pricing based on volume, with significant discounts above 100 units. SMD components often require higher MOQs (50–100 pcs) due to handling processes.

Do suppliers support product customization?

Yes, select suppliers offer labeling, branding, moisture barrier packaging (for SMD), and even partial testing/screening services. Shenzhen Jeking and Cxcw explicitly list customization capabilities including refurbished modules and graphic labeling, suitable for private-labeled components.

Are RoHS and REACH compliance standards enforced?

While not always documented upfront, most active suppliers adhere to RoHS standards for lead-free components. Buyers should explicitly confirm compliance status, particularly for export to EU or North American markets. Request material declarations or third-party test certificates when required.

How to manage risk when sourcing from multiple suppliers?

Diversify across at least two qualified vendors per component type to mitigate stockout risks. Implement incoming inspection protocols for parametric validation. Maintain a bill-of-materials (BOM) with cross-referenced alternatives to ensure continuity during supply disruptions.